Market Reaction: Nvidia Faces Pressure After China’s AI Breakthrough

Last week, the stock market jumped in response to President Donald Trump‘s vision of making the U.S. the “world capital of artificial intelligence and crypto.” However, this ambitious goal is now facing significant challenges.

On Monday, an announcement about China’s open-source AI model, DeepSeek R1, created major turbulence for investors. Even the tech giant Nvidia Corp. NVDA took a hit, experiencing a loss of approximately 17% during early trading.

Concerns are growing that the U.S. may be losing its edge in the AI race. DeepSeek’s ability to rival leading American AI solutions at a much lower cost poses a threat to the pricing power of U.S. tech companies, which could disrupt their growth trajectories.

See Also: Stock Of The Day — Nvidia Breaks Support After DeepSeek AI Disruption

Analyst Michael Gayed noted that, “The Stargate project was launched in part to assert the United States’ global AI dominance. If China has the ability to develop comparable products using less expensive technology, market perspectives may shift dramatically.”

Despite the grim outlook for some, certain analysts remain optimistic about Nvidia’s position.

Cantor Fitzgerald analyst CJ Muse stated that “DeepSeek R1 is actually very bullish for Nvidia” in an interview with Bloomberg TV. He argues that this advancement indicates the tech industry is moving closer to achieving artificial generative intelligence (AGI), potentially enhancing AI use in everyday activities.

Nvidia’s Stock: Statistical Advantages Amidst Technical Challenges

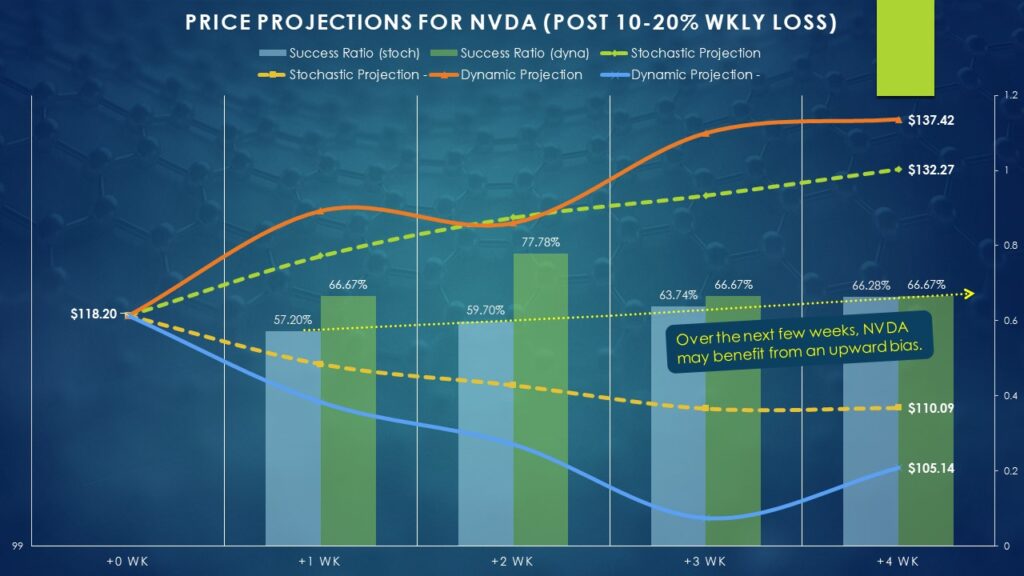

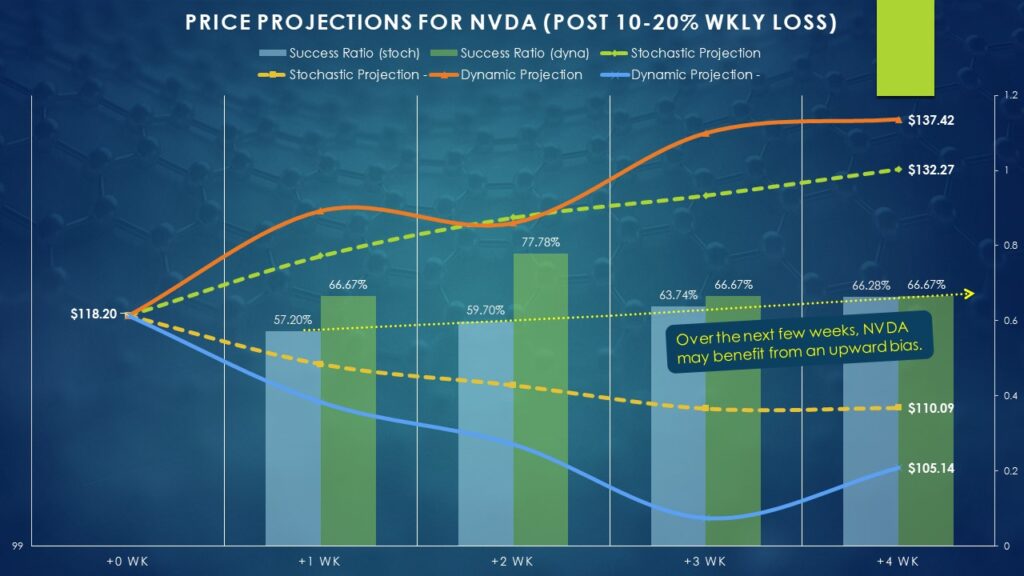

Nvidia’s stock is on course to experience a weekly decline of about 15% following Monday’s drop. However, it’s important to remember that the week is still in its early stages. Optimists point to historical data showing Nvidia’s stock typically has an upward bias.

Analysis from the past five years indicates there is roughly a 57% probability that a stock position initiated at week’s start will be positive by its conclusion. This figure increases to about 66.3% over a four-week period, suggesting that Nvidia stock often trends upward in the long run.

While the overall trend suggests potential for recovery, the introduction of DeepSeek introduces a new level of uncertainty to Nvidia’s typical profit-loss patterns. Even during a drop of 10% to 20% in one week, past data shows that the chances of Nvidia rising in the following month remains at 66.7% with a median return of 16.26%.

However, there is a noteworthy risk to consider. From late March last year, Nvidia stock appears to have developed a head-and-shoulders pattern, which historically signals bearish trends for tech stocks.

Compounding the situation, Nvidia’s competitor Advanced Micro Devices Inc. AMD seems to be experiencing similar challenges. As the market continues to analyze DeepSeek’s full impact, a cautious approach may be warranted.

Strategizing Options in a Volatile Landscape

Given the significant technical disturbances due to the recent news, an investment in Nvidia may seem quite aggressive. Yet, the odds favor Nvidia for the near future as investors typically buy the dip.

If one were to consider a starting price of $118.20, optimistic projections suggest Nvidia could reach between $132.27 and $137.42 by the close of trading on February 21. Traders might consider the 108/130 bull call spread for options set to expire on February 21.

This multi-leg options strategy involves purchasing a lower strike call option (the $108 call) and selling a higher strike call option (the $130 call). The goal is for Nvidia’s stock to rise to or above the $130 mark, leading to maximum payout.

While the bull spreads limit both risk and potential rewards, they also help minimize costs. The credit received from the short call can offset the initial cost of the long call, effectively lowering the net investment.

However, the 108/130 call spreads carry a high net cost of $1,090. For a more cautious strategy, traders might consider the 127/130 bull call spread, which has a lower cost of $95 but requires Nvidia stock to hit a higher breaking point of $127.95 to break even.

Now Read:

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.