Trump’s Pressure on Powell Creates Market Uncertainty Amid Declining Stocks

As I pen this article approaching lunchtime on Monday, stocks are experiencing a sharp downturn. All three major stock indexes are falling significantly, with the Nasdaq leading at a 3% drop.

In contrast, gold futures have surged past $3,400, achieving a new all-time high.

The prevailing “risk-off” sentiment in the market stems from President Donald Trump’s recent attacks on Federal Reserve Chairman Jerome Powell.

As highlighted in last Thursday’s Digest, Trump had expressed a desire for lower interest rates… immediately.

Last week, Trump criticized Powell, dubbing him “‘Too Late’ Jerome Powell” and stating that “Powell’s termination cannot come fast enough!”

This morning, Trump intensified his rhetoric, calling Powell a “major loser” while reiterating his demand for lower interest rates.

However, the real market turmoil today is not just fueled by insults, but rather by Trump’s recent threats to fire Powell.

Wall Street values stability, and the prospect of Trump dismissing the sitting Fed chair—who has not executed his directives—could profoundly unsettle the market. As much as stocks have declined recently, a “Powell firing” is not currently factored into valuations.

As reported by Bloomberg:

Concerns are mounting that President Donald Trump will follow through on his threat to dismiss Federal Reserve Chairman Jerome Powell, potentially instigating policies that could lead to a recession.

The dollar weakened, along with US stock futures and Treasuries, lifting the yield on 30-year bonds by up to 10 basis points in a low-volume, post-holiday market.

Investors are weighing the possibility of Powell’s termination and its implications for the U.S. economy.

What lies ahead? Let’s explore two distinct market forecasts: one bullish and one bearish.

Stock Market Reactions to Trump’s Tariff Pause

Earlier this month, on April 9, the stock market surged following President Trump’s announcement of a 90-day pause on certain tariffs.

I spoke with Jeff Clark, a seasoned trader and editor of Jeff Clark Trader, to assess whether the rally influenced his previously bearish market outlook.

Before the significant rally, Jeff informed his subscribers:

Ultimately, if this is truly a bear market, we could see the S&P drop to levels akin to late 2023, around 4,150 or 4,100.

The best buying opportunities may emerge in October or November.

While we can trade in the meantime, historical patterns suggest a final washout in late fall, presenting a chance to invest at significantly lower prices.

Despite the recent rally, Jeff maintained his bearish stance.

He projected a brief relief rally, which would ultimately stall and transition into another downward trend.

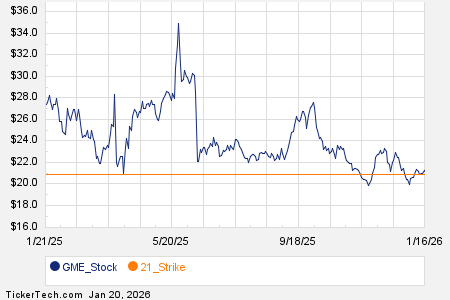

Since that prediction, the S&P initially climbed to about 5,453 but subsequently lost momentum and retreated to 5,275. As of Monday, the index has fallen further to 5,138, below previous support levels.

Source: TradingView

So, what can we expect moving forward?

In the medium-term, Jeff anticipates further declines. The crucial marker to monitor now is 5,200.

Recent Market Pullback: Not a Bearish Start Yet

Last week, Jeff suggested that the current pullback was not the onset of his anticipated next phase of decline.

He believed that the relief rally initiated a couple of weeks ago had room for further growth.

Jeff’s overview encapsulated expectations for the rally:

Stocks are likely to rise in the near term, with oversold conditions justifying a climb toward our target range of 5,400-5,500.

It’s plausible to argue for even higher levels if this rally accelerates, but I do not foresee a break above the 50- and 200-day moving averages near 5,750.

As the S&P approaches 5,750, the odds favor a short position.

Ultimately, the index will likely need to revisit the 4,835 low, potentially surpassing it.

For the near term, I lean bullish but remain cautious.

To provide context, reaching 5,750 would entail a 12% increase from current levels, with a subsequent decline to 4,835 suggesting a 16% loss.

According to Jeff’s latest update, the pivotal support level is now 5,200. The closing price today will significantly influence his short-term perspective:

If we close above 5,200, I favor an upward move in the coming days.

Conversely, closing below 5,200 raises the likelihood of revisiting the 5,000 mark and possibly the recent low of 4,835.

I maintain a mildly bullish outlook for the week, subject to change if the S&P falls below 5,200.

The current sentiment seems dire, yet daily technical indicators show signs of turning bullish, hinting at a probable quick upward movement before lowering again.

It’s vital to monitor whether the S&P remains above or drops below 5,200 today.

Regardless of today’s moves, Jeff’s overarching forecast remains unchanged: a drop to an S&P level of around 4,150 or 4,100 is still expected in this bear market.

Market Predictions: Divergent Views from Analysts Jeff and Luke

One analyst foresees a significant decline, while another anticipates a recovery in the S&P 500. Both viewpoints provide valuable insights into current market conditions.

Jeff’s Cautionary Outlook: A Possible Decline Ahead

Analyst Jeff suggests that the market could experience a troubling dip, estimating a 29% decline from a potential relief rally peak of 5,750.

For those holding stocks long, this situation might prove challenging.

However, if you can exploit opportunities during oversold conditions, capitalizing on a bounce may be beneficial.

Quickly taking profits, then allowing the market to retract, may provide further chances to invest…

In summary, there’s a likelihood of numerous trading opportunities.

