Understanding Market Volatility Amid Uncertain Tariff Policies

The Impact of Uncertain Tariff Announcements

This week’s market fluctuations felt like a thrilling roller coaster, largely due to inconsistent tariff announcements. The reciprocal tariffs are either active, paused, or limited, particularly regarding China—making it hard for investors to maintain focus.

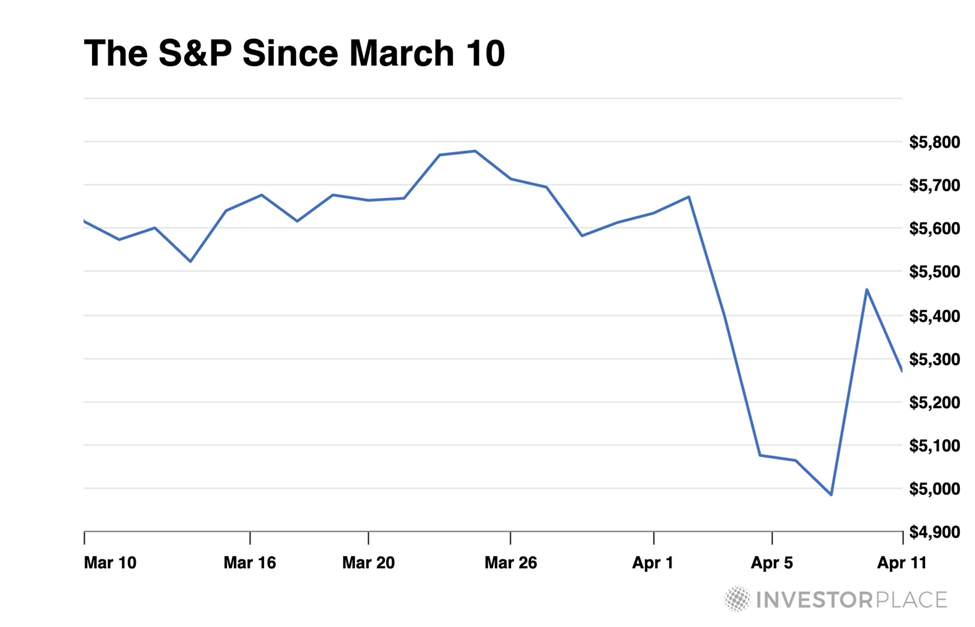

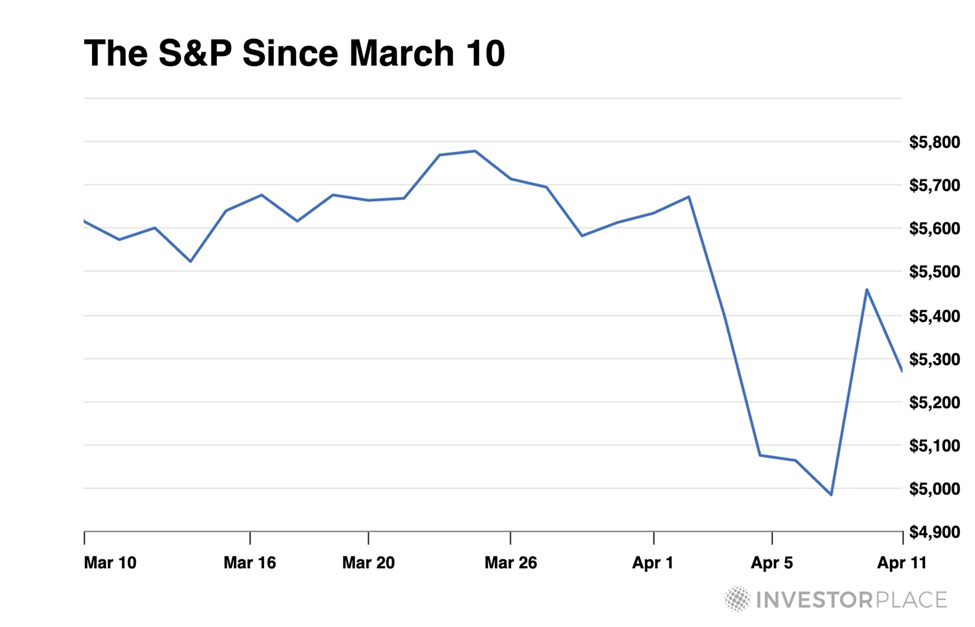

To visualize this, you can see how the market reacted following the tariff news on April 2 in the chart below.

Last Sunday, President Trump stated he was not worried about the Stock market, saying, “I don’t want anything to go down, but sometimes you have to take medicine to fix something.” But following a 90-day pause on tariffs, the Stock market surged, leading Trump to declare it as “the biggest day in financial history.” However, recovery of the previous losses remains incomplete.

After a tumultuous week on Wall Street, the pressing question is: what should investors do now? Global macro analyst Eric Fry from InvestorPlace offered valuable insights this week, alongside his accurate forecast regarding the tariff “pause.” Here, we will explore Eric’s advice and share one of his promising investment report picks that continues to thrive amid market fluctuations.

Macro Insights on Current Market Trends

For those new to the Digest, Eric employs a “macro” approach, contrasting with the typical Wall Street “micro” analysis, which focuses on specific company metrics like price/earnings ratios and income statements.

Eric identifies major trends that can drive long-term movements across entire sectors. He then targets stocks positioned to benefit significantly from these trends. His strategy has resulted in over 40 tenfold Stock winners.

While this may seem like a fair amount, achieving one 1,000% growth in a career is a significant accomplishment for most investors. Having 40 such successes puts Eric’s track record in a unique category.

