Is the AI Revolution Leading to Job Losses?

The famed artist Pablo Picasso once remarked that every act of creation starts with an act of destruction. This quote, surprisingly, seems to encapsulate the AI Revolution perfectly.

Amidst the excitement surrounding AI technology, there’s also significant concern regarding its potentially harmful effects.

Currently, major tech firms are investing hundreds of billions of dollars each year, aiming to develop sophisticated AI applications that will change our daily lives—how we work, recreational activities, travel, shopping, and more.

But as these models improve, will they be able to do our jobs better than we can? Does the rise of AI signal the end for many jobs?

The answer might unfortunately lean towards a yes.

Artificial intelligence is already capable of coding, marketing, design, handling taxes, recommending restaurants and travel spots, writing scripts and advertisements, providing customer service, and even managing investments.

While AI isn’t outperforming most of us yet, it’s on that trajectory. Look at how far this technology has advanced within just two years.

Rapid Progress in the AI Sector

When OpenAI rolled out ChatGPT in late 2022, its initial model, GPT-3, was impressive but far from reliable; it made frequent mistakes and was often seen as having toddler-level intelligence, as noted by the firm’s own CTO.

Today’s versions—such as the o3 and Deep Reasoning models—can handle much more complex tasks, like coding and drafting legal documents. Some even claim these models demonstrate PhD-level intelligence.

In essence, AI has advanced from a toddler’s comprehension to that of a highly knowledgeable individual within just two years.

So what does the near future hold? It’s likely that AI will soon not only perform our duties but do them far more efficiently than most of us.

And this view isn’t isolated.

Goldman Sachs (GS) projects that AI could displace around 300 million full-time jobs. Additionally, McKinsey Global estimates that roughly 15% of workers globally will need to switch careers due to AI. OpenAI’s research indicates that about 20% of the workforce might be vulnerable to AI-driven automation. Citi sees AI affecting over half of jobs in the finance sector. Moreover, a recent survey by the Conference Board revealed that nearly 50% of CEOs believe they will eventually replace human workers with AI.

There’s no denying it—AI is poised to take over numerous jobs. The shift may occur sooner than we anticipate.

The Beginning of Job Losses Due to AI

Many Americans think that fears about the ‘AI Jobs Apocalypse’ are exaggerated; they believe that any significant impacts are still 10 to 20 years away.

However, signs indicate that job losses linked to AI have already commenced.

For instance, last week, Salesforce (CRM) announced layoffs of over 1,000 employees as it shifts focus toward AI products and services.

This is just a glimpse of what’s happening.

Meta (META) is laying off about 5% of its workforce. CEO Mark Zuckerberg mentioned that this year would mark the development of “an AI engineering agent” with the coding and problem-solving skills of a competent mid-level engineer.

Microsoft (MSFT) and Amazon (AMZN) are also letting go of underperforming staff, all while planning to invest nearly $100 billion each in AI infrastructure this year.

Additionally, Workday (WDAY) revealed plans to cut nearly 10% of its workforce as part of a strategy to bolster AI initiatives. Intel (INTC) announced layoffs of approximately 15% of its staff, reallocating resources to enhance AI. Similarly, Dell (DELL) has laid off over 10,000 employees in its shift toward AI investments.

Last year, Best Buy (BBY) announced significant layoffs, including cuts to its Geek Squad and customer service teams while launching a new collaboration with Google Cloud to use generative AI for technical support.

Language-learning platform Duolingo (DUOL) previously relied on a network of contractors for support tasks such as creating course content and correcting user errors. Last year, they laid off 10% of that workforce in favor of AI solutions.

Companies like Klarna, Advanced Micro Devices (AMD), Cisco (CSCO), Activision Blizzard (ATVI), and Intuit (INTU) are also part of this expanding list of companies laying off employees due to AI advancements.

The message is clear: Many Americans are already experiencing job losses driven by AI.

This trend is likely to persist.

AI as a Tool for Higher Profits and Efficiency

A recent survey by Duke University and the Federal Reserve Banks of Atlanta and Richmond revealed that 61% of U.S. companies plan to implement AI in the next year to automate tasks previously managed by employees.

These firms aim to enhance product quality (58% of surveyed companies), increase output (49%), cut labor costs (47%), and replace workers (33%).

This shows that companies are embracing AI to maximize profits.

And it appears to be working.

Across the S&P 500, companies reported an average earnings growth of over 10% this quarter, one of the highest rates since the pandemic began five years ago.

