The AI Boom: Lessons from the Dot-Com Era for Investors

Editor’s note: “The Second AI Boom: How to Prepare for a Trillion-Dollar Swell” was previously published with the title “AI’s Second Boom: How the Next 24 Months Could Transform Your Portfolio” in April 2025. It has since been updated to include the most relevant information available.

In late 1994, tech company Netscape introduced its web browser, unknowingly igniting one of the most explosive investment booms in modern history.

From late 1994 through 1999, the Dot-Com Boom provided early investors an opportunity to amass significant wealth. A notable example is Stripes founder Ken Fox, who, along with Walter Buckley and Pete Musser, became a ‘paper billionaire’ by investing in B2B e-commerce firms during this prosperous time.

Remarkably, substantial returns weren’t only reserved for the pioneers; even latecomers found success. The most significant gains actually occurred during the

Dot-Com Boom’s second half.

Parallels Between Today’s AI Boom and the Dot-Com Era

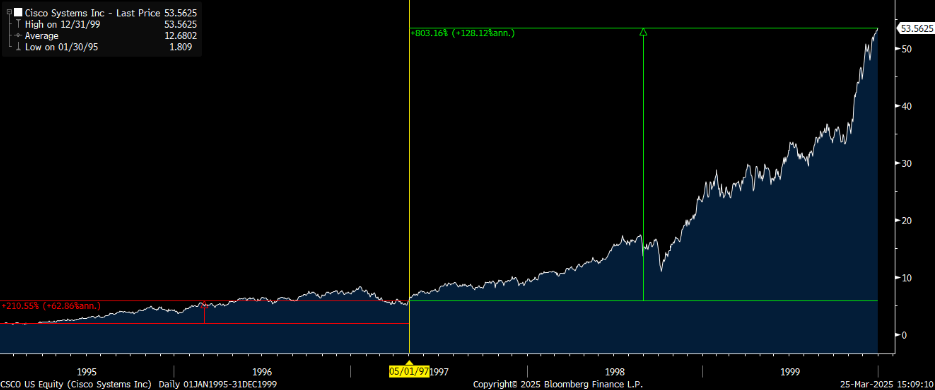

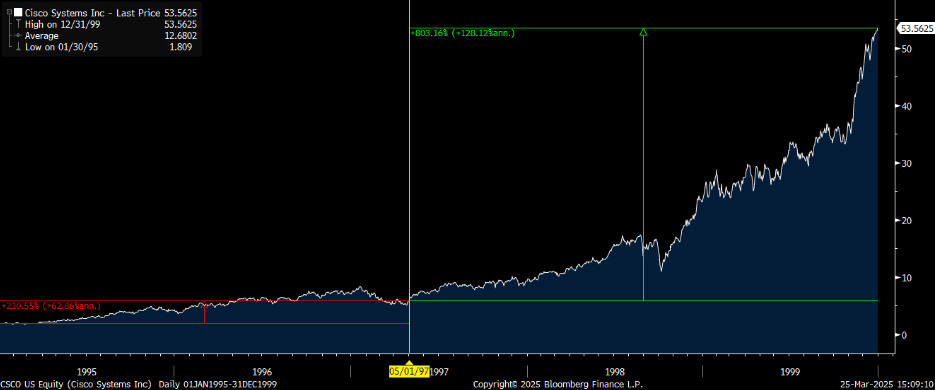

CISCO (CSCO) exemplifies this trend. As the demand for modern internet infrastructure surged, this networking solutions provider experienced a significant rise in request for its products. The stock appreciated over 200% from early 1995 to the summer of 1997.

However, the bulk of Cisco’s profits happened in the ‘second half’ of that boom.

Between mid-1997 and late 1999, CSCO skyrocketed an astonishing 800%.

To put it another way, in the initial two years of the dot-com era, Cisco tripled its value. In its final years, CSCO saw its stock rise by nearly 9 times.

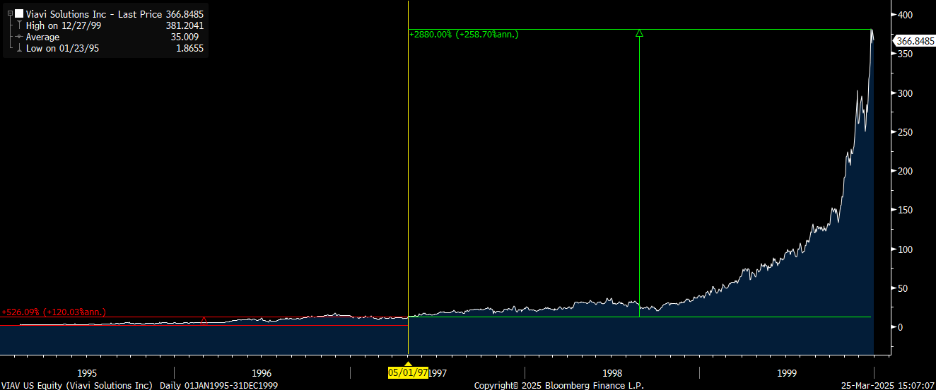

A similar narrative unfolds with Viavi Solutions (VIAV), another player in the networking space. From early 1995 to summer 1997, this stock surged about 500%. However, from mid-1997 to late 1999, it astonishingly climbed nearly 3,000%.

