“`html

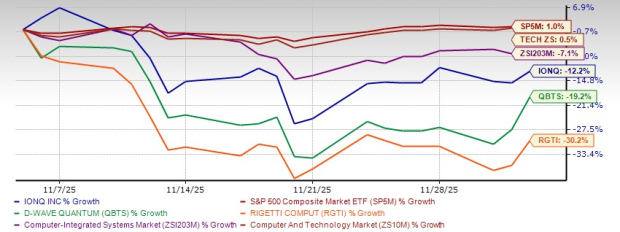

IonQ (IONQ) experienced a 12.2% stock decline over the past 30 days, contrasting with a 1.1% gain in the S&P 500. Market analysts view this dip as a normal correction following a strong rally earlier in 2025, and it points more to profit-taking by investors than any negative shift in IonQ’s fundamentals.

During this period, IonQ’s stock underperformed compared to the industry, which declined by 7.1%, and the sector, which gained 0.5%. Competitors Rigetti Computing (RGTI) and D-Wave Quantum (QBTS) also faced significant declines of 30.2% and 19.2%, respectively. IonQ reported record contracted bookings and has expanded its federal engagements through new research contracts, supported by a strong balance sheet of $3.5 billion in cash and no debt.

The estimated loss per share for IonQ in 2026 is projected at $1.74, indicating a 66.2% improvement from 2025, with revenues expected to reach $182.5 million—a growth of 68.9% year-on-year. IonQ’s forward price-to-sales (P/S) ratio stands at 95.5, significantly exceeding the industry average but still below peers like D-Wave and Rigetti.

“`