In a conversation with Eric on Monday, he asserted that the current tariff rollout by the administration was flawed. He also predicted potential outcomes:

“My bullish scenario is that this proposed tariff policy is so bad that it’s good. Severe trade imbalances need correction, but I doubt this policy is the best way forward. It may be so poorly conceived that it won’t persist.”

“I speculate the Trump administration might achieve successes one country at a time and ultimately abandon this broad global tax affecting 185 nations.”

“If that occurs, I believe markets could recover. I’m optimistic as I sense that this tariff policy likely won’t last long.”

I spoke with Eric again on Wednesday after the announcement regarding the tariff rollback. By then, the markets were already on an upward trajectory. Here are highlights from our discussion.

“The markets are rallying significantly now. The trade war persists, but it has certainly taken a new direction.”

“Notably, this move mirrors what billionaire Bill Ackman advocated over the past two days. Ackman, a hedge fund manager and key Republican contributor, was not alone in his views; Jamie Dimon, CEO of JPMorgan, echoed similar sentiments, as did other significant Trump supporters on Wall Street.”

“I suspect President Trump acknowledged a shift among top Republican donors and supporters. That shift likely influenced his recent announcement.”

Despite the uptick in the markets on Wednesday, Eric cautioned there could be hurdles down the line, which we witnessed immediately as the market declined again on Thursday. Here is Eric’s guidance for investors who are feeling overwhelmed by rapid market movements.

“When stocks slide, it often feels like you own too many, and when they rise, it seems like you don’t own enough. This is the inherent nature of investing.”

“You must stay focused and avoid getting rattled by headlines and market noise. Assess your available opportunities and act decisively when suitable.”

“This approach applies across all market scenarios—bull and bear alike. I believe it holds true in this instance as well.”

One Stock to Watch Amid Market Fluctuations

Understanding Canada Goose: Investment Insights Amidst Trade Challenges

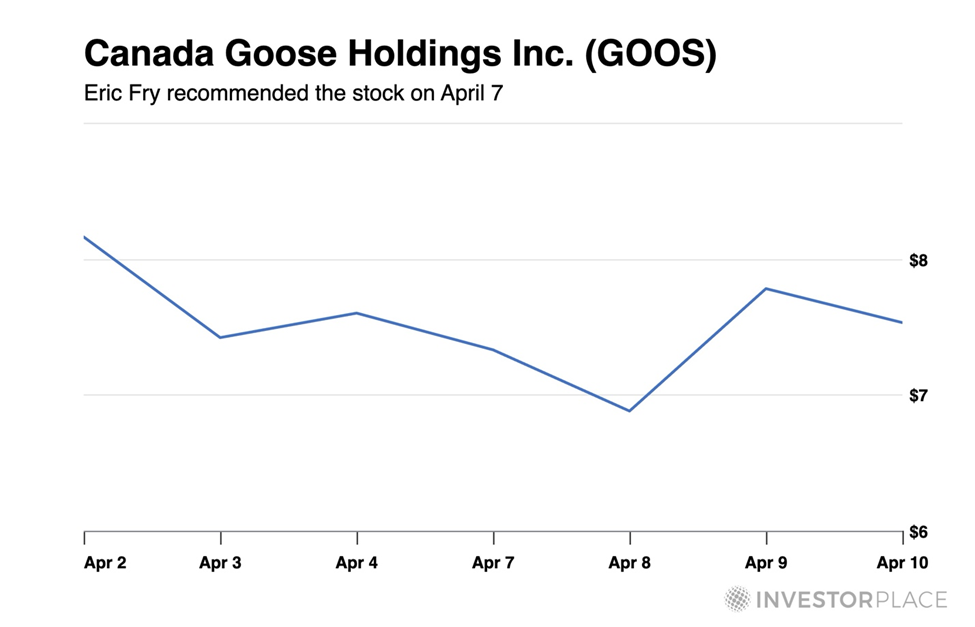

The investment philosophy that has benefited Eric is evident in his latest recommendations. Recently, through his Investment report service, Eric has highlighted luxury apparel brand Canada Goose Holdings Inc. (GOOS) as a worthy consideration.

For those who may not know much about Canada Goose, let Eric explain:

Founded in 1957, Canada Goose is a global performance luxury and lifestyle brand. Like Patagonia and North Face, it offers a variety of outdoor sportswear, including parkas, puffers, rain jackets, and hoodies, catering to both outdoor enthusiasts and urban fashion aficionados.

An important question arises: “How will the trade war impact Canada Goose’s profits?”

Eric notes that although purchasing goods from Canada has become pricier for many consumers, Canada Goose exports to the U.S. without incurring duties. This advantage comes from the U.S.-Mexico-Canada Agreement (USMCA) signed by President Trump during his administration, which imposes no tariffs on apparel and textile exports from Canada to the U.S.

However, it’s critical to recognize that the journey ahead for GOOS may not be entirely straightforward. Volatility is expected, which the stock has already shown in April, as illustrated below.

Despite potential short-term fluctuations, Eric encourages investors to maintain perspective:

I cannot predict the future direction of the stock market, nor can I determine how long the current selloff will last. However, I do believe that acquiring quality companies at reasonable prices is essential for long-term wealth creation. Therefore, I will consistently provide selective “Buy” recommendations throughout this downturn.

Given the likelihood of ongoing market volatility, it is advisable to filter out the noise. Investors should focus on evaluating the available opportunities and act judiciously when appropriate.

For more insights on Eric’s Investment report selections, click here.

Wishing you a pleasant weekend,

Luis Hernandez

Editor in Chief, InvestorPlace