Elon Musk’s Future with Tesla: Will He Shift Focus Amid Challenges?

Elon Musk’s connection with Tesla TSLA is as intrinsic as it gets for CEOs and their companies. Under his bold leadership, he transformed Tesla into a major player in the electric vehicle (EV) market. However, Musk’s deep involvement in politics, particularly his role in U.S. President Trump’s Department of Government Efficiency (DOGE), has raised concerns among investors. Many fear that Musk’s distractions come at a critical time when Tesla grapples with declining sales and increasing competition.

Recent reports from Politico indicate that Musk might step down from DOGE soon, which could allow him to focus more intently on Tesla. This news boosted Tesla’s shares by 5% yesterday, reflecting some investor optimism.

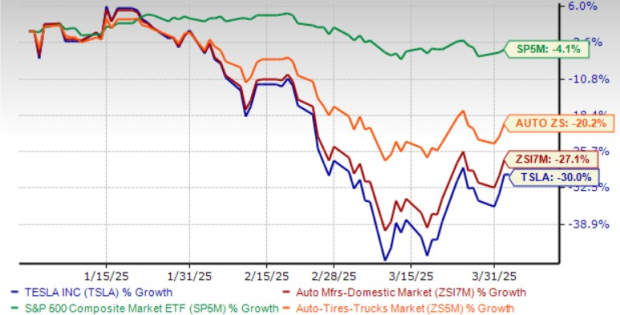

Initially, Musk’s relationship with Trump helped elevate Tesla’s Stock late last year, as investors anticipated favorable policies for the company. However, his visibility in DOGE has generated apprehension regarding his divided focus, identified as a significant factor contributing to Tesla’s 30% stock decline in 2025.

Year-to-Date Price Comparison

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Given Tesla’s slipping share prices and ongoing uncertainties, many are left wondering whether Musk will indeed leave DOGE. Even if he fully commits to Tesla, is the Stock still a worthwhile investment? Or are systemic issues affecting its value? Let’s explore.

Possibility of Musk Leaving DOGE Appears Remote

According to the Politico report, insiders suggest that Musk and Trump have agreed that it is time for him to return to his core business responsibilities. However, there is mounting frustration within some circles of the Trump administration about Musk’s unpredictable nature being a potential political liability.

During a recent interview, Trump acknowledged Musk’s valuable contributions and noted that Tesla’s CEO has “a big company to run.” He also indicated that Musk could remain involved with the White House for as long as he chose.

When asked about the duration of his role as a special government employee, Musk stated, “I think we will have accomplished most of the work required to reduce the deficit by a trillion dollars within that time frame.”

Both Musk and the White House promptly dismissed the rumors from Politico, with White House press secretary Karoline Leavitt calling the report “garbage.” Musk labeled it “fake news” on social media. This solidifies that Musk will likely remain until his tenure officially ends on May 30. However, his increasing political commitments are just one of several issues Tesla faces. The company must work harder to regain investor confidence.

Disappointing Q1 Deliveries as BYD Surges Ahead

Tesla’s recent first-quarter delivery figures indicate a worrying trend, with only 336,000 vehicles delivered—well below the forecast of around 378,000 units. This represents Tesla’s lowest quarterly output in over two years, down from 495,570 in the previous quarter and 386,810 units a year ago.

Factors contributing to these lagging figures include retooling factories for the new Model Y SUV. Additionally, growing dissatisfaction with Musk’s public persona has damaged Tesla’s brand image. Reports of owners distancing themselves from Musk abound; instances of customers attaching stickers reading, “I bought this before Elon went off the rails,” as well as some opting to sell their vehicles in protest, illustrate this sentiment. The company faces slowing sales and increased competition in the U.S., China, and Europe.

In contrast, Chinese EV manufacturer BYD Co Ltd BYDDY reported a robust sales increase, delivering 416,388 battery electric vehicles (BEVs) in the first quarter of 2025, surpassing Tesla’s 336,681 units. This marks BYD’s second consecutive quarter as the world’s leading EV producer, showcasing its aggressive expansion strategy and innovative technology that challenge Tesla’s longstanding market position.

Tesla’s Robotaxi Promise Under Pressure

For Tesla, the pressure is mounting to launch more affordable models and to fast-track its autonomous driving initiatives, which are critical to its long-term strategy. The company aims to release an affordable vehicle in the first half of 2025 and continue expanding its portfolio.

Tesla is targeting a June rollout of its unsupervised Full Self-Driving (FSD) technology in Austin. In February, the company applied for a permit from the California Public Utilities Commission for a self-driving taxi service. Last month, it achieved initial approvals necessary to eventually launch its robotaxi program across the state; however, the initial efforts will still involve human drivers. The ultimate objective is a fully autonomous fleet that can compete with companies like Alphabet GOOGL.

