“`html

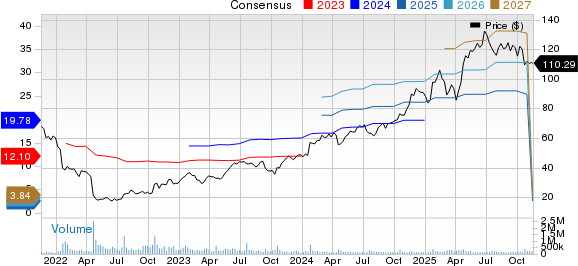

Netflix Inc. (NFLX) executed a 10-for-1 stock split on November 17, 2025, to enhance accessibility for retail investors. Shareholders as of November 10, 2025, received nine additional shares for every one share held. An investor with one share priced at $1,100 now holds 10 shares valued at approximately $110 each, resulting in no change to total investment value.

In addition to the stock split, Netflix’s 2025 third-quarter results displayed strong operational performance, with a revised 2025 free cash flow forecast of around $9 billion. The company anticipates a operating margin of 23.9% for Q4, marking a two percentage point year-over-year improvement. Year-to-date, Netflix shares have surged approximately 25.7%, greatly outperforming competitors like Apple, Disney, and Amazon.

Despite upcoming economic challenges and increased competition for content, Netflix is focusing on international expansion and diversifying its revenue through an advertising-supported tier. The company’s current market capitalization nears $467 billion, reflecting significant growth potential as it approaches 2026.

“`