AudioEye Prepares for Impressive Q4 2024 Earnings Report

AudioEye (AEYE) will unveil its fourth-quarter 2024 results on March 12. For this quarter, the company projects revenues between $9.7 million and $9.8 million, indicating 24% growth year-over-year. AudioEye also anticipates adjusted EBITDA in the range of $2.2 million to $2.3 million, and adjusted EPS between 18 cents and 19 cents per share.

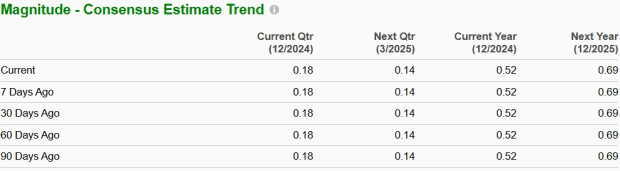

The Zacks Consensus Estimate for fourth-quarter revenues is set at $9.73 billion, reflecting a 23.67% increase compared to the same quarter last year. Additionally, the earnings consensus estimate stands at 18 cents per share, suggesting a substantial jump of 63.64% from the previous year’s figures. Notably, this estimate has remained steady over the past month.

Image Source: Zacks Investment Research

Discover the latest EPS estimates and surprises on Zacks Earnings Calendar.

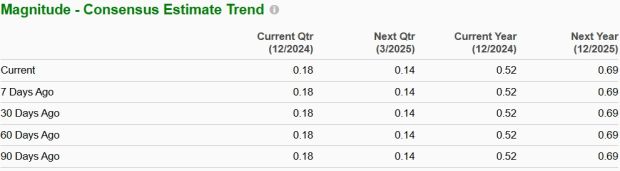

Earnings Surprise Trends

In its last reported quarter, AudioEye achieved an earnings surprise of 14.229%. The company has consistently beaten the Zacks Consensus Estimate over the last four quarters, with an impressive average surprise of 83.57%.

AudioEye’s Price and EPS Surprise Analysis

Audioeye, Inc. price-eps-surprise | Audioeye, Inc. Quote

Earnings Whispers for AEYE

Current analysis indicates that an earnings beat may not be guaranteed for AudioEye this quarter. Effective forecasting depends on a positive Earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold). Presently, AudioEye holds an Earnings ESP of 0.00% and a Zacks Rank of #3. For a comprehensive list of today’s Zacks #1 Rank stocks, visit here.

Factors Influencing Q4 Results

As AudioEye approaches its fourth-quarter results, investors may want to consider maintaining their current positions or waiting for a more advantageous entry point. Following a strong third-quarter showing, where revenues reached $8.93 million (up 14% year-over-year) and adjusted EBITDA totaled $2 million, management forecasted fourth-quarter revenues between $9.7 million and $9.8 million, supporting anticipated 24% growth year-over-year.

The digital accessibility provider has likely benefitted from the ongoing expansion of its Enterprise and Partner/Marketplace channels, which showed a remarkable 21% annualized growth rate in the third quarter. The recent acquisition of ADA Site Compliance, with revenues around $2 million in 2023, is expected to positively influence fourth-quarter results, although integration costs could temporarily modulate some earnings improvement.

During the quarter, AudioEye introduced its Accessibility Protection Status feature, which enhances risk assessment capabilities beyond traditional scoring systems. This innovative approach is likely to improve the company’s competitive position against traditional consulting firms and those relying solely on automation. According to management, this feature promises up to 300% better protection than conventional consulting methods and 400% more than purely automated solutions.

In celebrating three years of the A11iance Team—comprising accessibility experts with disabilities who have evaluated over 3,400 customer websites and identified over 35,000 accessibility issues—the company continues to offer a distinct service enhancement, although it necessitates continued investment.

The expanded partnerships with Finalsite (K-12 schools) and CivicPlus (government) established in the third quarter are anticipated to begin yielding results in the fourth quarter, though the full revenue impact may not be realized for another three years. CEO David Moradi has previously remarked that these partnerships could ultimately generate “tens of millions of dollars” in additional revenue once fully developed.

With a gross margin of 80% reported in the third quarter and a successful completion of a $7 million at-the-market offering at $24.65 per share, AudioEye’s financial standing remains robust. Nevertheless, investors should carefully monitor how the company progresses towards its “Rule of 47” objective, balancing growth initiatives with profitability improvements.

