IPO Activity Faces Downturn in U.S. and Stockholm Amid Economic Shifts

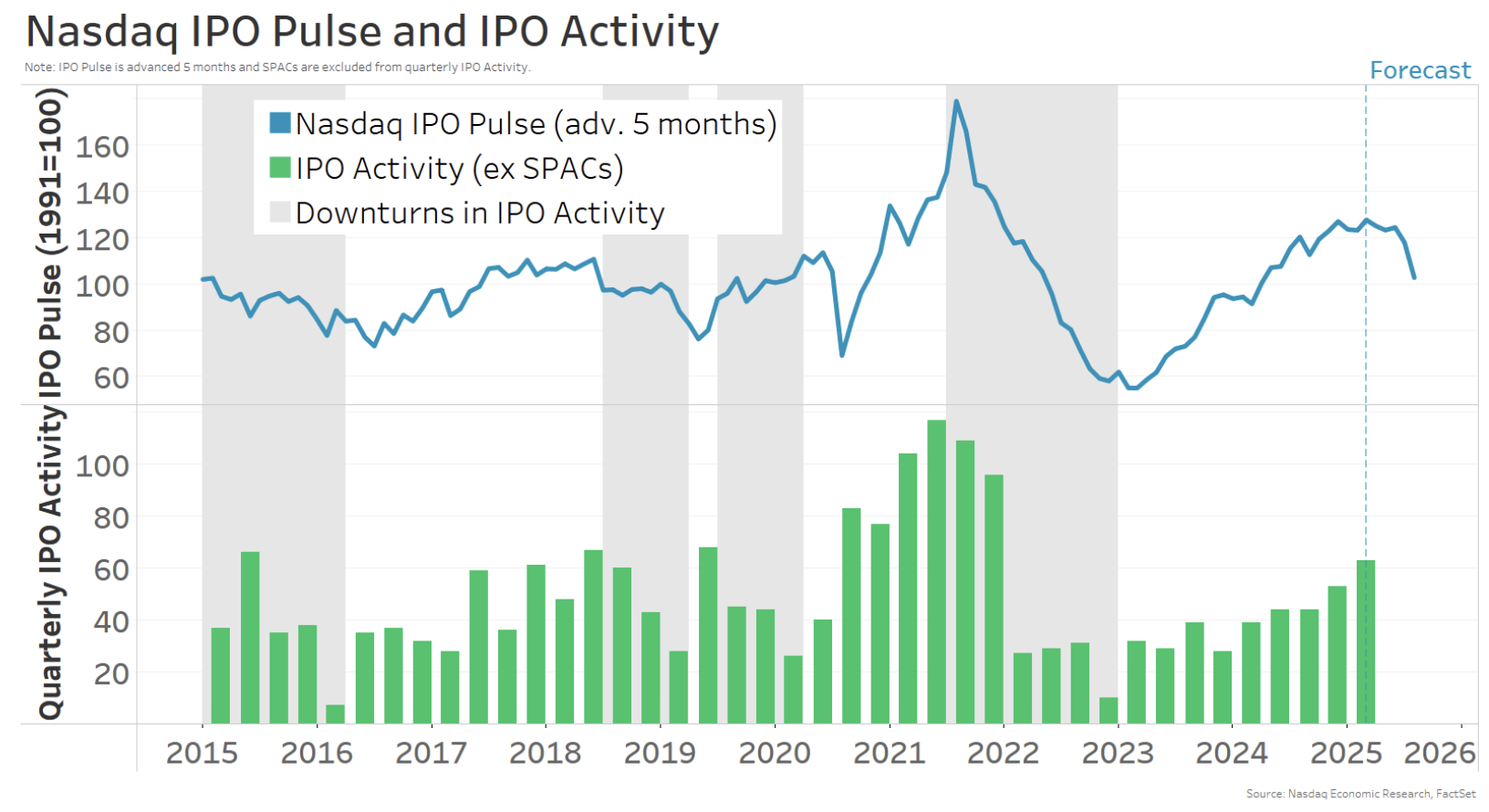

In our last update in mid-January, Nasdaq’s IPO Pulses for the U.S. and Stockholm indicated that initial public offering (IPO) activity would likely continue its upward trend into midyear. This uptrend did persist through the first quarter; however, the economic environment has shifted significantly since then.

