Trade Tensions and AI Race Shape China-US Economic Rivalry

The Intensifying Trade War

Recent headlines in major financial news have focused on the escalating trade war between China and the United States, the world’s two largest economies. Following President Trump’s return to the White House, efforts were made to address the significant trade imbalance. This led to a series of retaliatory tariffs and heightened market volatility. While Wall Street remains fixated on these developments, many investors overlook the initial catalyst for the 2025 market correction—the AI competition.

DeepSeek’s Disruptive AI Launch

In late January, the Chinese startup DeepSeek unveiled its large language model, reminiscent of ChatGPT. DeepSeek claimed it nearly matched the performance of leading American chatbots like Alphabet’s (GOOGL) Gemini and OpenAI’s ChatGPT, along with Microsoft’s (MSFT) offerings. This announcement triggered a dramatic $1 trillion drop in U.S. market capitalization, primarily impacting high-profile stocks, such as Nvidia (NVDA).

Analysts Challenge DeepSeek’s Claims

The U.S. stock market’s decline stemmed from DeepSeek’s assertion that it developed its AI for less than $6 million. However, a report from SemiAnalysis refuted this, estimating DeepSeek’s hardware expenses to exceed $500 million.

The AI Supremacy Battle: China vs. US

Although DeepSeek’s statements were inflated, this scenario underscores two important lessons for investors:

1. AI’s Economic Significance: The market’s $1 trillion shift illustrates how vital the competition for AI supremacy is to the global economy. Success in AI will have vast implications for both national security and economic advantage.

2. High Costs of Developing LLMs: Companies aspiring to create competitive large language models must invest heavily in infrastructure and hardware, particularly data centers.

Energy Demands of Data Centers

Electricity use is projected to triple by 2030, as noted by Boston Consulting Group. While the United States currently leads in AI development, China excels in energy production. Presently, China has a capacity of approximately 3 terawatts compared to 1 terawatt in the U.S. By 2050, it plans to expand this to 8.7 terawatts versus 2 in the U.S. Moreover, China is constructing 26 nuclear reactors and has plans for hundreds more. The Trump administration has emphasized that securing leadership in AI is essential for national security.

Without sufficient energy, the U.S. risks falling behind in the AI race. The most promising investment opportunities may lie in power sources that support AI advancements.

Investment Opportunities in AI Energy

Nuclear Solutions for Energy Needs

Oklo (OKLO) is developing small fission nuclear reactors to provide clean, dependable energy. Recent reports indicated that the White House is contemplating actions to expedite nuclear reactor development, prompting a 10% surge in Oklo’s shares.

Utilities Capitalizing on AI Expansion

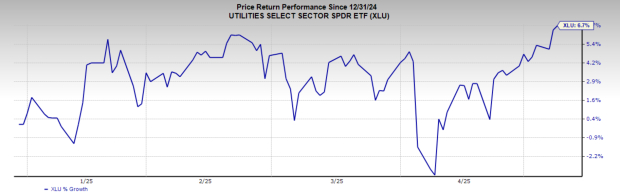

The Utilities Select Sector SPDR ETF (XLU) presents a diversified way to capitalize on the energy demands of AI. Despite the U.S. market struggles in 2025, XLU shows impressive relative strength and is approaching 52-week highs.

Image Source: Zacks Investment Research

Conclusion

The outcome of the ongoing AI competition between China and the U.S. will shape global economic dynamics. While the U.S. holds a slight edge in AI technology, China’s advantage in energy production is significant, placing U.S. interests at a crucial juncture.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.