NVIDIA Stocks Face Downturn Amid Tariff Concerns and Market Volatility

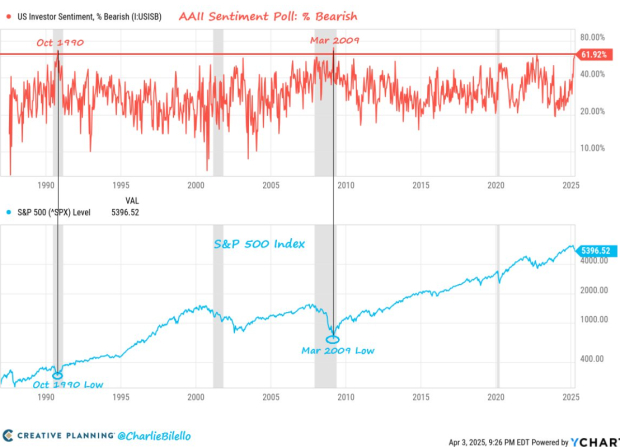

President Donald Trump’s Liberation Day is unfolding in unexpected ways. In light of last week’s extensive tariffs, analysts fear a steep market downturn reminiscent of the Great Depression. This volatility has not spared major companies, including tech giant NVIDIA Corp NVDA.

While there are some signs of recovery for the bulls this Monday, NVDA Stock has dropped about 11% over the past five sessions. Since the beginning of the year, its equity has decreased by 28%, marking a significant shift that has arisen from the post-pandemic recovery. During 2023 and into 2024, NVIDIA experienced a surge in valuation driven by high demand for its graphics processors, essential to the artificial intelligence boom.

However, challenges persist for the optimists. Competitive pressures, emerging adversaries in the AI market, and an unfavorable political environment are combining to create headwinds for NVDA Stock. Consequently, market makers are forecasting negative outcomes for NVDA options, reflecting a generally poor sentiment, especially when analysts reference the Great Depression.

Pessimism has reached such a level that the risk profile for some option spreads has inversely shifted. This environment is presenting a unique opportunity for savvy contrarians.

Strategies for Navigating NVDA Stocks

In the context of typical bull call spread strategies, which generally benefit from a rising equity price, NVDA’s current situation is distinct. Normally, traders need the stock to surpass a breakeven price to achieve profitability. However, those selling call spreads start with an initial cash advantage as they receive a credit from the call buyers. These sellers don’t necessarily aim for a decline; even sideways movement can suffice for them to retain the premium collected.

What sets the current scenario apart is the extreme fear of volatility. This fear means that high-yield bull call spreads do not require NVDA Stock to rise significantly; the stock merely needs to avoid a substantial decline—a compelling proposition indeed.

For instance, consider the 92/93 bull call spread with options expiring this Friday. This strategy entails buying the $92 call (currently priced at an ask of $690) while simultaneously selling the $93 call (with a bid of $620). The proceeds from the short call help offset the long call’s debit, resulting in a net cash outlay of $70.

If NVDA Stock holds at or above the short strike price upon expiration, the maximum reward is the strike price difference (multiplied by 100 shares) minus the initial outlay, totaling $30. This equates to a nearly 43% return without the necessity for the stock to rise; the current market price is above the short strike price, allowing for potential declines still to yield the full reward.

Market conditions change constantly, so specific details may vary. However, tariff-induced turmoil has led to inverted risk profiles in certain call spreads, making the aforementioned spread function more like a credit spread, benefiting debitors.

Understanding the Risk Inversion’s Calculations

Analysis of pricing data since January 2019 indicates a 56.13% probability of weekly profitability, derived from the number of positive weeks against the total weeks. Thus, traders can consider the aforementioned 92/93 bull spread as having an advantageous position based on these historical trends.

Nonetheless, the focus isn’t on whether NVDA Stock will rise this week, but whether it can avoid dropping below $93, which is the short strike price of this call spread. Currently, traders perceive a 2% margin of safety relative to the stock’s approximate price of $95. The relevant question shifts to whether NVDA can perform better than a 2% loss this week.

The likelihood that NVIDIA Stock will exceed a 2% loss in any given week stands at nearly 72%.

However, this situation doesn’t guarantee a risk-free outcome. There remains a possibility that unforeseen events could cause NVDA Stock to decline beyond the anticipated safety margin.

In conclusion, the current market is enabling traders to secure significant rewards while allowing for some leeway. Such favorable combinations are rare in the financial landscape.

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.