Oil prices saw significant gains this month, with Brent crude surpassing $70 a barrel and West Texas Intermediate exceeding the mid-$60s, marking substantial monthly increases. However, volatility remains high, as daily fluctuations often exceed 1%, driven by geopolitical tensions and a strengthening U.S. dollar. This creates a challenging environment for investment in the energy sector, necessitating disciplined strategies over emotional reactions to market shifts.

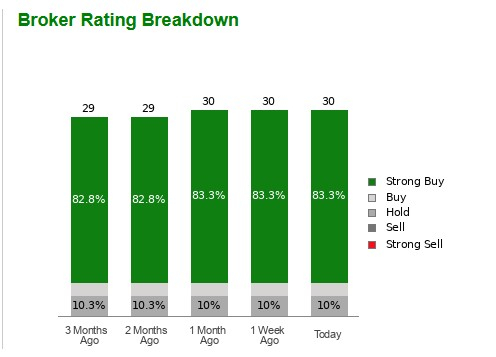

Key energy stocks gaining broker favor include Expand Energy, Energy Transfer LP, and Archrock, Inc. Expand Energy, based in Oklahoma City, is now the largest natural gas producer in the U.S., with 25 out of 30 brokers recommending Strong Buy ratings. Energy Transfer, a Dallas-based midstream provider, boasts an attractive average brokerage recommendation of 1.50, with 13 strong endorsements. Archrock focuses on natural gas compression in Texas and holds a favorable average brokerage rating of 1.55.

As geopolitical tensions impact pricing, investors are advised to consider broker-recommended stocks to navigate the volatility effectively. The discrepancies between market reactions and actual supply fundamentals may present opportunities for disciplined investors.