Market Volatility: Smart Investment Strategies Amid Tariff Concerns

The stock market has experienced a significant sell-off recently, leading many analysts to describe it as a stock market crash prompted by President Donald Trump’s tariff announcements. This week, stocks fell sharply as reciprocal tariffs took effect. Although the market saw a brief recovery after Trump announced tariff relief for all countries except China, losses continued on Thursday.

While it remains uncertain how these developments will unfold, many market participants believe that the tariffs will negatively impact the economy.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

However, I believe that widespread selling may not be the best strategy, particularly for individual investors. They often fare better when they hold stocks for a three- to five-year timeframe. While the tariffs may influence short-term perceptions, they are unlikely to remain a dominant concern five years from now.

Consequently, I am shifting my focus from current anxieties to future opportunities, allowing me to capitalize on lower stock prices today. I have identified 10 companies that rank high on my investment list, each positioned for substantial growth over the next five years. Here’s a breakdown by category:

Key Chip Manufacturers: Taiwan Semiconductor and ASML

Before tariffs dominated the headlines, artificial intelligence (AI) was the leading market trend. While discussions of tariffs have overshadowed AI developments, the competition in this space continues. The market has not yet reached the computing capacity needed for a widespread generative-AI rollout, indicating a sustained demand for chips.

Taiwan Semiconductor Manufacturing (NYSE: TSM) stands as the world’s premier contract chip producer, manufacturing chips crucial for training and executing AI models. Company management anticipates that revenue from AI-related chips will increase at a 45% compound annual growth rate over the next five years, and that forecast is unlikely to have changed, especially since semiconductors are exempt from tariffs.

Producing these chips requires specialized machinery, which brings ASML Holding (NASDAQ: ASML) into focus. ASML is the sole provider of technology needed to manufacture extreme ultraviolet lithography machines critical for chip production.

As demand for chips escalates, the need for ASML’s machinery will also grow, positively impacting its stock.

AI Hardware: Nvidia and Broadcom

The race in AI is still very much alive. Hyperscale companies are planning to make significant capital investments this year, primarily for data centers housing AI computing devices.

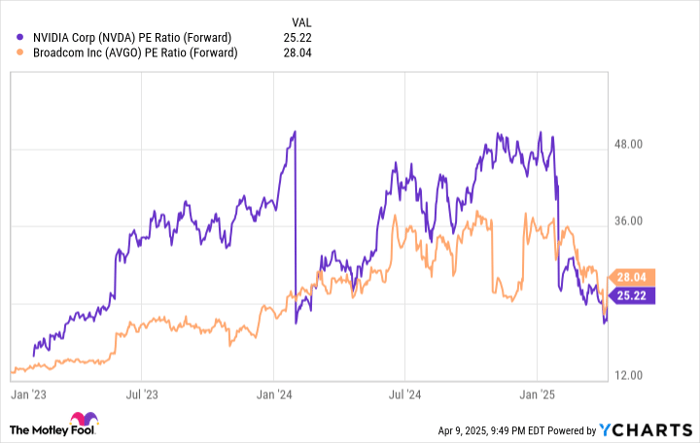

Nvidia (NASDAQ: NVDA) specializes in graphics processing units (GPUs), while Broadcom (NASDAQ: AVGO) produces custom AI accelerators and connectivity switches essential for running AI models. Both companies expect considerable growth in the coming years.

Despite their central role in AI, these stocks have recently dipped more than others and are currently more affordable than they have been for a while.

NVDA PE Ratio (Forward) data by YCharts; PE = price to earnings.

This landscape makes both stocks excellent purchases today, as their hardware remains in high demand.

AI Hyperscalers: Amazon, Meta Platforms, and Alphabet

Amazon (NASDAQ: AMZN), Meta Platforms (NASDAQ: META), and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) have emerged as major investors in AI, building capacity for their operations and their clients via cloud computing services. These AI hyperscalers are likely to realize substantial returns on their investments within the next five years.

