Nasdaq Composite Index Sees Correction Amid Economic Uncertainty

The Nasdaq Composite index reached its latest peak on December 16, 2024, but has struggled this year due to rising economic uncertainty in the U.S., largely driven by the new administration’s policies. As of now, the index has declined over 14% from that December high, placing it in correction territory. A stock market correction is defined as a 10% to 20% decline in a major index. The likelihood of this correction persisting is heightened by increasing fears of a U.S. recession and a downgraded economic growth forecast for the year.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

It’s not surprising to see leading artificial intelligence (AI) stocks experiencing further declines following recent pullbacks. Investors are cashing in on profits amidst the surrounding economic uncertainty. Lately, companies benefitting from the surge of this technology enjoyed significant increases in share prices over the past couple of years.

Long-term projections reveal that the global AI market is slated for impressive growth, expected to deliver productivity benefits across various industries. According to McKinsey, AI software and services could contribute $23 trillion annually to the global economy by 2040. Consequently, now might be an opportune moment to explore one AI Stock poised to emerge as a significant long-term investment, particularly during this market correction.

Microsoft: A Tech Giant Ready for Growth Through AI

Microsoft (NASDAQ: MSFT), the world’s second-largest company, has experienced a 17% decline in value during the current Nasdaq correction. Microsoft stands out as a prime contender to capitalize on the AI software boom, given its access to expansive end markets that promise to bolster growth over time.

A key driver for Microsoft is the surging demand for AI services in the cloud. In the second quarter of fiscal 2025 (ending December 31, 2024), Microsoft’s Intelligent Cloud segment reported an impressive 19% year-over-year revenue growth, surpassing $25 billion. Notably, revenue from cloud-based AI services soared by an astonishing 157% compared to the previous year.

While revenue growth in AI services could have been more robust, Microsoft’s capacity constraints limited its fulfillment of demand. However, the company is actively expanding its data center capabilities “in line with both near-term and long-term demand signals.” This strategic move is critical, as numerous clients are turning to Microsoft for cloud-based AI solutions, contributing to a stable revenue pipeline.

Moreover, Microsoft is offering an array of AI models on its Azure cloud platform from partners like OpenAI and DeepSeek, enabling clients to develop AI applications and agents. The company is also rolling out industry-specific models from major firms such as Siemens, Rockwell Automation, and Bayer, simplifying AI integration for businesses.

Robust Revenue Pipeline Predicted to Drive Earnings Growth

The increase in Microsoft’s commercial remaining performance obligations (RPO) underscores this potential for growth, rising an impressive 36% year over year to reach $298 billion. RPO represents the total worth of contracts that a company has yet to fulfill. This robust growth suggests that Microsoft is securing contracts at a pace exceeding its current fulfillment capacity.

As the company enhances its infrastructure to meet growing demands, it is well-positioned to achieve significant revenue and earnings growth in the future. Additionally, the market for cloud-based AI services is projected to expand at an annual growth rate of almost 40% through 2030, further reinforcing Microsoft’s potential for outstanding growth in this segment.

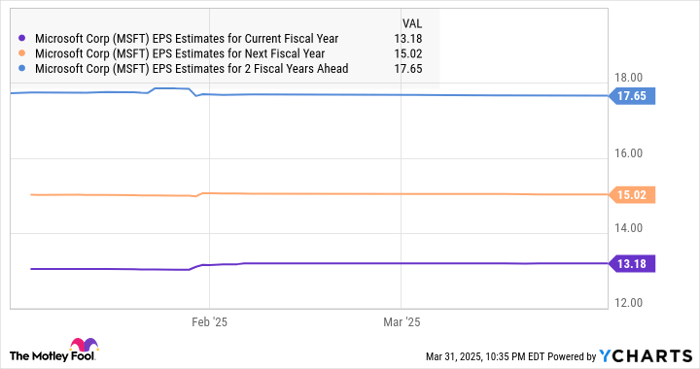

Analysts anticipate an increase in Microsoft’s earnings growth, following an estimated boost of 12% this fiscal year.

MSFT EPS Estimates for Current Fiscal Year data by YCharts

With the enormous opportunity in the cloud AI market, Microsoft appears capable of sustaining its strong earnings growth momentum. If projections hold and the company achieves earnings of $17.65 per share in the coming years amid an attractive valuation, considerable upside is possible.

Currently, Microsoft trades at 25 times forward earnings, making it an appealing AI Stock to consider amid market corrections, especially given its lower valuation compared to the Nasdaq-100 index’s multiple of 29. If Microsoft aligns its multiple with that of the index and meets the consensus earnings estimate, its Stock price could reach $512.

This scenario represents a potential upside of 36% from current values. Industry observers should remain alert, as Microsoft has the potential to outperform earnings expectations, leading to a premium valuation and significant long-term gains.

Is Investing $1,000 in Microsoft Right for You?

Before deciding to purchase Stock in Microsoft, it’s important to consider the following:

The Motley Fool Stock Advisor analyst team recently identified what they believe to be the 10 best stocks for investors at this time. Notably, Microsoft was not included in this list. The stocks chosen have the potential for impressive returns in the years to come.

Reflect on Nvidia’s inclusion in this list back on April 15, 2005… if you had invested $1,000 at that time, your investment would now be worth $676,774!*

Stock Advisor offers investors a clear path to success with strategies for building a portfolio, regular analyst updates, and two new Stock picks each month. Since 2002, the Stock Advisor service has generated more than four times the returns of the S&P 500. Don’t miss the latest top 10 list, available when you join Stock Advisor.

see the 10 stocks »

*Stock Advisor returns as of April 1, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft and Rockwell Automation. The Motley Fool suggests the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not reflect the views of Nasdaq, Inc.