Political Controversies Impact Tesla’s Sales and Stock Performance

Tesla Inc. (TSLA) has long been associated with its dynamic CEO Elon Musk. His visionary leadership and business strategies transformed Tesla into a key player in the electric vehicle (EV) sector. Like Amazon revolutionizing retail and Netflix reshaping entertainment, Musk’s innovations led to excitement surrounding new car releases and significant stock price spikes. However, the landscape has shifted significantly.

Currently, instead of headlines celebrating Tesla’s technological advancements, Musk’s growing entanglement in politics is drawing scrutiny. This shift has investors, including loyal Tesla fans, increasingly dissatisfied, with some even boycotting the brand.

Once viewed as Tesla’s greatest asset, Musk is now seen by some as a liability due to his heightened political activities.

Musk’s Political Involvement Effects on Brand

Musk’s alignment with right-wing politics appears to be negatively affecting Tesla’s reputation. According to a recent survey from Electrifying.com, 59% of potential buyers indicated they are deterred from purchasing a Tesla due to Musk’s actions. Alarmingly, 61% of current EV owners are contemplating switching to a Chinese brand.

Protests have surfaced outside Tesla locations in major U.S. cities such as New York, Seattle, and Kansas City as demonstrators protest Musk’s connections to former President Trump and his moves toward extensive government spending cuts. The backlash extends beyond U.S. borders, with rising anti-Musk sentiments in Europe.

Indications are clear that some Tesla owners wish to distance themselves from Musk. Bumper stickers stating, “I bought this before Elon went off the rails” are emerging, while more Tesla drivers are choosing to sell their vehicles in protest.

Tesla’s stock has also taken a hit; after surging following Trump’s election win in late 2024, it has since erased all those gains. Once buoyed by Musk’s political associations, the company now seems to be suffering from them.

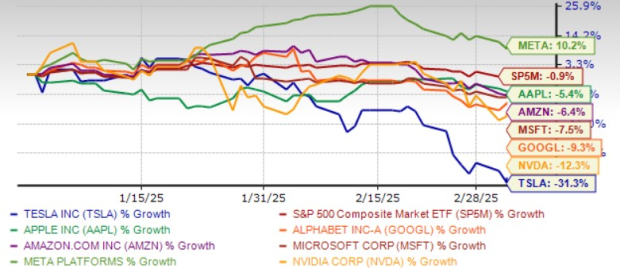

Year to date, TSLA shares have plunged over 30%, underperforming its peers within the Magnificent Seven.

YTD Price Performance Comparison

Image Source: Zacks Investment Research

Musk’s Distraction During a Critical Period for Tesla

In addition to leading Tesla, Musk is now heavily engaged in political affairs, serving as head of President Trump’s Department of Government Efficiency (“DOGE”)—a role that involves implementing significant cost reductions within the government, including scrutinizing federal employees’ jobs. This political focus is detracting from his attention on Tesla during a crucial time.

Tesla faces a challenging market characterized by slowing sales and fierce competition. Deliveries are down in key markets, with sales in Europe dropping by 45% year-over-year in January. Likewise, China’s sales saw declines, with approximately 15% in January and a nearly 50% plunge in the following month, according to CPCA. Competitors like BYD Co Ltd (BYDDY), NIO Inc. (NIO), XPeng, and Li are intensifying the challenge in China.

In the U.S., Tesla’s position is also weakening, particularly in California where sales have waned throughout 2024. The company’s U.S. EV market share decreased to below 50%, down from 63% in 2022, with the battery electric vehicle (BEV) market share falling from 59% in January 2024 to 45% in January 2025, according to Wards Auto.

These statistics highlight Tesla’s mounting struggles, including its first-ever annual decline in global deliveries in 2024. Musk faces pressure to expedite affordable model launches and enhance autonomous driving capabilities, key elements of Tesla’s long-term strategy.

Investors are increasingly concerned about Musk’s divided attention during this critical period, as his political involvement threatens Tesla’s brand strength.

