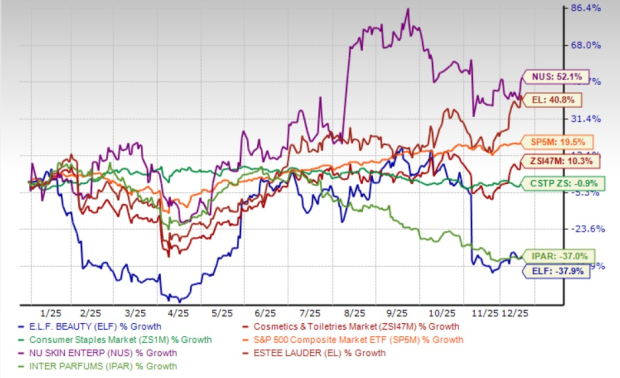

**e.l.f. Beauty, Inc. (ELF) has seen its shares decline by 37.9% year-to-date, significantly underperforming the industry’s 10.3% growth and the S&P 500’s 19.5% gain.** This drop highlights investor concerns over slowing organic growth, margin pressures, and a challenging outlook. Just this year, major competitors like Estee Lauder (EL) and Nu Skin (NUS) have risen by 40.8% and 52.1%, respectively, while e.l.f. continues to face difficulties.

In Q2 of fiscal 2026, e.l.f.’s organic sales turned negative due to shipment disruptions linked to retailer delays in adopting a price increase. With 75% of production sourced from China, rising tariffs have heavily impacted gross margins. Operating expenses are climbing, partly due to increased marketing efforts and significant debt from the recent Rhode acquisition, which has heightened financial risks. Analysts have subsequently cut earnings estimates for fiscal years 2026 and 2027, reflecting these ongoing challenges.

Despite its strong brand momentum and strategic expansion efforts, e.l.f. Beauty carries a Zacks Rank of #5 (Strong Sell) and may see subdued earnings in the near term due to margin pressures, slower organic growth, and high operational costs. Investors are advised to take a cautious approach as the company navigates these challenges into 2026.