For a detailed look at how Jeff plans to navigate a bear market, revisit our April 11, 2025, Digest here.

Luke Lango’s Optimistic Forecast for the S&P 500

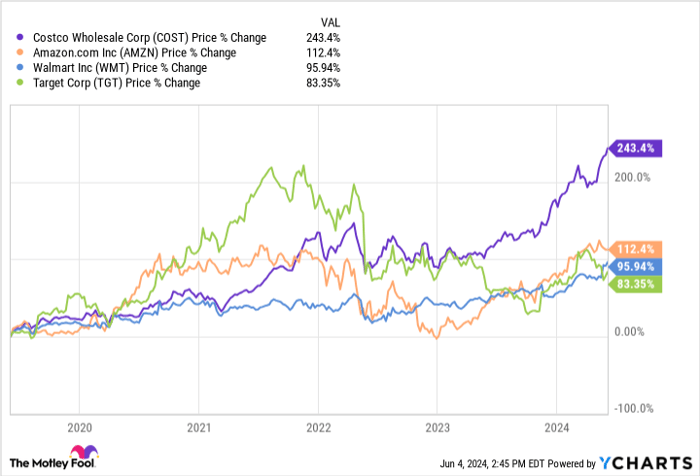

Contrasting with Jeff, hypergrowth expert Luke Lango predicts the S&P 500 could rise 15% by late summer, contingent upon two key factors:

- Rate cuts from the Federal Reserve

- De-escalation of the trade war

Luke is confident that these developments are on the horizon.

Fed’s Rate Cuts: A Key to Market Recovery

Luke’s analysis cites Federal Reserve Chairman Jerome Powell’s recent remarks which hint at reluctance to cut rates amidst deteriorating economic conditions.

After Powell’s speech last Wednesday, President Trump reacted by stating on Truth Social, “Powell’s termination cannot come fast enough!”

Here’s Luke’s perspective on Powell:

Maintain composure and remember: Actions speak louder than words.

While Powell may dismiss imminent cuts, the prevailing economic conditions suggest otherwise…

We believe the Fed is on the verge of initiating a comprehensive rescue effort for the U.S. economy, which could lead to a stock market surge.

Luke supports this view with insights from Bloomberg’s U.S. Financial Conditions Index, which indicates that financial conditions are presently tighter than any time in the last decade, excluding the COVID-19 downturn.

Simultaneously, several economic indicators are troubling:

- Consumer confidence is at a near 50-year low

- Retail sales are slowing

- Business investment has stagnated

- The housing market is essentially frozen

- Bond yields, however, have been increasing

This collection of data is concerning.

It underscores the necessity for Fed intervention, which I believe Powell is quietly preparing for, despite his public statements…

So, when might this intervention occur?

We anticipate it could happen in June.

By that time, sufficient data will likely provide the necessary political and academic justification for the Fed to implement rate cuts.

Luke adds that a positive tone from the Fed’s May meeting, just two weeks away, may begin to propel stock prices upward.

Trade War Resolution: Another Boost for Markets

In addition to Fed action, Luke emphasizes that improvement in the global trade situation is crucial for a market rebound.

Here’s Luke on trade developments:

Since the launch of the “Liberation Day” tariffs by the U.S. in early April, tariffs have actually decreased rather than increased.

The average U.S. tariff rate rose from 2.5% to 27% on April 2. However, following a 90-day pause and exemptions for electronics, it has already reduced to approximately 23%.

If rumored exemptions for auto parts materialize, it may drop to around 20%. Further deals on steel/aluminum or with China could drive it closer to 10%.

The changes indicate a significant shift in trade dynamics.

Although aggressive rhetoric from Washington persists, Luke asserts that actions reveal a trend toward de-escalation.

In conclusion, market volatility is expected in the short term. However, the Federal Reserve’s FOMC meeting on May 7 could provide clarity. If Luke’s predictions of dovish signals hold, Wall Street is poised to shift quickly.

If trade deals emerge alongside lower tariffs, this could further energize the market.

With anticipated rate cuts in June, Luke envisions that:

The stock market could experience a significant rally.

We might witness the S&P 500 rising 10% to 15% by late summer.

While others may worry, we are preparing to seize opportunities.

Navigating Divergent Forecasts from Luke and Jeff

Rather than reconciling the differing viewpoints, it may be more beneficial to recognize their uniqueness.

InvestorPlace and our partner TradeSmith value independence, providing diverse market insights from our expert analysts.

As entrepreneur Jim Rohn advised:

Stay open to both sides of the debate.

Knowing an opposing viewpoint can strengthen your own analysis.

During volatile markets, focusing on shorter-term predictions can enhance your chances of successful investing.

For this reason, TradeSmith’s innovative AI tool—named An-E—proves useful.

As shared in our last Digest, An-E predicts stock prices for thousands of stocks, funds, and ETFs over a month, offering insights with conviction levels. This tool remains effective in both bullish and bearish conditions.

Developed in-house using advanced machine learning and over 1.3 quadrillion data points, An-E can enhance your trading strategies by helping to time entries and exits based on 30-day projections.

If you missed CEO Keith Kaplan’s presentation from last week, you can view a free replay here.

Regardless of whether you align more with Jeff’s bearish outlook or Luke’s bullish stance, An-E will guide your decisions by focusing on what the data indicates—crucial for adapting your market strategy.

Wishing you a productive evening,

Jeff Remsburg