Smart Stock Selections Amid Current Market Pullbacks

Experiencing a stock market sell-off can be difficult. Seeing the value of your holdings drop significantly can be unsettling.

However, such market conditions present opportunities to invest. Finding quality stocks to purchase at lower prices is often fruitful during downturns.

Considering an investment of $1,000? Our analyst team has identified the 10 best stocks to invest in right now. Continue »

This time offers promising options. Here are two compelling picks: Shopify (NASDAQ: SHOP) and Apple (NASDAQ: AAPL). Read on to learn why these stocks are worth considering for long-term investment.

1. Shopify

Shopify’s shares have declined by 8% this year, not due to poor performance but rather market volatility. The e-commerce company reported strong fourth-quarter results, continuing its trend of impressive earnings.

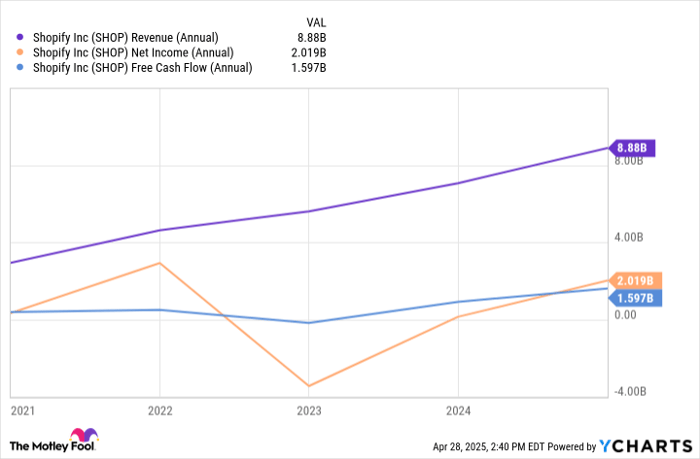

Revenue growth remains robust, and recent changes have bolstered its profitability. Last year, the company posted a positive net income and free cash flow.

SHOP Revenue (Annual) data by YCharts.

While investors may not be overly enthusiastic about Shopify consistently exceeding expectations, the stock appears well-positioned for future growth. The company has established a strong brand identity, offering a comprehensive service for merchants to create online stores.

Shopify has captured over a 10% share of the fiercely competitive U.S. e-commerce market, aided by an app store featuring thousands of options for merchants to customize their stores.

This model creates switching costs, which help retain customers in the long term while also capitalizing on the growing e-commerce market. Shopify aims to be a sustainable entity for the next century.

Though it remains uncertain if the company can achieve this goal, it stands to benefit from the ongoing shift toward online retail over the next decade. Thus, aside from trade tensions, Shopify remains a top stock to consider purchasing during this dip.

2. Apple

Apple faces significant challenges stemming from current economic conditions. The tech titan relies on manufacturing in countries like China, which has been a focal point for tariff discussions.

Geopolitical issues involving China, alongside slowing revenue growth, have prompted many investors to sell off Apple shares. As a result, its stock is down 16% year to date.

Nevertheless, the company retains several advantages. While the stock may not replicate its remarkable 2010s performance, it is expected to provide solid returns over time.

Here are three factors to consider:

First, Apple generates substantial free cash flow, allowing it to reduce dependence on Chinese manufacturing. A recently earmarked $500 billion investment in the U.S. will support expanding its local manufacturing capacity, marking just the beginning.

Second, the company’s future plans spotlight services rather than hardware, although iPhone sales still contribute significantly to revenue. With 2.35 billion devices in use, Apple is tapping into various monetization strategies.

Having surpassed one billion paid subscriptions, the company aims to develop even more initiatives. Over the next decade, its high-margin services segment is poised to expand substantially faster than the hardware division, positively impacting profitability.

Third, while Apple may not be widely recognized as a dividend stock, it effectively raises its dividends over time. Its forward yield is currently 0.5%, lower than the S&P 500 average of 1.3%.

However, with a 92.3% increase in the past decade and a conservative cash payout ratio of 14%, potential for future dividend growth remains high. Investors choosing to reinvest dividends may achieve superior returns.

Should you invest $1,000 in Shopify right now?

Before investing in Shopify stock, it’s worth noting:

The Motley Fool Stock Advisor team identified the 10 best stocks for current investment, excluding Shopify. These selected stocks could yield significant returns in years to come.

For reference, when Netflix appeared on this list on December 17, 2004, investing $1,000 then would now be worth $607,048!* Likewise, in April 2005, Nvidia would have turned a $1,000 investment into $668,193!*

The Stock Advisor average return is 880%—significantly outperforming 161% for the S&P 500. Explore the latest top 10 list when you join Stock Advisor.

*Stock Advisor returns as of April 28, 2025

Prosper Junior Bakiny holds positions in Shopify. The Motley Fool is invested in and recommends Apple and Shopify. The Motley Fool follows a disclosure policy.

The views expressed are those of the author and do not necessarily reflect those of Nasdaq, Inc.