Federal Reserve’s Rate Decision Sparks Confusion Amid Market Turmoil

The market atmosphere has turned grim recently. Stocks have taken a deep dive, bonds are under strain, and consumer confidence is faltering. Amid this backdrop, Federal Reserve Board Chair Jerome Powell delivered a crucial message to investors: “We’re in no rush to cut rates.”

Even as the economy grapples with the consequences of a global trade war and wavering sentiment, Powell’s response was straightforward: “We’re going to wait and see.”

Wall Street reacted negatively to the news, with both stocks and yields dropping in response.

However, here’s a critical takeaway: don’t panic just yet. More importantly, don’t just hear the words; observe the actions.

While Powell stated there would be “no cuts for now,” the shifting landscape suggests a different story may be unfolding…

We suspect the Fed is on the verge of initiating a full-blown rescue mission for the U.S. economy, which could potentially lead to a rally in stocks.

Let’s delve into the details.

Powell’s Stagflation Dilemma and the Federal Reserve’s Tough Choice

In our view, Powell’s message from yesterday signified that the Fed is at a crossroads.

He acknowledged that the extensive tariff regime imposed by Trump is not only more significant than anticipated but has the potential to drive inflation higher while simultaneously hindering growth. This presents a challenge: soaring inflation combined with declining growth could lead to stagflation.

Such a scenario places central banks in a precarious situation—whether they should raise rates to combat inflation or lower them to stimulate growth.

Powell admitted that the Fed remains uncertain about the next steps and has opted to wait on the sidelines to gain clarity.

While this may seem prudent, it is a precarious gamble. And Powell is undoubtedly aware of the stakes involved.

Why the Fed Must Act: Financial Conditions Are Too Tight

When we cut through the Fed’s jargon and examine the data, one clear message emerges: The central bank should already be reducing rates.

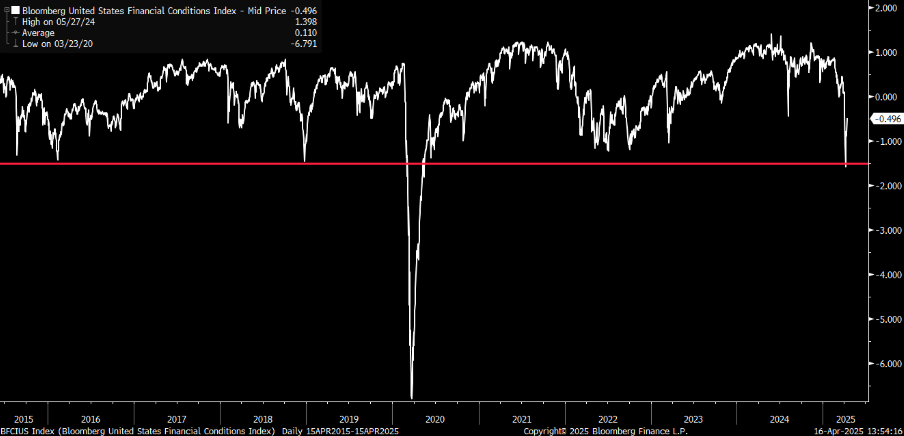

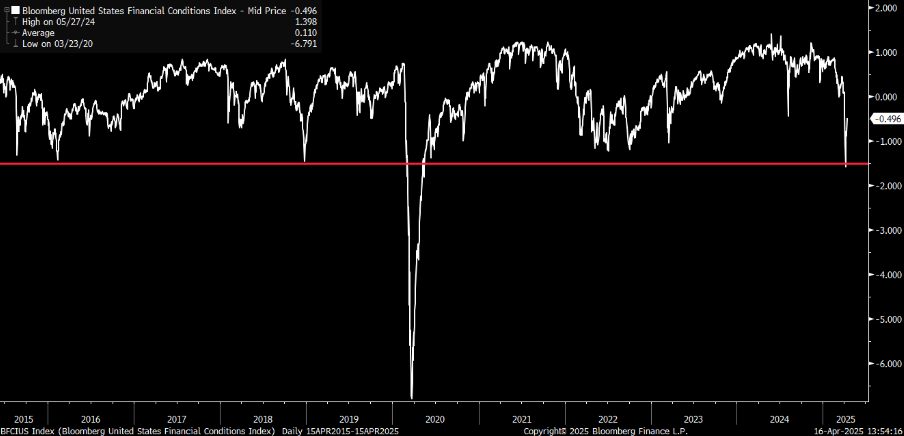

Bloomberg’s U.S. Financial Conditions Index—an aggregate indicator of credit spreads, equity levels, and money supply—shows financial conditions have tightened to levels not seen outside of the 2020 COVID crash, marking a decade-high.

Currently, these conditions are tighter than during key events like China’s 2015 economic slowdown, the 2018 Fed turmoil, and the inflation crisis of 2022.

Essentially, the financial environment is too restrictive.

Given the current backdrop:

- Consumer confidence is nearing a 50-year low. The University of Michigan’s latest findings indicate consumer sentiment has dropped 11% to 50.8 this month, marking a 12-year low and one of the lowest levels since 1952.