Despite the positive signs earlier this year, IPO prospects are now clearly deteriorating. This decline began before the historic tariffs announced on April 2. The escalating sell-off in April has contributed to notable slowdowns in both the U.S. and Stockholm IPO Pulses. Several companies have already postponed their IPOs in recent days.

U.S. IPO Activity Anticipates a Softening Trend

Consistent with our analysis from January, IPO activity in the U.S. maintained its upward trajectory in Q1 2025, with 58 non-SPAC IPOs (see chart below, green bars) – the highest number recorded in over three years. However, signs of a slowdown are emerging.

Following a peak around a 3¼-year high in December, the Nasdaq IPO Pulse has diminished this year, plunging to a 16-month low in March (blue line).

Chart 1: Nasdaq IPO Pulse Declines to 16-Month Low in March Preceding Tariffs

To assess whether this recent decline signifies an incoming downturn in IPO activity, we compared it against historical downturns. We used a similar method to the National Bureau of Economic Research, evaluating the depth, diffusion, and duration of current trends. Unfortunately, early signs of downturns often look alike, making it difficult to discern between genuine downturns and false alarms. Up until March, it was not possible to confirm an impending downturn, but the increased market volatility in April raises the likelihood of a real downturn taking hold in Q2.

Stockholm Also Faces Decreased IPO Activity

Similarly, in Stockholm, Q1 IPO activity saw an upswing with eight IPOs (see chart below, green bars) – the second-highest quarterly total in nearly three years, just behind Q4 2024’s 10 IPOs. However, there are indications that this increase may not be sustainable.

After lingering just below its summer 2024 high through January, the Nasdaq Stockholm IPO Pulse fell to a 14-month low in March (blue line).

Chart 2: Nasdaq Stockholm IPO Pulse Declines to 14-Month Low in March

The analysis of this downturn relative to past trends shows that by March, it was leaning towards a true downturn based on its depth and distribution. However, it is currently tracking as a false alarm in terms of duration. All three aspects—depth, diffusion, and duration—must align for a genuine downturn to take place. Similar to the U.S., it is premature to declare a significant downturn in Stockholm IPO activity as of March; however, the global sell-off in April makes such a downturn highly probable.

Increased Uncertainty and Tariffs Impacting Market Stability

An essential factor contributing to the weakening outlooks in the IPO Pulses was heightened uncertainty, which we spotlighted in our 2025 outlook from December. This uncertainty arose from rapid changes in U.S. trade policy, pushing U.S. uncertainty to a peak in March (see chart below, red line). While Swedish uncertainty (blue line) remained at its historical average, the fluctuations in the U.S. impacted global markets.

Chart 3: U.S. Uncertainty Peaks, While Sweden Remains Average

Since the announcement of reciprocal tariffs on April 2, the ensuing global sell-off has further clouded the outlook.

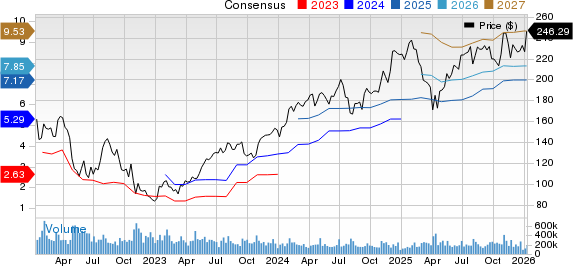

In terms of performance, both the MSCI Sweden (blue line) and MSCI USA (red line) peaked in mid-February and have since experienced corrections, each declining by 10% or more.

Chart 4: U.S. Uncertainty and Trade Policy Leading to Market Corrections

Market performance is a critical element in both IPO Pulses, as it influences valuations, volatility, and investor sentiment. We observed the decreasing market returns in April likely pushing the IPO Pulses further into downturn territory.

Future IPO Activity Expected to Slow in U.S. and Stockholm

Looking ahead, IPO activity is likely to decelerate significantly in both the U.S. and Stockholm, as historic trade policy shifts contribute to ongoing challenges. The severity of these downturns will be clearer in our next update scheduled for July.