The S&P 500 Faces Volatility: Insights on Investing Today

Recent weeks have brought considerable turmoil to the Stock market, leaving many investors feeling unsettled by the fluctuations.

Following a steep decline at the start of April due to uncertainties stemming from President Trump’s tariff policies, the S&P 500 (SNPINDEX: ^GSPC) noted a historic rally, only to see another drop the very next day.

Wondering where to invest $1,000 right now? Our team of analysts has identified the 10 best stocks to purchase now. Learn More »

Despite the recent volatility, the S&P 500 remains nearly down 13% since mid-February. This situation raises alarms for some investors regarding the possibility of a recession. If you’re concerned about how future volatility could impact your portfolio, here are three key considerations to keep in mind.

Image source: Getty Images.

1. Selling Is What Triggers Losses

When Stock prices drop, your portfolio’s value can plummet. It’s disheartening to see your account balance decrease, but it’s crucial to understand that you’re not actually losing money unless you make the choice to sell.

Daily fluctuations in stock prices are common, and sometimes the declines can be steep. Ultimately, your true gain or loss is determined by what you initially paid for your investments versus what you sell them for. Therefore, the only way to realize a loss is by selling while the price is below your purchase price.

For instance, if you buy a share of Stock for $500 and its value climbs to $600, your portfolio gains $100 in value. However, you won’t actually profit from this increase unless you sell at that higher price.

Conversely, if the stock price drops to $400 and you decide to sell, you’ll incur a $100 loss. Yet, if you hold onto the investment until it rallies back to $500 or more, you won’t have realized any loss, even if the journey was tumultuous.

2. The Value of Time in Investing

To secure a rebound in your investments, it is essential to allow them sufficient time. Although there are no guarantees in the Stock market, well-established companies often recover from even the most severe downturns and recessions.

Historically, the market has shown an impressive capacity for overcoming challenging conditions. While today’s climate may feel unprecedented, it is not the first time investors have confronted immense uncertainty.

For example, during the Great Recession, which marked the toughest financial crisis post-World War II, skepticism loomed over major financial institutions. Nevertheless, the market managed to rebound. Similarly, the onset of the COVID-19 pandemic saw the S&P 500 lose more than a third of its value in about a month, yet it eventually recovered.

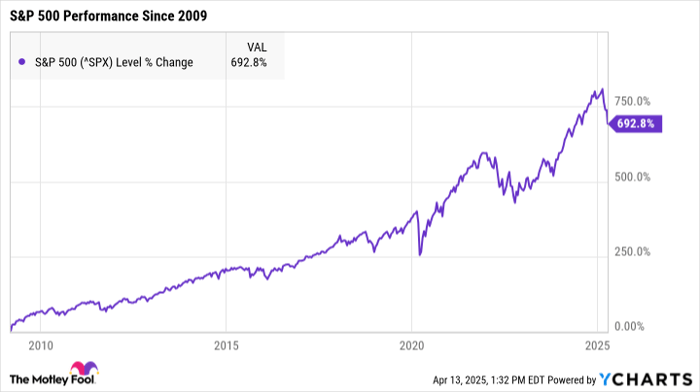

Since the S&P 500 hit its low in March 2009, the index has achieved total returns nearing 700%.

^SPX data by YCharts

While it’s unrealistic to expect similar returns moving forward since past performance does not guarantee future results, the history shows that the market can endure tough times. Despite the discomfort of market corrections, remaining invested is crucial for maximizing your potential gains when recovery occurs. It’s advisable to focus on solid companies with prospects for long-term growth, as they have a higher likelihood of bouncing back.

3. Timing is Less Critical Than You Think

When Stock prices decline, it may feel like a poor time to invest. However, downturns often present excellent buying opportunities, with stocks essentially available at reduced prices.

Investing during high price periods is not necessarily disadvantageous either—as long as you maintain a long-term perspective. Historically, the market has provided substantial returns over decades. Even purchases made at peak prices can yield significant growth in the long run.

For example, had you invested in an S&P 500 index fund in November 2007, just before its slide into the Great Recession, your portfolio would have faced immediate losses. The S&P 500 wouldn’t hit a new high until 2013. Nevertheless, if you had held your investment for ten years, you’d have realized total returns exceeding 70%, nearly doubling your initial investment.

^SPX data by YCharts

It’s certainly possible that you could have earned more by investing right at the market’s lowest point in 2009; however, that doesn’t negate the potential for significant returns by investing at less favorable times.

This strategy also acts as a reminder to consider consistent investments regardless of market conditions. With dollar-cost averaging, you regularly invest a predetermined amount throughout the year. This approach allows you to buy shares at high and low prices alike, ultimately maximizing your returns without needing to accurately time the market.

Although the market’s future may be uncertain, it shouldn’t deter you from investing. If you’re hesitating, consider the words of renowned investor Warren Buffet.

“I can’t predict the short-term movements of the Stock market. I haven’t the faintest idea whether stocks will be higher or lower a month or a year from now,” he expressed in a 2008 New York Times article. “What is likely, however, is that the market…

Consider Your Investment Options: Is the S&P 500 Index Worth It Now?

Evaluating the S&P 500 Index Investment

Before committing to an investment in the S&P 500 Index, there are several important factors to consider:

The Motley Fool Stock Advisor analyst team recently highlighted their selection of what they believe are the 10 best stocks for investors to buy at this time. Notably, the S&P 500 Index does not feature among these picks. The chosen stocks have the potential to deliver significant returns over the coming years.

Reflect on the past successes of stocks featured in their recommendations:

- When Netflix was included in this list on December 17, 2004, an investment of $1,000 would have grown to $495,226*.

- Similarly, after Nvidia was recommended on April 15, 2005, that same $1,000 investment would have escalated to $679,900*.

It is important to note: Stock Advisor boasts an impressive average total return of 796%, significantly outperforming the 155% return of the S&P 500 during the same period. For those interested, the most current top 10 stock recommendations are available upon joining Stock Advisor.

*Data reflects Stock Advisor returns as of April 14, 2025

Katie Brockman has no positions in any of the stocks mentioned. The Motley Fool also holds no positions in any of the stocks discussed. The Motley Fool adheres to a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.