AEYE Stock Performance and Valuation Metrics

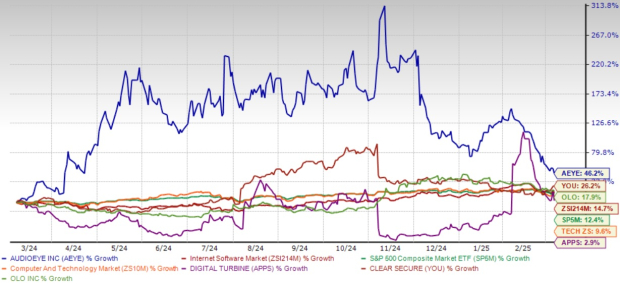

AudioEye’s stock has noticeably outperformed the market, demonstrating a remarkable rise of 46.2% over the past year. This performance has surpassed the broader Zacks Computer and Technology sector. Analysts and investors are now assessing the sustainability of this growth trajectory and their strategic approaches to the stock.

AEYE also outshined its peers in the Zacks Internet – Software sector, including Digital Turbine (APPS), Olo (OLO), and CLEAR Secure (YOU), which showed returns of 2.9%, 17.9%, and 26.2%, respectively, within the same timeframe.

1-Year Stock Performance Overview

Image Source: Zacks Investment Research

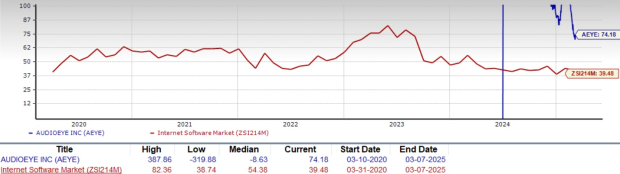

Despite this strong performance, AudioEye faces challenges, particularly with its current valuation. The trailing-12-month price-to-earnings ratio stands at 74.18, notably exceeding the Zacks Internet – Software industry average of 39.48, raising questions about the stock’s future outlook.

“`html

AudioEye’s Growth Promises Caution for Investors Ahead of Q4

Investors are keeping a close eye on AudioEye, Inc. (AEYE), concerned that its stock price may have grown too quickly in advance of upcoming earnings. While the company has shown significant revenue growth, it appears the stock’s valuation might not align perfectly with its fundamentals, potentially indicating a correction could be on the horizon.

AEYE’s P/E TTM Ratio Indicates High Valuation

Image Source: Zacks Investment Research

Investment Thesis

AudioEye offers a noteworthy investment opportunity in the digital accessibility sector, boasting impressive revenue growth of 21% in the third quarter and a 23% adjusted EBITDA margin. Despite these positive indicators, the company’s elevated valuation compared to its software peers suggests a need for cautious investment. Competition remains fierce, with rivals like accessiBe, UserWay, Level Access, and Deque Systems expanding their market presence. Recent partnerships with Finalsite and CivicPlus, along with the acquisition of ADA Site Compliance, demonstrate potential for future growth. However, investors should also consider the risks associated with competitive struggles and integration challenges. The firm’s innovative Accessibility Protection Status and dedicated A11iance Team provide points of differentiation, yet prudent investors may choose to wait for Q4 results to affirm sustainable competitive advantages before making significant investment decisions.

Conclusion

AudioEye shows encouraging growth within the digital accessibility market, backed by strategic partnerships and unique solutions. Still, investors should remain vigilant given the company’s high valuation and the surrounding competitive environment. While current shareholders might consider holding their positions, new investors could find it beneficial to wait until after fourth-quarter results are released. This would allow them to evaluate the company’s progress in integration efforts and assess the sustainability of its competitive advantages, potentially leading to better entry points for investments.

5 Stocks Set to Double

Among the top picks selected by Zacks experts, each stock has the potential for a +100% return or more in 2024. These recommendations come after previous picks surged by +143.0%, +175.9%, +498.3%, and +673.0%.

Many of the stocks profiled in this report are under the radar of Wall Street, creating an opportunity for early investment.

Explore These 5 Potential Home Runs >>

Digital Turbine, Inc. (APPS): Free Stock Analysis Report

Olo Inc. (OLO): Free Stock Analysis Report

AudioEye, Inc. (AEYE): Free Stock Analysis Report

CLEAR Secure, Inc. (YOU): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`