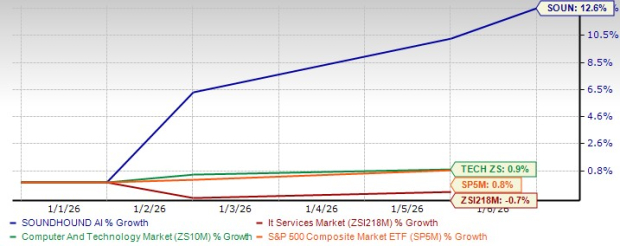

SoundHound AI, Inc. (SOUN) reported a robust third-quarter revenue of $42 million for the period ending in September 2025, marking a 68% year-over-year increase and prompting management to raise full-year guidance to $165–$180 million. As of January 6, 2026, shares are trading at $11.23, up 12.6% year to date, yet still below their 52-week high of $22.17. The company currently holds a forward 12-month price-to-sales ratio of 19.98, surpassing both the industry average of 15.91 and its own three-year median of 17.52.

Despite strong revenue momentum, SoundHound remains unprofitable on a GAAP basis and faces increased competitive pressure from major players like Microsoft’s Nuance Communications. Operational headwinds from global tariffs and automotive industry softness could affect near-term deployments. Analysts project a loss per share of 5 cents for 2026, an improvement from a 14-cent loss noted last year, but the stock’s current valuation suggests limited room for error as the market weighs growth potential against execution risks.

Looking ahead, SoundHound’s strategy focuses on expanding its voice commerce capabilities, aiming to enhance user transactions through partnerships with platforms like OpenTable and TomTom. Investors are advised to adopt a cautious stance, reflected in its Zacks Rank of #4 (Sell), as the premium valuation necessitates clear progress towards profitability amid ongoing losses.