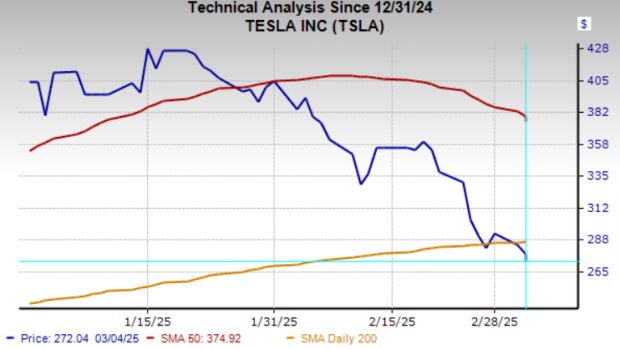

Technical Analysis Signals Weakness in Tesla Stock

Tesla’s stock reflects considerable technical weakness, trading below both its 50- and 200-day moving averages. Recently, it experienced a dip to 2025 lows, closing under the 200-day moving average for the first time since August 2024—a decline coinciding with the implementation of new tariffs by Trump, which prompted reciprocal duties from Canada and China.

Image Source: Zacks Investment Research

Morgan Stanley Offers Support Amid Turmoil

Even with ongoing difficulties, Morgan Stanley has reinstated Tesla as its “Top Pick” among U.S. automakers, highlighting the company’s advancements in AI and robotics.

Musk has been encouraging investors to recognize Tesla’s potential beyond just EVs, with a recent earnings call emphasizing that Tesla’s Optimus robot could create over $10 trillion in long-term revenues. He projects building thousands of Optimus units this year, potentially using them for repetitive tasks in Tesla factories, with an aim to market them to external businesses by late 2025.

In addition, Tesla is preparing for the June launch of its unsupervised Full Self-Driving (FSD) in Austin, following the release of FSD Version 13 in December. The company is currently deploying autonomous vehicles at its Fremont factory and is poised to expand unsupervised FSD throughout the U.S., pending necessary regulatory approvals. Last week, Tesla sought regulatory permission in California for a ride-hailing service. While facing significant challenges, Tesla’s AV and robotics initiatives could redefine its growth trajectory beyond the EV market.

Insights for Investors

Tesla’s reputation is undoubtedly suffering due to Musk’s political pursuits. Given the stock’s fall below its 200-day moving average, prospective buyers should proceed with caution. The company must navigate numerous hurdles to meet its 2025 objectives. The stock remains susceptible to Musk’s forthcoming actions, particularly if political controversies escalate.

Nevertheless, Tesla possesses strong technology, an expanding energy storage division, a solid financial framework, and an extensive supercharger network. Potential investors should monitor Tesla’s progress in autonomous vehicles, as advancements in FSD approvals and robotaxi initiatives could drive long-term success.

For current shareholders, exercising patience may prove beneficial, and they should await a more advantageous exit point. Long-term investors may find it reasonable to remain engaged with Tesla’s future possibilities despite the current volatility.

The Zacks Consensus Estimate for Tesla’s earnings per share (EPS) in the first and second quarters has diminished over the past 30 days, while projections for the full year of 2025 have remained stable.

Recent Updates and Insights on Tesla and Semiconductor Stocks

Projections for Tesla Inc. (TSLA) have improved over the past 30 days. TSLA currently holds a Zacks Rank #3 (Hold), indicating a steady outlook. For a comprehensive review of top-performing stocks, consider viewing the full list of Zacks #1 Rank (Strong Buy) stocks here.

Highlights from Zacks: The Leading Semiconductor Stock

While NVIDIA has experienced an astonishing rise of more than 800% since our recommendation, it is only 1/9,000th the size of the company we identify as our top semiconductor stock. Although NVIDIA remains strong, this new contender has significant growth potential.

With robust earnings growth and a widening customer base, this semiconductor stock is well-positioned to meet the soaring demand driven by advancements in Artificial Intelligence, Machine Learning, and the Internet of Things. Notably, global semiconductor manufacturing is estimated to surge from $452 billion in 2021 to $803 billion by 2028.

Discover This Stock for Free >>

For the latest insights from Zacks Investment Research, you can freely download 7 Best Stocks for the Next 30 Days.

For detailed stock analysis, visit:

For further reading on Tesla’s challenges, refer to this article at Zacks Investment Research.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.