Rumble Inc: Riding the Waves of Stock Volatility

Billed as a haven for free speech, video-sharing platform Rumble Inc RUM presents a mixed bag in the investment world.

From a financial standpoint, RUM stock has shown considerable instability, carrying a generally negative bias. Despite this, when faced with high selling pressure, investors often shift from fear to greed, making Rumble a speculative option worth considering.

In December, Rumble entered a strategic investment deal with a blockchain company, causing RUM stock to soar. However, soon after, doubts surfaced about the company’s valuation. Rumble does not yet generate profits, and its sales growth has decreased recently, prompting investors to reevaluate the risk and retreat.

The fallout has been significant. For the week ending January 10, RUM stock fell by 19.65%. As of now, it has dropped more than 6% with investors trying to maintain the $10 support level. Once the current week concludes, there’s potential for a recovery.

RUM Stock: Behavioral Dynamics Favor Recovery

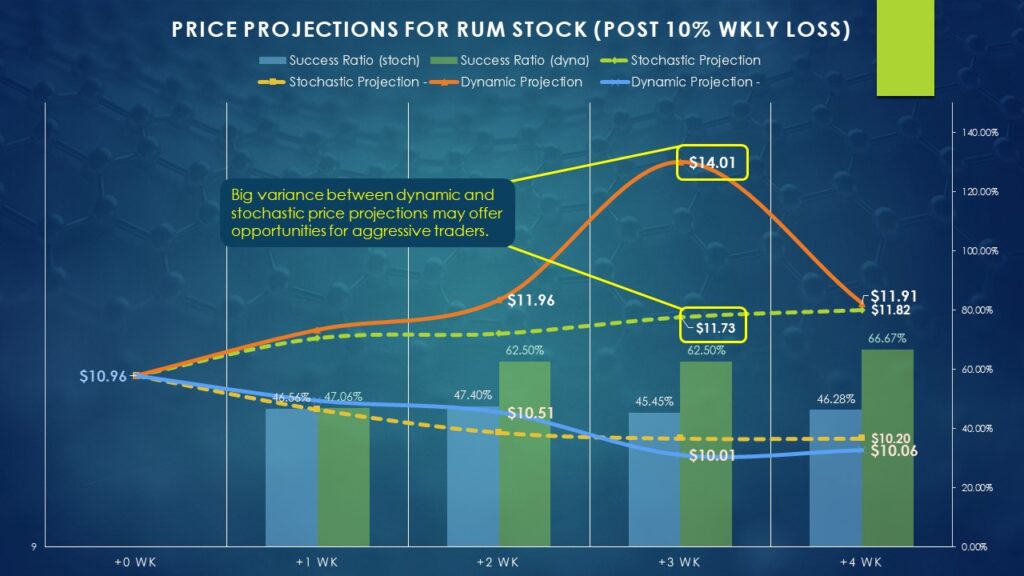

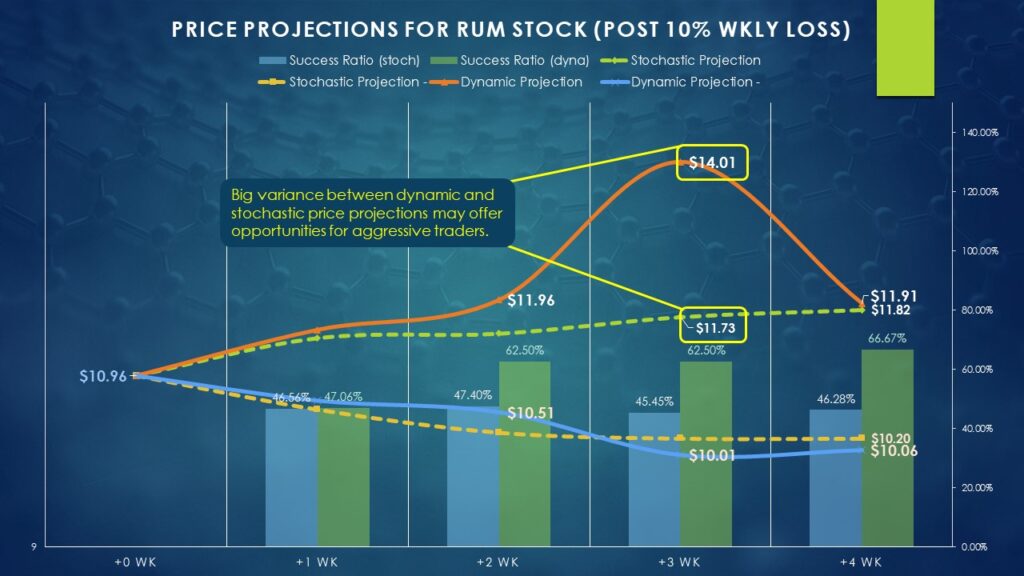

As mentioned, RUM stock experiences a negative trend. On a week-to-week basis, there’s about a 47% chance for a positive return. When looking at a four-week span, the probability slightly decreases to 46%, indicating caution for those considering long-term investments in Rumble stock.

Interestingly, this landscape shifts dramatically under significant selling pressure. Statistically, following a weekly loss of 10% or more, RUM stock tends to recover by the end of the fourth week, showing a positive return in about 66.7% of cases.

It is important to note that while applying these probabilities restricts the data sample, trends are still observable. Historically, a weekly loss increases the likelihood of a positive return in the fourth following week to 50.5%, which improves to 53.5% for losses of 5% or more. This suggests that the more significant the loss, the greater the market’s eagerness for recovery.

Furthermore, the fourth week following a 10% drop reveals a median return of 8.68%. However, in the third week, the median return spikes to 27.83%. This trend indicates that buyers tend to re-enter the market around the third week after a notable decline.

Traders should be aware that the immediate week after a significant drop provides little insight on recovery trends, so considering a cautious approach may be beneficial during this time.

Options Strategies for the Adventurous Trader

With last Friday’s closing price at $10.96 as a reference, traders can strategize relevant options trades. An aggressive move might target the third week following a 10% drop, leveraging the median return of 27.83%. If this occurs, RUM stock could reach around $14.01 by the options expiry on January 31, closely aligning with a significant resistance level.

Market makers are currently providing substantial returns for call spreads, specifically those with a short strike price of $14. The most lucrative option is the 12.50/14.00 call spread, where traders can buy the $12.50 call and sell the $14 call.

Throughout a typical three-week period, RUM stock shows a median positive return of 7.01%, indicating a potential upside of around $11.74. More conservative investors might opt for a call spread with a shorter strike of $12.50 as a balanced approach.

Lastly, for those preferring to wait out the initial volatility, targeting the February 7 options expiry may be wise. Here, potential returns suggest RUM could reach about $11.91, where an 11/12 bull call spread presents a desirable payout and sufficient time for the strategy to play out.

Read Next:

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.