“`html

Trump’s Swift Tariff Moves Divides Opinions and Shakes Markets

Contrast Between Two Presidential Terms

The leadership styles of President Donald Trump during his first and second terms are drastically different. In his first term, he had no experience in governance and lost the popular vote. However, with a wealth of political experience and connections, he has returned as the 47th President, armed with a strong political network. Despite Trump being the common factor, the contrast is significant.

Political analysts across the political spectrum speculate about Trump’s preparedness for the presidency and the implications of his tariff plans. What stands out is the quick implementation of these tariffs. Within a month, Trump imposed tariffs on Canada, Mexico, Colombia, and China, and hinted at action against the European Union.

Market Reactions to Tariff Policies

Investors must navigate the tumultuous waters of politics and economics, as stock market success doesn’t always align with political rhetoric. While temporary agreements with Mexico, Colombia, and Canada have provided some relief, tensions with China are escalating, inciting further volatility.

China retaliated today by imposing tariffs between 10% and 15% on liquefied natural gas, crude oil, and agricultural machinery. This follows the Trump administration’s recent 10% tariff on Chinese imports. Trump’s promise of a robust response suggests a growing tit-for-tat strategy between the two leading global economies.

Understanding Market Behavior Amid Trade News

Amid increasing trade war uncertainty, intelligent investors focus on market price action over news reports. It’s crucial to evaluate how stock prices react over time, as excessive focus on news can distort one’s understanding of the underlying market dynamics.

A fitting analogy for market reactions is the experience of muscle soreness after a workout. Those who exercise regularly might feel some discomfort after an intense session but can continue to function normally, unlike those who have been inactive for a while. Recent tariff news has caused market jitters, yet investors are growing desensitized to the headlines, suggesting they’ve already accounted for them in stock prices.

Concerns Over Artificial Intelligence Perceptions

Another cause for concern has been a Chinese startup’s claims of replicating OpenAI’s ChatGPT at a lower cost, raising alarms in the tech community. However, some Wall Street analysts, as well as crypto advocates like David Sacks, are skeptical about the validity of these claims.

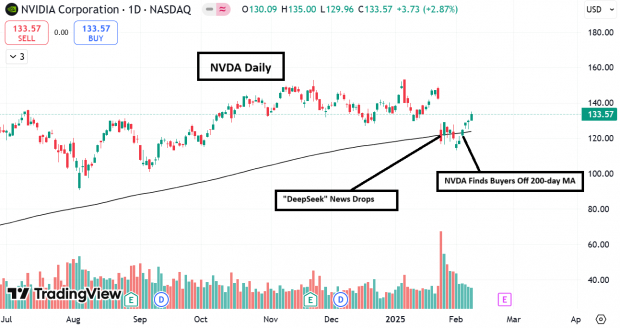

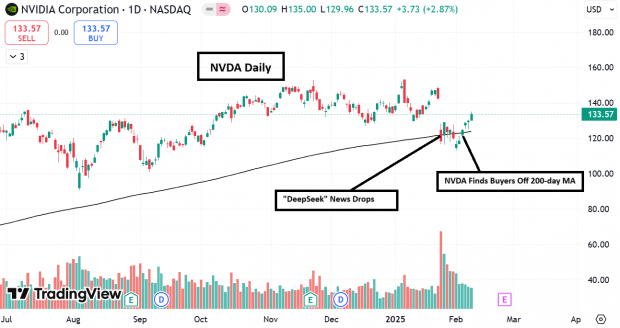

Market behavior often provides a clearer picture than media reports can convey. For instance, on January 27th, Nvidia (NVDA) faced significant losses following the DeepSeek news. However, analysis shows this was simply a retest of its long-term 200-day moving average, and it has since recovered most of its losses.

Image Source: Zacks Investment Research

Oklo (OKLO) also saw a dramatic shift. Following a plunge to $29 post-News, it has nearly doubled in value over a span of ten sessions, indicating the initial fears may have been exaggerated.

