# The Urgency of AI Adoption: Stocks Dividing Industry Success

Companies must urgently adopt and integrate AI technologies to survive and thrive in today’s economy.

In the early 1900s, Eric Fry’s grandfather lost his job on an Illinois farm—not to another person, but to Henry Ford’s tractor.

After being displaced by this innovation, he relocated west to Montana to work as a cowboy.

This story serves as a cautionary tale for the present era.

Currently, AI is displacing workers in nearly every sector, creating a significant divide between what Eric calls the “AI Appliers” and the “AI Victims.”

Eric argues that the impact of AI today is as disruptive as the introduction of tractors was to American agriculture. The situation is accelerating as we near the reality of artificial general intelligence (AGI).

In today’s Digest, Eric examines two stocks that have taken strikingly different paths as AI reshapes our Stock market. One is generating wealth rapidly; the other is losing it.

This divergence is why Eric is alerting investors through an important new presentation titled “The Final Warning.” He’ll elaborate on this today.

In short: AI is not just forthcoming; it’s already here. Eric believes that investors have a limited time to prepare. Now, I’ll let him continue from here.

Have a good weekend,

Jeff Remsburg

**********************

Once, I asked my dad why his father left farming in Illinois for cattle country in Montana.

“Henry Ford eliminated all the farm jobs,” he explained. “My father couldn’t find work on the farms, so he moved to Bozeman to be a cowboy.”

While Henry Ford didn’t personally destroy farm jobs, his pioneering tractor did. The Fordson Model F, which came into production in 1917, became a staple for farmers in the Midwest.

By 1922, the Fordsons commanded a 70% market share and by 1928, 700,000 units were being produced annually.

Today, artificial intelligence mirrors Henry Ford’s revolutionary tractor.

This technology promises widespread gains in efficiency but also risks reducing or eliminating entire employment sectors.

Such changes are difficult to grasp and harder to accept, which is why we must “future-proof” our lives as much as possible.

This necessity underscores the once-in-a-generation investment opportunities that AI is presenting.

As a result, artificial intelligence is dividing the business landscape into two distinct categories: AI appliers and AI victims.

To survive and prosper, companies must adopt and integrate AI technologies swiftly. Those that fail to do so are likely to fail themselves, especially with AGI on the horizon.

I first raised concerns about approaching AGI last August, providing insights on companies that would be AI winners or losers to my subscribers in my elite trading service, The Speculator.

It appears my predictions were accurate, both figuratively and literally.

Today, let’s explore one AI success story to identify the traits behind its market success and another company that investors should steer clear of as AI progresses.

Worthy of a Toast

Since I highlighted this AI success last August, its Stock has surged by 80%.

This Boston-based company provides AI-enabled solutions across various aspects of the restaurant business—ranging from online order fulfillment to reservations management and supply chain oversight.

I am referring to Toast Inc. (TOST).

Since its founding in 2011, Toast has been perfecting a platform that integrates all necessary technology for restaurants, including online ordering, contactless payments, delivery services, and bookkeeping.

As a result, nearly everyone who has ordered takeout or delivery online has engaged with this platform.

This technology has enabled Toast to achieve an impressive 119% net revenue retention rate since 2015. This key metric shows the percentage of revenue retained from existing customers over time.

Effectively, Toast has transformed into a data-focused software company, possessing one of the largest datasets in the restaurant sector. This data empowers them to develop advanced AI tools for the industry.

Toast’s software can assist restaurants in real-time cost evaluations, helping them understand which food items to promote and at what prices. Such insights can significantly impact success in the highly competitive restaurant market.

The more data Toast gathers from its expanding client base, the more effective its AI becomes.

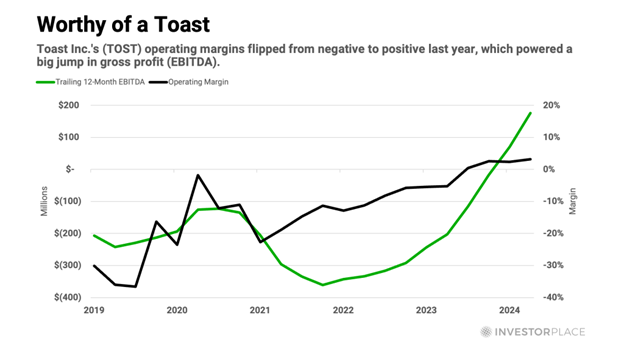

Additionally, Toast has improved its operating margins, shifting from negative to positive—it moved into positive territory nine months ago and continues to grow. Consequently, its gross profit (EBITDA) is also positive and climbing.

Last week, the company reported record revenue and EBITDA for the first quarter, exceeding analyst estimates significantly. As a result, the Stock jumped 10% on the day of the earnings announcement.

Toast’s rapid integration of AI technology into its platform is a crucial reason for its expected continued success.

This company is worth investigating further, as it is likely to produce growing revenues and earnings in the coming years.

As AI technologies permeate various sectors, the list of successful “AI appliers” will expand daily. However, the number of “AI victims” will likely grow even larger.

As we turn to an at-risk Stock, here’s one to avoid…

There Can’t Be Winners Without Losers

Companies that fail to incorporate AI technologies often lack the necessary expertise or possess business models that are fundamentally at odds with AI.

In either scenario, we do not want to hold stocks in companies threatened by AI.

That’s why I continue to highlight at-risk companies from time to time, as I did…

Shutterstock’s Financial Struggles amid AI Disruption: Key Insights

Last August, I highlighted Shutterstock Inc. (SSTK) as a company positioned precariously within the evolving AI landscape.

At that time, I noted:

Once a leading graphics company with a significant library of proprietary images, Shutterstock is now facing serious competition due to advancements in Generative AI technologies like OpenArt.

These technological changes have led to an increase in subscriber “churn,” resulting in collapsing gross margins and net income. This decline mirrors a waning demand for Shutterstock’s core content library.

Since my initial analysis, Shutterstock’s financial performance continues to decline. The company reported earnings per share (EPS) of only $1.01 last year, falling short of the $1.90 that analysts had anticipated. Furthermore, the consensus earnings estimate for this year has dropped from $3 to $2.10. As a result, the stock price has decreased by more than 40% since my warning.

Shutterstock’s situation is indicative of a broader trend in the market. It emphasizes the need to analyze all potential investments through the lens of AI, being mindful of both the opportunities and the risks it presents.

I recently completed four new research reports focusing on investments in AI ahead of the rise of artificial general intelligence (AGI). Among these reports, three identify a stock to buy, while the fourth advises caution regarding three stocks to sell.

Ahead of AGI’s advent, I am reiterating my “Final Warning.”

In an upcoming event, available to watch now here, I will outline a three-part strategy that includes:

- Insights into why sectors such as precious metals, energy, real estate, and biotech are currently significant.

- My top AGI-related stock pick, which has already gained 46% while the S&P 500 index declined by 5%.

- Critical advice on stocks to avoid or sell immediately to mitigate potential losses.

Click here to view my urgent “Final Warning” presentation.

Regards,

Eric Fry