2024: A Year of Economic Recovery and Steady Growth

As we approach the end of 2024, economies—especially in the US—are displaying a strong recovery. The disruptions caused by Covid have diminished, marking a transition to what many are calling a “Goldilocks” economy: conditions are just right, avoiding extremes of too hot or too cold.

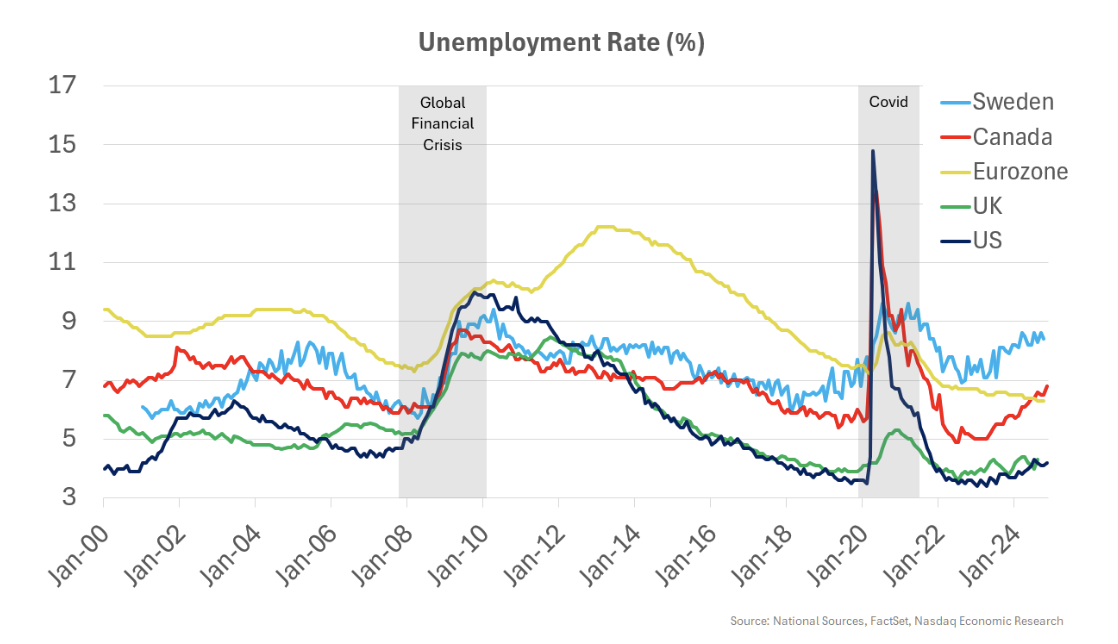

Labor Markets Show Signs of Stabilizing

Labor markets are one area where this stability is evident. During the pandemic, unemployment soared, followed by a tightening workforce as economies reopened. Now, the unemployment rates in the US (dark blue line), Canada (red line), Sweden (light blue line), and the UK (green line) are rising—but only to levels comparable to those seen during the last economic expansion in the 2010s. Overall, these labor markets appear to be returning to normal, only slightly tight but not historically so.

Inflation Levels Near Target Again

Softening labor markets have also played a role in bringing inflation rates back to the target level of around 2%. Initially, inflation surged during Covid due to supply chain issues, driving up costs for goods, energy, and food. Afterward, wage inflation resulted from labor shortages when economies reopened. Fortunately, with supply chains returning to normal and wage growth moderating, inflation is now stabilizing at approximately 2% in major economies.

Central Banks Manage Growth Without Causing Recessions

To manage inflation, central banks have raised interest rates. Interestingly, they have succeeded in cooling economies enough to reduce inflation without triggering a recession, although it was a close call in several countries. In the US, for instance, the unemployment rate stands at 4.2% while inflation is recorded at 2.3%, and projections indicate nearly 3% real GDP growth—one of the highest expected growth rates among advanced economies.

Interest Rate Cuts Could Prop Up Economic Growth in 2025

As inflation is brought under control, major central banks have shifted their focus to stimulating growth by cutting interest rates in 2024. The Bank of Canada and Sweden’s Riksbank have already reduced rates by 125 basis points, while the Federal Reserve and European Central Bank have cut by 75 basis points each. The Bank of England has cut rates by 50 basis points. More reductions are expected in the upcoming year.

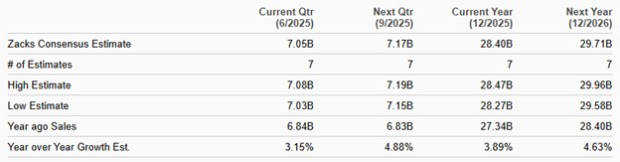

The expected reductions in interest rates should lead to increased economic growth in 2025 by lowering borrowing costs for consumers and businesses. This boost in demand could result in higher company revenues, positively impacting the markets.

The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. © 2024. Nasdaq, Inc. All Rights Reserved.