Image Source: TradingView

Neutral Market Sentiment Near Record Highs

As US stocks approach their all-time highs, sentiment remains surprisingly neutral. According to the latest American Association of Individual Investors (AAII) survey, bullish sentiment is at its lowest since November 2023, with a -15.3% bull/bear spread indicating widespread cautiousness. This begs the question: can negative sentiment amid tariff concerns propel stocks higher?

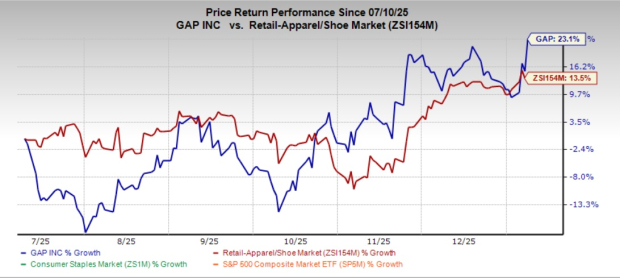

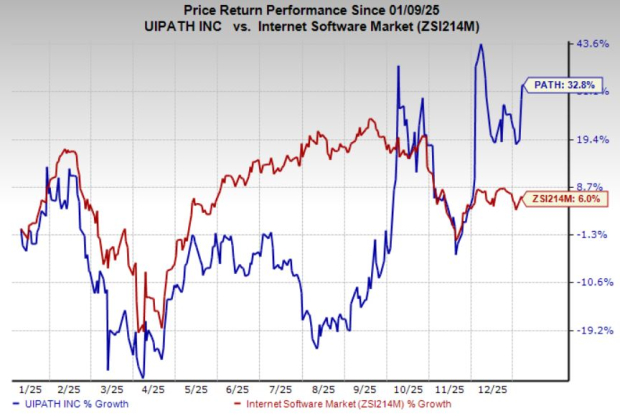

Emerging Trends in Industry Participation

Over recent months, a resurgence of industry groups has emerged despite the dominance of the mega-cap “Magnificent 7.” New sectors such as robotics and space technologies show promise for investors seeking diverse opportunities. Palladyne AI (PDYN) also presents significant growth potential in this evolving landscape.

“`

Stocks Soar: Serve Robotics and Leading Space Companies Make Strides

Market Responds to Tariff Strategies Amid Wall Street Resilience

Serve Robotics (SERV) and AST SpaceMobile (ASTS) saw shares rise by 8% and 20%, respectively, on Monday. RocketLab USA (RKLB) also experienced a strong breakout, accompanied by significant trading volume in the space sector.

Bottom Line

While President Trump’s tariff policies have created some market fluctuations, investors appear to be adjusting well. Concerns linger regarding the ongoing trade disputes with China; however, current market movements suggest that much of this risk may already be considered in stock prices. Additionally, the hype surrounding DeepSeek’s AI developments seems exaggerated as major AI and tech companies have experienced rebounds. With the stock market nearing historic highs and new sectors emerging, it is crucial for investors to focus on broader market trends rather than getting sidetracked by fleeting news headlines.

Gain Access to Zacks’ Latest Recommendations for Just $1

We’re serious about this offer.

In an unexpected move a few years ago, we provided our members with a chance to access all of our stock picks for just $1 over a 30-day period. There is no obligation to pay more.

This opportunity has attracted many investors, even though some chose to pass, suspecting a hidden catch. Our goal is simple: we want you to become familiar with our range of portfolio services, including Surprise Trader, Stocks Under $10, Technology Innovators, and others. These services achieved over 256 double- and triple-digit gains in 2024 alone.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Serve Robotics Inc. (SERV): Free Stock Analysis Report

AST SpaceMobile, Inc. (ASTS): Free Stock Analysis Report

Rocket Lab USA, Inc. (RKLB): Free Stock Analysis Report

Palladyne AI Corp. (PDYN): Free Stock Analysis Report

Oklo Inc. (OKLO): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.