Yet at the same time, unemployment is climbing sharply. In the summer of 2022, 1.3 million Americans filed for unemployment benefits. Today, that number is nearly 2 million.

This simultaneous rise in unemployment and surge in corporate profits is abnormal. It suggests that businesses are increasingly replacing human labor with AI to enhance productivity and profitability.

The AI Jobs Apocalypse is already here.

Preparing for the AI Job Market Shift: Stocks to Consider

Are you prepared for potential changes in the job market? It’s essential to take action now.

Understanding the AI Jobs Shift: What It Means for You

Companies that harness AI to increase profits and reduce expenses will likely see significant earnings growth. This success will reflect positively on their stock prices.

Meanwhile, businesses that fail to adapt may struggle to keep up.

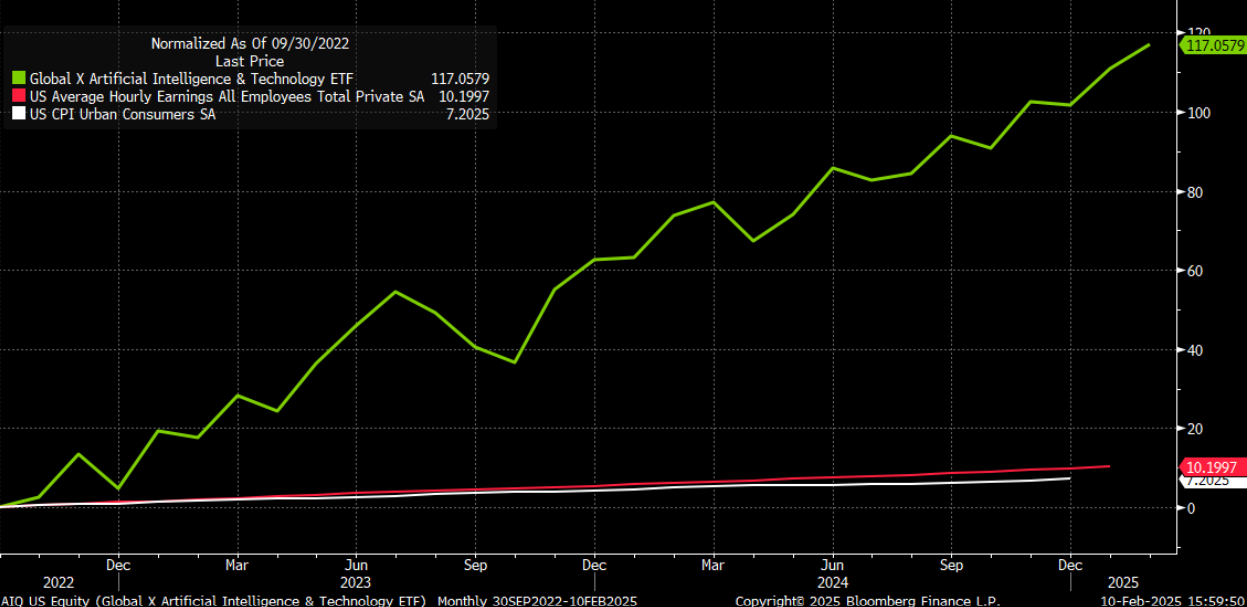

The current economic landscape reflects this trend. Since September 2022, the average hourly wages for American workers have climbed by 10%, yet inflation has risen by 7%. Consequently, real wages have only increased 3%, which barely outpaces the cost of living.

In contrast, stocks in the AI sector have surged by 120% since September 2022, significantly outpacing inflation. This growth highlights how AI investments can potentially lead to greater financial returns.

As the AI Jobs Apocalypse unfolds, the gap between wage growth and AI stock performance will likely continue to widen.

Your options are clear: You can choose to remain passive, collect your current salary, and risk falling behind as living expenses rise. Alternatively, consider investing in AI stocks to leverage the potential of this significant technological advancement.

Understanding the challenges ahead can be daunting. Many people I know, myself included, worry about financial stability in these changing times.

While not everything can be controlled, it is vital to prepare as best as you can.

To assist with this, I have created a comprehensive presentation on the implications of the AI Jobs Apocalypse for the economy, stock market, and your finances.

This presentation serves as a guide for navigating the new AI-driven landscape, packed with insights that may prove valuable as we enter this “Age of AI.”

Watch the video now to learn more.

On the date of publication, Luke Lango did not hold (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. For continued updates on market trends, follow Luke’s Daily Notes. You can find the latest issues on your subscriber platforms: Innovation Investor and Early Stage Investor.