Regardless of the outcomes of their AI initiatives, each company has solid fundamentals to sustain operations while AI investments develop. With stocks significantly down from past highs and reaching low relative valuations, now is an opportune time to purchase shares in these established giants, even after their recent uptick.

GOOGL PE Ratio (Forward) data by YCharts.

International Exposure: MercadoLibre

MercadoLibre (NASDAQ: MELI) holds a distinct position; it is listed on a U.S. exchange but operates solely in Latin America, where it has become the leading fintech and e-commerce player.

Despite a recent sell-off in line with broader market trends, the stock has been relatively insulated from tariff impacts. Currently down about 10% from its peak, it represents a compelling investment opportunity considering its strategic market position.

Other Notable Stocks: The Trade Desk and CrowdStrike

Recently, I’ve also identified The Trade Desk (NASDAQ: TTD) and CrowdStrike as promising investment options. With these stocks’ potential and market dynamics in mind, they could perform well in the near future.

Market Insights: The Trade Desk and CrowdStrike Offer Unique Opportunities

Among the companies making headlines are The Trade Desk (NASDAQ: TTD) and CrowdStrike Holdings (NASDAQ: CRWD).

The Trade Desk Experiences Market Volatility

The Trade Desk finds itself in a challenging position after its fourth-quarter earnings report, which marked the first instance of missing revenue guidance in its public history. This disappointing result, coupled with a lower revenue outlook for 2025, triggered a significant sell-off of its stock, further exacerbated by a general downturn in the market over recent weeks.

As it stands, The Trade Desk is a key player in advertising services, particularly within the connected TV sector, which is expected to grow increasingly attractive. With its stock price nearly 65% below its all-time high, it presents a compelling investment opportunity in the current market climate.

CrowdStrike Remains a Steady Player in Cybersecurity

CrowdStrike, a prominent name in cybersecurity, operates in a sector where spending is unlikely to be curtailed, even amid economic uncertainty. While growth may be challenging as companies navigate tight budgets, CrowdStrike is positioned to retain its existing revenue stream.

This context might lead to fluctuations in the stock price, yet it also creates an attractive entry point for investors looking at one of the leading cybersecurity firms. Over the next few years, CrowdStrike is expected to be a frontrunner in a field poised for substantial expansion.

Long-Term Investment Perspective

Shifting focus from short-term gains to long-term potential reveals numerous investment opportunities within the current landscape. The Trade Desk and CrowdStrike highlight just a couple of the attractive buys available today, although the market contains even more valuable options.

Should You Invest $1,000 in Nvidia Right Now?

Before considering an investment in Nvidia, it’s essential to evaluate the current landscape:

The Motley Fool Stock Advisor analyst team recently highlighted what they consider the 10 best stocks to buy now, with Nvidia notably absent from the list. The stocks that made it could deliver significant returns in the coming years.

For historical context, take the example of Netflix, which made this list on December 17, 2004. An investment of $1,000 at that time would have grown to $509,884! Similarly, Nvidia was included on April 15, 2005, where a $1,000 investment would now be valued at $700,739!

It is essential to note that the average return from Stock Advisor has been an impressive 820%, far exceeding the 158% average return of the S&P 500. Staying informed about the latest recommendations is crucial, and joining Stock Advisor can provide access to this valuable information.

*Stock Advisor returns as of April 10, 2025

Suzanne Frey, an executive at Alphabet, serves on The Motley Fool’s board of directors. Randi Zuckerberg, sister of Meta Platforms CEO Mark Zuckerberg, previously held a market development role at Facebook and also sits on The Motley Fool’s board. John Mackey, the former CEO of Whole Foods Market, also holds a board position. Keithen Drury has investments in a variety of companies, including ASML, Alphabet, Amazon, Broadcom, CrowdStrike, MercadoLibre, Nvidia, Taiwan Semiconductor Manufacturing, and The Trade Desk. The Motley Fool recommends several of these firms and maintains specific positions. For a complete disclosure policy, please refer to their website.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.