Joby Aviation (NYSE: JOBY), a frontrunner in the electric vertical take-off and landing (eVTOL) industry, is advancing in the Federal Aviation Administration (FAA) certification process, with significant implications for its business model as it aims to create a vertically integrated transportation service. However, the company faces notable risks, including a high cash burn projected at $646 million for 2026 and potential future dilution of shares due to necessary capital raises. Additionally, competition from autonomous eVTOLs like Boeing’s Wisk poses a long-term threat, as Wisk may develop a cost-effective, pilot-free model.

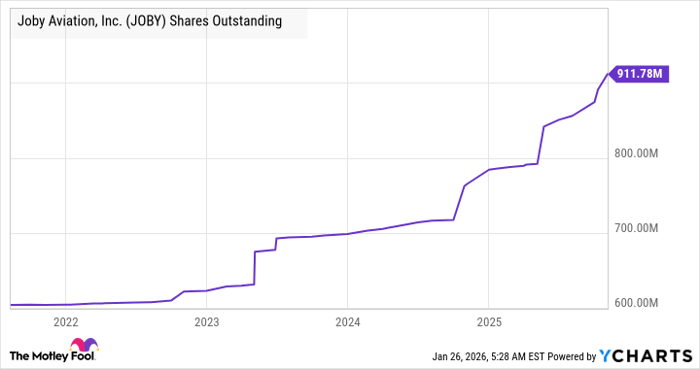

Currently, Wall Street anticipates Joby’s net cash to dip from $1.03 billion in 2023 to around $710 million by 2025, spurring the need for an equity raise in 2026. Despite these challenges, Joby has established strong partnerships with firms like Delta Air Lines and Uber, which can greatly enhance its operational capabilities and market reach.