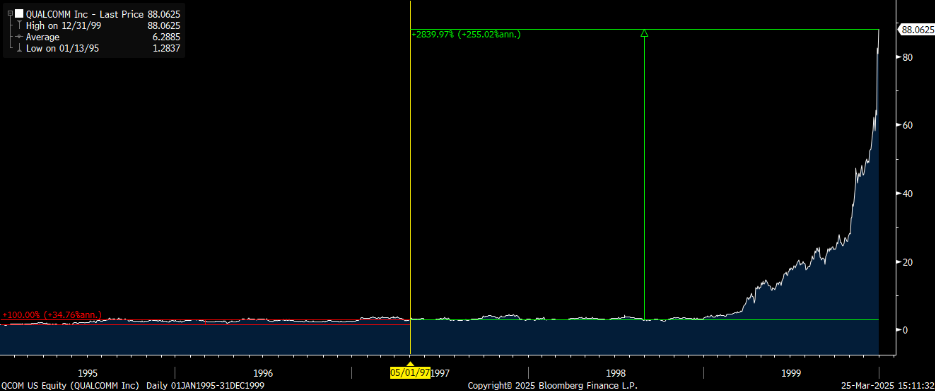

Qualcomm (QCOM) followed a similar trajectory. This stock doubled in value in the initial phase of the boom, from early 1995 to summer 1997. It then skyrocketed over 2,800% from mid-1997 to late 1999.

# AI Investment Boom: Historical Patterns and Future Potential

Examples of 1990s tech giants like Semtech (SMTC), Applied Materials (AMAT), Oracle (ORCL), Paychex (PAYX), and Sanmina (SANM) showcased remarkable growth during the Dot-Com Boom. These companies achieved their highest returns later in that cycle.

What drove their success? It wasn’t just the debut of Netscape’s browser, but rather what followed in its wake.

Why the Most Profitable AI Investment Opportunities Are Ahead

Like many emerging technologies, it took time for web browsers such as Netscape to gain traction. However, once they did, it initiated an “acceleration phase.” This stage saw transformative companies like Amazon rise, built upon the foundations of those early technologies.

Today, we are witnessing a similar trajectory with AI.

The AI Boom officially began in late 2022 with the launch of ChatGPT, a pivotal moment akin to Netscape for today’s generation. Since its debut, AI has been a focal point in the media, with stocks in the sector rallying significantly.

The Market’s Current Climate: Volatility and Potential Upside

It’s crucial to note that we are not nearing the end of this profitable era; rather, we are at its midpoint. Historical patterns suggest that the next 24 months could yield even greater returns than the previous two years, reminiscent of the market dynamics seen in 1998 and 1999.

However, this cycle faces interference. Recent actions by U.S. President Donald J. Trump have introduced a series of tariffs, reigniting a global trade war that has resulted in tremendous market volatility.

This volatility has produced a series of substantial market fluctuations. Notably, the volatility index (VIX), which serves as Wall Street’s fear gauge, recently soared to 52.33, a threshold not seen since major market crises like COVID-19 and the 2008 financial collapse.

Upcoming Triggers for Market Rally

Reflecting on the Dot-Com Boom, the market has navigated turbulent waters before. In 1998, amid global currency upheaval, the Russia default, and the collapse of Long-Term Capital Management, many believed the tech boom was over. Yet, the largest tech rally took off during this chaos.

I anticipate history may repeat itself. On May 7, I expect a significant announcement from President Trump that could trigger a $7 trillion market influx. This influx would attract sidelined investors eager to capitalize on emerging opportunities.

This pivotal event intertwines current market chaos, trade war developments, and the ongoing AI Boom—all critical factors for investors.

With market panic and fluctuating headlines resembling the climate in 1997, an enormous opportunity is brewing beneath the surface. If actions from Washington on May 7 light the spark, we could see a significant rally.

In preparation for what I term The 2025 Summer Panic, I recently hosted a detailed briefing outlining critical historical comparisons, reasons the AI Boom will continue, and how investors can position themselves effectively as the date approaches.

During this session, I discussed an essential economic event promoted by President Trump that is likely to catalyze growth in a select group of stocks, potentially positioning investors for success.

As of publication, Luke Lango holds no direct or indirect positions in the mentioned securities.

For inquiries regarding this topic, you can reach out at [email protected].