Innodata Set to Report Strong First-Quarter Earnings on May 8

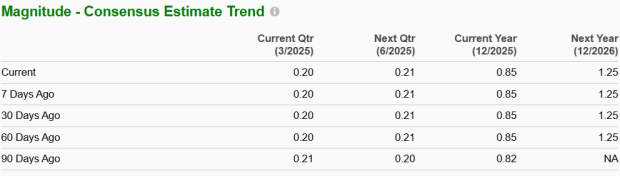

Innodata (INOD) is set to announce its first-quarter 2025 results on May 8. Analysts anticipate a significant increase in revenue, with the Zacks Consensus Estimate projected at $58.66 million, reflecting a substantial 121.36% year-over-year rise.

The expected earnings per share (EPS) stands at 20 cents, indicating an impressive growth of 566.67% compared to the same period last year.

Image Source: Zacks Investment Research

Earnings Performance Overview

Innodata has demonstrated a strong earnings surprise history, posting a surprise of 40.91% in the last quarter. The company has surpassed the Zacks Consensus Estimate in each of the previous four quarters, with an average surprise rate of 220.46%.

Innodata Inc. Price and EPS Surprise

Assessment of Earnings Expectations

Despite the positive trends, current metrics do not guarantee an earnings beat for Innodata this quarter. The company’s earnings ESP is at 0.00%, paired with a Zacks Rank of #3 (Hold). This combination suggests cautious optimism.

Key Considerations for INOD for Q1 Results

Innodata approaches its first-quarter 2025 earnings report after delivering exceptional performance in the fourth quarter of 2024, where it achieved a 127% increase in year-over-year growth. While strong momentum is expected to continue, some factors may prompt investors to maintain current positions or seek better entry points.

The recent launch of Innodata’s Generative AI Test & Evaluation Platform, utilizing NVIDIA technology, signifies a strategic move to enhance its AI services. Although introduced at NVIDIA GTC 2025 in March, revenue from this platform will only materialize after its full commercial release in Q2 2025.

Innodata’s strong ties with its largest customer, a contributor to notable growth in Q4 2024, are expected to influence Q1 results positively, especially after announcing additional contracts worth approximately $24 million in annualized revenue. However, the heavy reliance on one client may pose risks amidst efforts to diversify by engaging with seven other major tech firms.

The company projects a 40% or greater revenue growth for the full year of 2025, indicating strong potential, yet the anticipated reinvestment of cash from operations may affect profit margins in the short run. Such investments are intended to support multi-year growth but may cause volatility in immediate financials.

Industry trends, particularly AI-driven investments from major tech players, likely benefitted Innodata’s first-quarter performance. With a robust balance sheet showing $46.9 million in cash at the end of 2024, the company appears well-positioned to navigate market fluctuations while executing its expansion plans.

Investors should pay attention to Innodata’s progress in diversifying its customer base and the rollout of new offerings like the AI Test & Evaluation Platform. While long-term growth prospects remain positive, potential ups and downs related to ongoing investments and client concentration necessitate a careful approach leading up to the first-quarter 2025 earnings report.

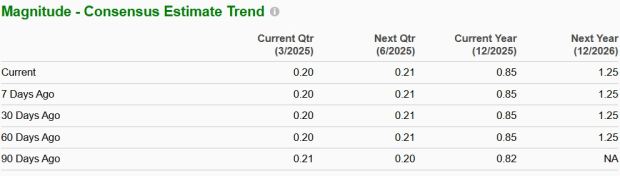

Stock Performance and Valuation Insights

INOD shares have surged 467.5% over the past 12 months, significantly outperforming the Zacks Computer and Technology sector’s growth of 5.1% and the broader industry’s gain of 7.5%.

1-Year Stock Performance Overview

Image Source: Zacks Investment Research

Although INOD trades at a premium, with a six-month forward P/S ratio of 4.62x compared to the average of 1.75x in the Zacks Computer – Services industry, this valuation may be justified given the company’s promising growth and strategic position within the generative AI sector.

Valuation of INOD’s P/S Ratio

Image Source: Zacks Investment Research

Morgan Stanley forecasts combined capital expenditures of $300 billion in 2025 and $337 billion in 2026 for major players like Amazon (AMZN), Alphabet (GOOGL), Meta Platforms (META), and Microsoft, targeting advancements in GenAI and large language models. By capitalizing on Big Tech’s rising investments in GenAI, Innodata is well-equipped to serve as a key partner in data engineering, especially for developing supervised fine-tuning data necessary for training sophisticated AI models.

Conclusion

Innodata presents a mixed investment outlook as it nears the first-quarter 2025 earnings announcement. Investors should be attuned to the company’s growth potential while remaining cautious about potential volatility stemming from investment strategies and client dependencies.

Innodata’s Growth: Promising Results Amid Valuation Concerns

Innodata Inc. (INOD) has demonstrated substantial growth, reporting a remarkable 127% increase in fourth-quarter 2024 revenue. For 2025, the company anticipates over 40% revenue growth. However, investors should be cautious due to current valuation levels.

Future Prospects and Risks

The beta launch of its NVIDIA-powered AI Test & Evaluation Platform signals future potential for the company, yet full commercialization is not expected before the second quarter. Although Innodata has made strides in diversifying its client base, customer concentration risk remains a concern, particularly with its reliance on large technology firms.

Furthermore, upcoming plans for reinvestment in operations may put temporary pressure on margins, despite a healthy cash position of $46.9 million. The prospects of reinvesting could enhance growth in the long run, but may pose immediate challenges.

Conclusion

Innodata presents a careful consideration for investors. Despite strong recent growth, it faces high valuations and increasing competition within the AI services sector. The expected impact of the NVIDIA-powered platform, along with ongoing customer risks and planned investments, suggests that short-term volatility may occur. Investors should evaluate the option to hold existing positions or potentially wait for a more favorable entry point after the first-quarter results are released.