NVIDIA Faces Bearish Trends: A Critical Assessment for Investors

NVIDIA Corporation (NVDA), a leading player in the semiconductor industry, has recently exhibited a bearish chart pattern amidst regulatory challenges. This situation poses a crucial question for NVIDIA investors: Should they sell their shares, or should they hold on to them, believing in the company’s solid fundamentals? Let’s examine the facts.

Emerging Death Cross Pattern; NVIDIA Stock Experiences Decline

Several semiconductor stocks, including NVIDIA, experienced declines on Wednesday. Specifically, NVIDIA’s stock fell by 5.7%, coinciding with the appearance of a death cross pattern last week. This technical pattern indicates that NVIDIA’s short-term 50-day moving average (DMA) has dipped below its long-term 200 DMA, which frequently signals an impending downtrend.

On Wednesday, NVIDIA’s stock closed at $113.76. The 50-DMA was recorded at $125.86, whereas the 200-DMA was at $127.72. The last instance when the NVIDIA stock encountered a death cross was in April 2022, resulting in a significant 50% drop over the subsequent six months, culminating in its lowest valuation in October 2022.

Technical Indicator & Overlays – NVIDIA

Image Source: Zacks Investment Research

Concerns over stricter regulations affecting NVIDIA’s chip sales in China have contributed to the decline in its shares. This downturn has been exacerbated by the U.S. government’s decision to add various Chinese companies to a trade blacklist centered on national security, negatively impacting NVIDIA’s sales potential.

Will NVIDIA Stock Recover?

Chinese regulatory scrutiny is currently deterring local tech firms from purchasing NVIDIA’s H20 chips, citing energy efficiency violations. Nevertheless, sales of the H20 chips remain stable since enforcement of these regulations has not been strict. NVIDIA plans to engage with regulators to resolve the issue.

Historically, NVIDIA has managed to navigate U.S. regulatory hurdles effectively and has shown resilience against such challenges. Notably, $100 serves as a strong support level for NVIDIA stock. If the stock drops below this figure, it could indicate a longer-term downtrend. The stock previously tested this support in August and September before rebounding to an all-time high of $150.

Despite the current volatility, the intense demand for NVIDIA’s next-generation Blackwell chips and its dominant position in the graphics processing units (GPUs) market suggest potential upside for the share price. Moreover, major tech firms like Alphabet Inc. (GOOGL) and Microsoft Corporation (MSFT) have adopted Blackwell chips, lauding their excellent energy efficiency and enhanced AI capabilities.

NVIDIA holds a commanding market share of over 80% in the discrete GPU sector, giving it a competitive advantage as its CUDA software platform gains traction among developers, outperforming Advanced Micro Devices, Inc. (AMD) ROCm software platform.

NVIDIA’s Financial Health Remains Strong

Despite fluctuations in stock prices, NVIDIA maintains a robust financial standing. For the fiscal year ending January 2025, the company reported a remarkable revenue increase of 114%, totaling $130 billion. It anticipates further sales growth of 65% year-over-year in its first quarter.

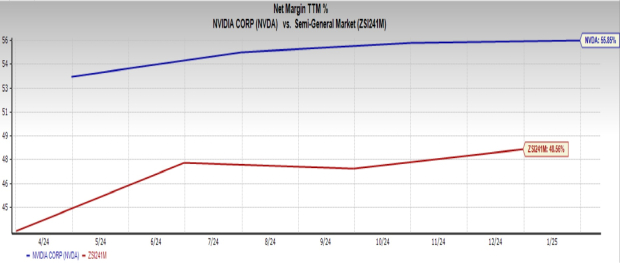

NVIDIA also excels in profitability, with a net profit margin of 55.9%, well above the 48.6% margin typical of the Semiconductor – General industry. This highlights NVIDIA’s efficient profit generation capabilities.

Image Source: Zacks Investment Research

Strategic Considerations for Trading NVIDIA Stock

Considering NVIDIA’s robust financials, the escalating demand for the Blackwell chip, and its dominance in the GPU market, the recent drop in share price should not overly alarm investors. Current shareholders might consider holding their shares for potential long-term gains.

However, new investors may want to wait for a more favorable entry point, given the current stock volatility. At present, NVDA carries a Zacks Rank of #3 (Hold). To view the complete list of today’s Zacks #1 (Strong Buy) Rank stocks, click here.

Only $1 to see All Zacks’ Buys and Sells

We’re not kidding.

A few years back, we surprised our members by granting access to all our stock picks for just $1 over 30 days. There’s no obligation for further payments.

Many have seized this opportunity, while others were skeptical. Our goal is for you to familiarize yourself with our portfolio services, which include Surprise Trader, Stocks Under $10, Technology Innovators, and more, which together closed 256 positions with double- and triple-digit gains in 2024 alone.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis report

Microsoft Corporation (MSFT): Free Stock Analysis report

NVIDIA Corporation (NVDA): Free Stock Analysis report

Alphabet Inc. (GOOGL): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.