- Retail sales are slowing significantly, especially when excluding core data. Despite a 1.4% increase in March, analysts caution that this surge is likely temporary. In February, retail sales saw only a 0.2% rise, falling short of the expected 0.7% growth.

- Business investment has stalled, decreasing by $130 billion from Q3 to Q4 of 2024.

- The housing market is stagnant. According to the National Association of Realtors, existing home sales have fallen 1.2% year-over-year.

- On top of these challenges, bond yields are rising, with the 10-year yield now at 4.29%, higher than before Trump’s “Liberation Day” announcement.

This combination of factors raises alarms.

It essentially demands response from the Fed. We believe Powell is quietly laying the groundwork for intervention, irrespective of his public statements.

Inflation Fears Are Overstated

Yes, one reason behind the Fed’s cautious stance is concerns about inflation.

Potential tariff-related inflation could impact the economy substantially. The Fed may be hesitant to reduce rates hastily as inflation appears poised to re-accelerate. This perspective is justifiable… in theory.

However, in practice, this inflation threat seems exaggerated. Consider the following:

- CPI inflation is currently at 2.4%, very close to the Fed’s target of 2%.

- Core CPI inflation has reached 2.8% and is trending downward.

- Trends in producer and import/export prices indicate a cooling pattern. According to data from the Bureau of Labor Statistics, U.S. import prices dropped 0.1% in March after a 0.2% increase in February. Additionally, PPI for final demand fell by 0.4% in March, with goods down 0.9% and services decreasing by 0.2%.

While tariffs may cause a temporary spike in inflation, the Fed understands that a broader view suggests more stability ahead.

Federal Reserve’s Potential Rate Cut: An Examination of Economic Signals

When determining long-term monetary policy, it is often better to ignore short-term price fluctuations. This is a principle stated by policymakers in various instances in the past.

Considering the risks at hand—where a slight inflation spike is weighed against the threat of an economic collapse—it is reasonable to expect that Federal Reserve Chair Jerome Powell will prioritize growth in his decisions.

Expected Intervention from Powell and the Federal Reserve

When can we expect the Federal Reserve to act?

We anticipate that action will take place in June.

By this time, we believe enough economic data will have emerged to provide Powell and his team the necessary political and academic support to initiate rate cuts. We predict that by June, the trade war tensions will have lessened, inflation concerns will ease, and the markets will likely be vocally requesting assistance.

Our core prediction is a rate cut in June, with forward guidance expected during the Fed’s May meeting. In fact, we would not be surprised to hear signs of this ‘pivot’ as early as next month.

Once the announcement is made…

The markets will react strongly.

Trade War Eases: A Positive Influencer

However, the actions of the Fed do not represent the whole picture.

The other critical aspect is the global trade war—which, as we are pleased to report, seems to be cooling down.

Since the U.S. introduced “Liberation Day” tariffs in early April, we have seen tariff rates decrease.

The average U.S. tariff rate jumped from 2.5% to 27% on April 2. However, due to a 90-day pause and exemptions for electronics, this rate has already dropped to approximately 23%.

If reports of upcoming auto parts exemptions are accurate, we could see that rate fall to around 20%. Furthermore, should agreements regarding steel, aluminum, or trade with China materialize, we could see rates descend to closer to 10%.

This marks a significant shift.

Though the rhetoric from Washington remains combative, similar to the Federal Reserve, actions often outweigh words. And currently, the actions indicate a trend towards de-escalation.

This development is quite positive.

Potential Stock Market Surge Post-Fed Pivot

Bringing it all together:

- The Fed is nearing the end of its reasons for inaction. Data strongly suggests a rate cut is imminent.

- The trade war appears to be easing, leading to lower tariff rates.

- Financial conditions are tightening but will soon loosen.

- Inflation seems to be stabilizing rather than rising.

- Innovation in sectors like AI continues to advance steadily.

While challenges remain, clear signs of improvement are beginning to emerge.

As these two fundamental factors—monetary policy and international trade—shift, the stock market may experience significant gains. We would not be surprised to see the S&P 500 rise by 10% to 15% from its current position by late summer.

While others may be panicking, we are preparing to take advantage of the opportunities ahead.

That said, we acknowledge that turbulence lies ahead. Expect further volatility, sensational headlines, and fluctuations in the stock market.

Yet, with the Fed poised to act, a thaw in the trade war, and ongoing momentum in AI innovation…

This is a time to remain disciplined, strategic, and optimistic.

Consider buying the dip. Invest in the future. A recovery is on the horizon.

If you are keen to capitalize on this shift, we recommend purchasing stocks in AI 2.0 understanding the potential for on-demand, real-world responsive intelligence. These include embodied intelligence technologies that can see, hear, walk, talk, lift, and learn.

This burgeoning sector has piqued the interest of major tech companies, signaling substantial future investment potential. Our research leads us to a promising strategy for capturing the upcoming phase of the AI sector’s growth.

Discover the specifics of our top AI 2.0 investment choice.

As of the date of publication, Luke Lango had no positions in any of the securities mentioned in this article.

For inquiries or feedback about this article, please reach out to [email protected].