Alphabet’s Waymo remains a leader in the autonomous vehicle and robotaxi sector, bolstered by years of rigorous testing and strategic partnerships. With plans to invest an additional $5 billion, Waymo is well-positioned to maintain its dominance.

For Tesla, 2025 represents a crucial year. It must demonstrate that its autonomous vehicle technology can deliver results without further delays.

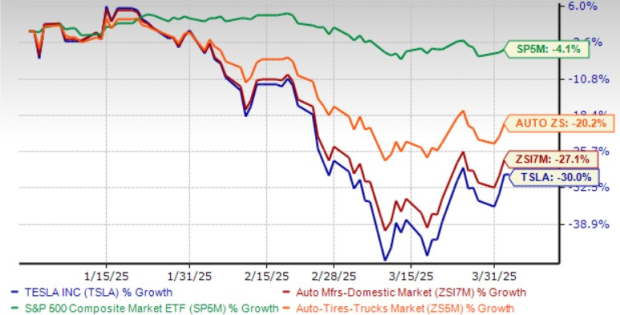

Analysts Adjust TSLA EPS Estimates Downward

Analysts are anticipating a reduction in Tesla’s earnings per share (EPS) estimates, a trend that may continue with the company’s first-quarter financials set to be released later this month.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Should You Consider Selling TSLA Stock Now?

Tesla’s EV Struggles Offset by Growth in Energy Sector

Tesla’s electric vehicle (EV) segment is currently facing significant hurdles. The company’s brand perception has shifted, competition in the market is intensifying, and they are navigating potential trade policy risks. Despite these challenges, Tesla is experiencing notable success in its energy generation and storage division. In 2024, deployments surged to 31.4 GWh, and during the first quarter of 2025, the company achieved 10.4 GWh in energy storage deployments—marking an impressive 156% increase year over year.

Future Growth Tied to Autonomous Driving Aspirations

Even with setbacks in its EV operations, Tesla’s long-term prospects increasingly depend on its autonomous driving initiatives. Achieving Full Self-Driving (FSD) approvals and advancements in robotaxi technology will be crucial for the company’s growth trajectory. Should Tesla effectively navigate these developments, its stock could rebound strongly, and investors selling now might miss future gains.

Long-Term Potential Amid Short-Term Challenges

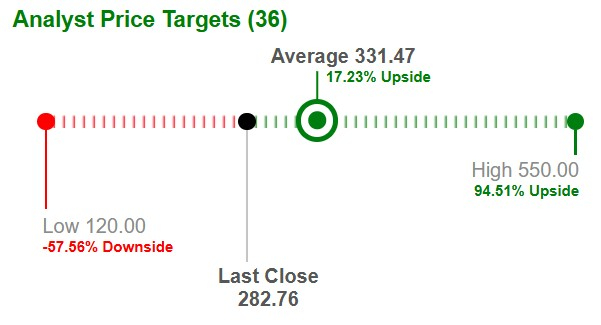

While ongoing short-term challenges may pressure the stock, Tesla’s long-term potential remains compelling. Analysts suggest that current market conditions do not represent an optimal exit point. In fact, Wall Street’s average price target indicates a potential upside of 17% from the existing price levels.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Recommendations for Investors

For current investors, holding onto shares appears to be a reasonable strategy amidst the volatility. However, potential new investors may wish to wait for clearer indicators that Tesla can fulfill its commitments regarding autonomous vehicles (AVs) and more affordable EVs. Presently, Tesla holds a Zacks Rank of #3 (Hold) with a VGM Score of D. For those interested, you can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Top Stock Predictions from Zacks Research

Our team at Zacks Investment Research has released a list of five stocks with the highest potential for gaining +100% or more in the near future. Among those, Sheraz Mian, Director of Research, emphasizes one stock poised for remarkable growth.

This top pick represents one of the most innovative financial firms. With a rapidly expanding customer base—over 50 million—and a broad array of cutting-edge solutions, this stock is well-positioned for significant gains. Notably, while not all elite picks guarantee success, this stock shows promise to outperform earlier Zacks’ recommendations like Nano-X Imaging, which surged by +129.6% in just over nine months.

Free: see our top stock and four additional contenders.

Interested in the latest recommendations from Zacks Investment Research? You can download “7 Best Stocks for the Next 30 Days” for free. Click here to access the report.

Tesla, Inc. (TSLA) : Free Stock Analysis report

Alphabet Inc. (GOOGL) : Free Stock Analysis report

Byd Co., Ltd. (BYDDY) : Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.