Uber’s Fourth Quarter Surprises Investors Despite Strong Earnings

On Feb. 5, San Francisco, CA-based Uber Technologies (UBER), a key player in ride-hailing, food delivery, and freight services, announced its impressive fourth-quarter 2024 earnings. Both earnings and revenue surpassed expectations and showed growth from the same quarter in 2023. Uber’s total revenue for 2024 reached $44 billion, marking an 18% increase.

Check out the Zacks Earnings Calendar for updates on market-shaping news.

Even with this strong performance, shares dropped 7.5%. Investors responded negatively to the weaker guidance for the first quarter of 2025. However, this market reaction could be seen as a potential buying opportunity. Let’s take a closer look.

Key Takeaways from UBER’s Q4 Report

In the fourth quarter of 2024, Uber reported earnings per share of $3.21, significantly exceeding the Zacks Consensus Estimate of 50 cents and showing a year-over-year growth of over 100%. Revenues reached $11.9 billion, also surpassing expectations of $11.7 billion. This represents a 20.4% year-over-year increase and a 21% rise on a constant currency basis.

As normal economic activity resumed after the pandemic, demand for Uber’s Mobility segment saw a remarkable surge, with revenues rising 25% in the December quarter.

Customer engagement soared, resulting in gross bookings from the Mobility segment climbing 18% year-over-year to reach $22.8 billion.

On the Delivery front, segment revenues rose 21% year over year. Gross bookings in this segment also grew 18% year-over-year, totaling $20.1 billion by the end of December.

Overall, trips increased by 18% to 3.1 billion, averaging around 33 million trips per day. The number of Monthly Active Platform Consumers rose 14% year over year to approximately 171 million.

Stock Fallout from Guidance

Uber warns that a strong dollar could negatively impact its first-quarter 2025 results. The company projects gross bookings in the range of $42 billion to $43.5 billion for the March quarter, expecting a constant currency growth rate of 17-21% compared to the first quarter of 2024. Unfortunately, this forecast did not meet the market’s expectations for stronger growth.

This guidance accounts for an estimated 5.5 percentage point impact due to currency fluctuations, affecting Mobility and Delivery growth by roughly 7 and 4 percentage points, respectively. Our estimate for first-quarter 2025 gross bookings is around $43.6 billion.

In addition to currency challenges, Uber faces potential setbacks from adverse winter weather, which may further impact trips and deliveries in the March quarter. Expected adjusted EBITDA for the quarter is between $1.79 and $1.89 billion, reflecting a year-over-year growth of 30% to 37%. This outlook also left investors unsatisfied.

Setbacks for Uber’s Self-Driving Plans

During the fourth-quarter earnings call, Uber’s CEO, Dara Khosrowshahi, mentioned that while advancements are being made in autonomous vehicle technology, bringing this technology to market will take longer than expected. Regulatory obstacles are likely to delay the commercialization of their autonomous vehicle initiatives.

Currently, Alphabet‘s (GOOGL) Waymo leads the U.S. robotaxi market, having made significant advances in cities like San Francisco, Phoenix, and Los Angeles. Electric vehicle manufacturer Tesla (TSLA) also poses strong competitive pressure in a rapidly growing sector.

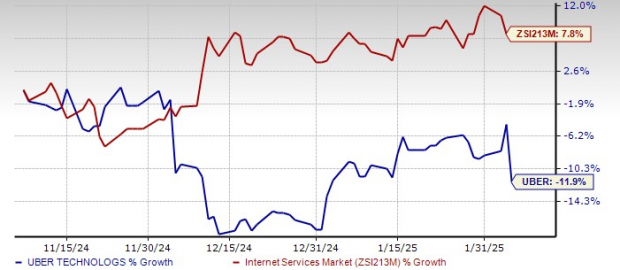

Fears related to advancements in robotaxi technology have weighed on Uber’s shares, which have seen a double-digit decline and underperformed compared to the industry over the past three months.

UBER Stock 3-Month Price Comparison

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Concerns About Uber’s High Debt

One area of concern is Uber’s increasing long-term debt, which has surged from $5.7 billion at the end of 2019.

Long-Term Debt to Capitalization

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

UBER Shares: Premium Valuation

UBER stock carries a relatively high valuation, as indicated by its Value Score of C. The current price-to-earnings ratio stands at 26.04X, compared to the industry average of 21.99X.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

What Should Investors Do with UBER Stock?

Despite the market’s concerns regarding guidance and high debt levels, Uber’s overall fundamentals remain sound. The company has diversified beyond ridesharing into food delivery and freight services, reducing risk and enhancing stability. Uber’s efforts to branch out internationally further bolster its position.

With ongoing market expansions and a variety of strategies, Uber appears well-equipped for long-term growth. Its projected long-term earnings growth rate of 36% far exceeds the industry’s 22%, suggesting that maintaining its Zacks Rank #3 (Hold) may be wise. New investors might, however, consider waiting for a better entry point. Check out the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Discover the Top 7 Stocks for the Coming Month

We have just released a list of 7 elite stocks from our current selection of 220 Zacks Rank #1 Strong Buys, which are expected to see significant price movements.

These stocks have outperformed the market on average by +24.3% annually since 1988. Make sure to give these selections your attention.

Want the latest picks from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days for free now.

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.