**Oil Prices Hit Five-Year Lows Amid Supply Glut**

Oil prices have reached their lowest point in nearly five years, with Brent Crude falling below $60 a barrel and West Texas Intermediate (WTI) dropping to the mid-$50s. Over the past six months, Brent and WTI have declined by 23% and 25%, respectively. Analysts attribute this downturn to an overwhelming supply overshadowing robust demand, particularly influenced by record U.S. crude output, sustained production from OPEC+, and reduced demand from China’s slowing economy. JPMorgan projects further declines, anticipating Brent to fall to $58 and WTI to hit $54 next year, while Goldman Sachs estimates $56 and $52, respectively.

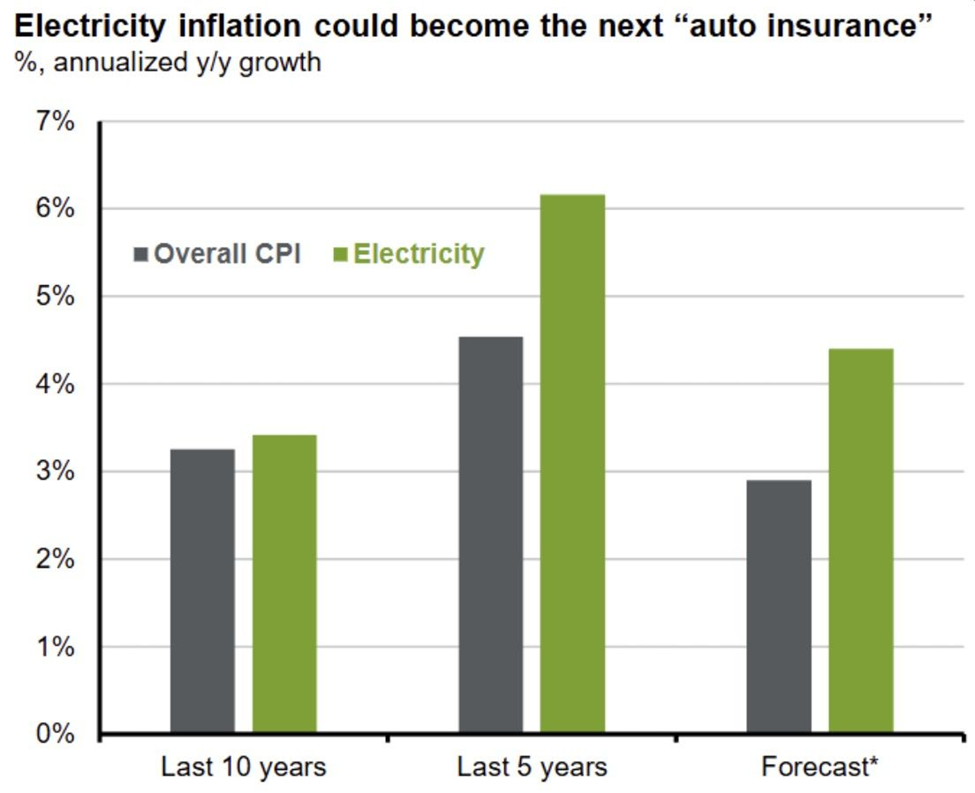

As demand for oil decreases, electricity consumption is surging, particularly driven by U.S. data centers that consumed approximately 176 terawatt-hours in 2023—4.4% of total U.S. electricity use. This demand is expected to double or triple by the end of the decade as AI workloads expand. However, while electricity demand rises, it does not correlate directly with oil consumption, as the majority of U.S. electricity is generated from sources other than oil. This dichotomy highlights a growing concern for energy markets: as oil is oversupplied, electricity prices are expected to rise, affecting consumers through increased utility bills.

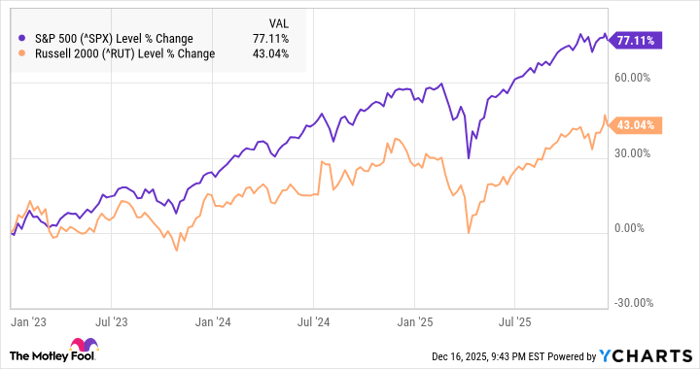

The implications for investors are pronounced: while the oil market struggles with excess supply, the electricity sector driven by AI presents new investment opportunities. Market experts suggest focusing on utility companies and energy storage solutions to capitalize on the growing demand for electricity. The overall landscape suggests that while oil investors may face challenges, the focus should shift towards sectors that align with the changing energy dynamics.