Market Update: Futures Dip and Key Earnings Released

Pre-market futures show a slight decline this morning, but they have not erased this week’s gains—though it is still early in the trading day. Additionally, bond yields are drifting downward. No economic reports are scheduled ahead of today’s market close, but several Q1 earnings reports are expected this morning (see below).

At this moment, the Dow is down 147 points, the S&P 500 has fallen 10 points, the Nasdaq is off by 60 points, and the small-cap Russell 2000 has dropped 15 points. The 10-year bond yield has slipped below 4.3%, while the 2-year yield is now beneath 3.8%. Initially, pre-market trading for the Nasdaq and S&P began positively, but news events have pulled all major indexes into negative territory.

Trade Talks: Conflicting Statements from Trump and China

Early today, President Trump informed Time Magazine that he had received a direct call from China’s President Xi Jinping. However, this claim was quickly denied by the Chinese embassy, which asserted that no tariff discussions are currently underway between the two largest trading nations. This follows U.S. Treasury Secretary Scott Bessent’s remarks earlier this week, which suggested the continuation of tariff discussions—also denied by China.

This conflicting news is significant as this week’s market rally appears largely based on the hope that upcoming trade negotiations will resolve the harsh tariffs imposed three weeks ago. With the 90-day pause ticking toward July 10th, the lack of a new trade agreement makes the tariff situation increasingly uncertain.

Q1 Earnings Roundup: Key Reports from CL, ABBV, and More

This morning, Colgate-Palmolive (CL) released its Q1 results, surpassing earnings estimates by 5 cents to reach 91 cents per share on revenues of $4.91 billion, exceeding the Zacks consensus by 1.15%. Following this news, shares increased by 1.4%, contributing to a 2% gain year to date.

In contrast, AbbVie (ABBV) also beat estimates in its Q1 report, with earnings of $2.46 per share surpassing expectations by 2.93%, driven by revenues of $13.34 billion—significantly higher than analysts’ $12.91 billion forecast. As a result, shares have risen 3.9%, adding to the stock’s 8.4% year-to-date increase.

On the other hand, AutoNation (AN) reported Q1 earnings of $4.68 per share, easily exceeding the $4.35 consensus estimate, supported by revenues of $6.69 billion—a 1.75% beat. Negative outlooks regarding increased vehicle costs due to tariffs have led to a 3.76% pre-market decrease in shares, which are now down year to date.

Perhaps the most noteworthy Q1 report came from financial advisory firm Lazard (LAZ), whose earnings of $0.56 per share exceeded the Zacks consensus by a remarkable 93%. Revenues also outpaced expectations, reaching $643.19 million—up 4.35%. However, shares remain flat, with a year-to-date decline exceeding 20%.

Looking Ahead: Anticipated Market Developments

As this trading week comes to a close, no further earnings reports are on the docket. However, after market open, investors will receive the final report on April Consumer Sentiment. The preliminary figure came in above the crucial benchmark of 50 at 50.8, and analysts anticipate it will remain stable.

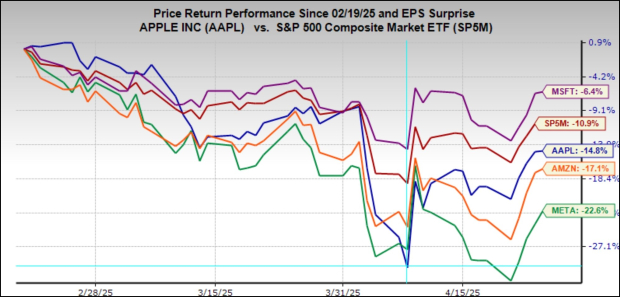

Looking into next week, a significant influx of Q1 earnings reports is set to emerge, including results from major players in the “Mag 7”: Microsoft (MSFT), Meta (META), Apple (AAPL), and Amazon (AMZN). Additionally, it will be Jobs Week, featuring private-sector payroll data for April on Wednesday and non-farm payrolls from the U.S. government on Friday morning. To round things out, the Personal Consumption Expenditures (PCE) report for March will be released a week from today.