Meta Platforms Faces Headwinds Amid Tariff Pressures and Stock Decline

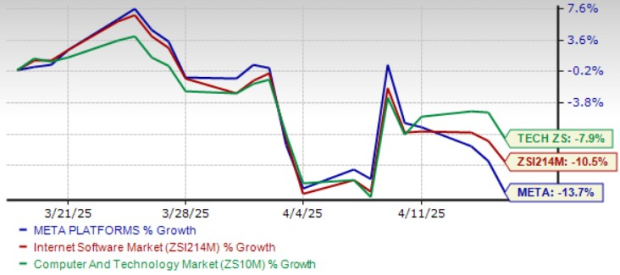

Meta Platforms (META) has seen its shares fall by 13.7% over the last month. This decline outpaces the Zacks Internet Software industry, which has decreased by 10.5%, and the Zacks Computer & Technology sector, down 7.9%, during the same period.

This downturn is largely linked to challenging macroeconomic conditions. U.S. President Donald Trump’s imposition of tariffs on trade partners, including China, Mexico, and Canada, has adversely affected the outlook for technology stocks like META. The increase in tariffs threatens the digital advertising space, where Meta, alongside Alphabet (GOOGL) and Amazon (AMZN), currently captures about 50% of projected global ad spending by 2028.

Higher tariffs and the ongoing trade conflict could dampen spending on digital advertising, which is critical for Meta Platforms given that over 90% of its revenue is derived from this sector. While Alphabet and Amazon will also feel the pinch, their lower revenue dependence on advertising compared to META might provide them with some protection. Both companies also offer cloud computing services, which could cushion their prospects amidst economic headwinds.

Since the tariff announcement on April 2, shares of Meta Platforms have plummeted by 14%, significantly more than Alphabet’s slight drop of 2.1% and Amazon’s decline of 11.2%.

META Stock Performance

Image Source: Zacks Investment Research

As investors consider the implications of tariffs and a possible recession, the question remains: what should one do with Meta Platforms Stock? Let’s explore further.

META Utilizing AI to Enhance Advertising Revenues

Meta Platforms is capitalizing on artificial intelligence (AI) to enhance user engagement, which positions the company favorably. With over 3.35 billion daily users, the data at META’s disposal fuels AI deployment, which is witnessing increasing adoption among more than 700 million active users monthly. The firm is rolling out updates designed to help Meta AI deliver personalized and relevant experiences, which is anticipated to drive engagement.

Furthermore, the company’s plan to ease content monitoring is expected to promote greater user interaction. The introduction of the Community Notes program is replacing the previous third-party fact-checking approach in the U.S. This change is aimed at fostering free speech on platforms like Facebook, Instagram, and Threads.

Meta is also focused on enhancing return on ad spend for advertisers. Its proprietary ad recommendation system, Andromeda, leverages expertise from NVIDIA (NVDA). By deploying META’s deep neural network on the NVIDIA Grace Hopper Superchip within Instagram and Facebook applications, the company has already seen over 6% improvement in recall efficiency for ad retrieval and an 8% increase in ad quality in selected segments.

Additionally, Meta is prioritizing social commerce through its platforms. Notably, the Meta Verified initiative offers businesses four subscription plans that build credibility by providing verified badges, account support, and impersonation protection, which fosters consumer trust and attracts new clients.

META Sees Estimate Revisions Reflect Downward Trends

The Zacks Consensus Estimate for first-quarter 2025 earnings stands at $5.22 per share. This reflects a 1.8% downward revision over the past month but indicates a robust 10.83% year-over-year increase.

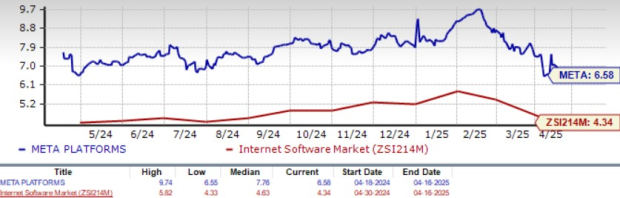

Meta Platforms, Inc. Stock Price and Consensus

Meta Platforms, Inc. price-consensus-chart | Meta Platforms, Inc. Quote

META has consistently exceeded the Zacks Consensus Estimate in each of the previous four quarters, boasting an average surprise of 13.77%. (Find latest EPS estimates and surprises on Zacks earnings Calendar.)

META Stock Valuation Analysis

Despite its promising prospects, META Stock is currently not trading at a discount. The Value Score of C indicates a stretched valuation at present.

The forward 12-month Price/Sales ratio for META stands at 7.9X, marginally higher than its median of 7.83X and significantly above the broader sector’s 5.81X.

P/S Ratio (Forward 12 Months)

Image Source: Zacks Investment Research

Why You Should Hold META Stock Now

Despite the beneficial effects of AI on both advertisers and users, Meta Platforms may face challenges in its first-quarter 2025 results due to unfavorable foreign exchange rates, which are projected to hinder total revenue growth by 3% year-over-year.

For operating expenses, estimates range between $114 billion and $119 billion. The company also anticipates growth in headcount driven by initiatives in infrastructure, monetization, and regulatory compliance. Given regulatory pressures in the U.S. and Europe along with tariffs, investing in Stock poses certain risks.

Meta is significantly investing in AI infrastructure, planning capital expenditures between $60 billion and $65 billion for 2025, aimed primarily at generative AI initiatives and its core business. While these investments might enhance long-term prospects, concerns arise due to the lack of monetization on newer platforms such as Threads.

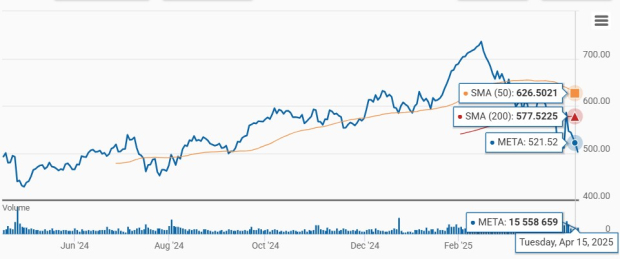

META shares are currently trading below the 50-day moving average, suggesting a bearish trend.

META Shares Below 50-Day SMA

Image Source: Zacks Investment Research

With a Zacks Rank #3 (Hold), investors may want to wait for a more opportune moment to increase their holdings in the Stock. For more on today’s best Zacks #1 Rank (Strong Buy) stocks, check here.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we surprised our members by offering them 30-day access to all our picks for just $1, with no further obligation.

Thousands have capitalized on this opportunity; others stayed skeptical, thinking there must be a catch. The truth is we want you to experience our portfolio services, like Surprise Trader, Stocks Under $10, Technology Innovators, which closed 256 positions with double- and triple-digit gains in 2024 alone.

Want the latest stock recommendations from Zacks Investment Research? Download the report on 7 Best Stocks for the Next 30 Days for free. Click here for details.

Amazon.com, Inc. (AMZN): Free Stock Analysis report

NVIDIA Corporation (NVDA): Free Stock Analysis report

Alphabet Inc. (GOOGL): Free Stock Analysis report

Meta Platforms, Inc. (META): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.