Zoom Video Sees Stock Dip Amid Mixed Q4 Fiscal Performance

Zoom Video (ZM) shares fell nearly 8% on Tuesday after the company released its fourth-quarter fiscal 2025 earnings report. Investors reacted negatively primarily due to the company’s disappointing revenue outlook for the forthcoming quarters.

Although Zoom exceeded the Zacks Consensus Estimate for both revenues and earnings, lower growth projections raised concerns, particularly as many organizations are now mandating that employees return to physical offices.

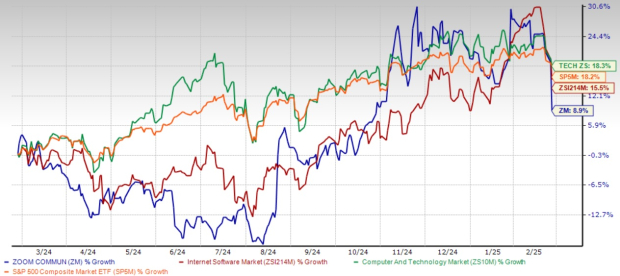

Over the past year, Zoom’s stock has increased by 8.9%, in contrast to the broader Zacks Computer and Technology sector, which saw a growth of 18.3%.

1-Year ZM Stock Price Performance

Image Source: Zacks Investment Research

Q4 Performance Highlights Robustness in Shifting Workplace Trends

In its fourth quarter, Zoom reported revenues of $1.184 billion, which surpassed the consensus estimate by 0.5% and marked a 3.29% increase from the previous year. This performance underscores Zoom’s strategic shift towards artificial intelligence capabilities.

When excluding the effects of foreign exchange, constant currency revenues reached $1.188 billion, up 3.6% year-over-year. The adjusted earnings per share were $1.41, exceeding the Zacks Consensus Estimate by 7.63%, although this figure was slightly lower than the prior year’s earnings.

Enterprise revenues, now making up 60% of total revenues (a 2 percentage point increase year over year), experienced growth of about 6% compared to the same quarter last year. Additionally, the trailing 12-month Net Dollar Expansion rate for Enterprise customers remained steady at 98%, indicating strong retention rates among larger clients.

Disappointing Guidance Pressures ZM Stock

Despite a solid quarter, Zoom’s forward guidance failed to meet market expectations. For the first quarter of fiscal 2026, the company forecasts revenues between $1.162 billion and $1.167 billion, down from the earlier estimated $1.174 billion. Similarly, for the full fiscal year 2026, anticipated revenues are in the range of $4.785 billion to $4.795 billion, reduced from previous guidance of $4.798 billion.

This tempered outlook highlights ongoing challenges as companies enforce in-office work policies, which may diminish the reliance on remote collaboration tools. Nevertheless, Zoom’s management has confidence in its AI-driven strategy; CEO Eric Yuan remarked, “As Zoom AI Companion becomes increasingly agentic, we look forward to continuing to help our customers fully realize the benefits of AI and discover what’s possible with AI agents.”

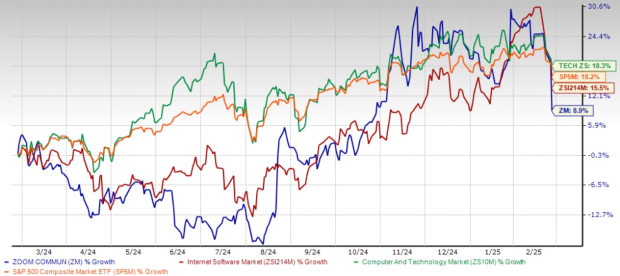

The Zacks Consensus Estimate for fiscal 2026 suggests a revenue growth of 2.73% to reach $4.79 billion, while the earnings estimate is set at $5.29 per share, signifying a 4.51% decline year-over-year.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

Financial Health Remains Strong Despite Concerns

Even with the slowing growth, Zoom continues to showcase a robust financial position. Operating cash flow for the fourth quarter increased by 20.9% year-over-year, reaching $424.6 million, while free cash flow grew by 25.1% to $416.2 million. The company maintains a strong balance sheet with roughly $7.8 billion in cash, cash equivalents, and marketable securities.

Moreover, Zoom has actively engaged in shareholder returns, repurchasing around 4.3 million shares in the fourth quarter and 15.9 million shares throughout the fiscal year. The company concluded the quarter with operating cash flow and free cash flow margins of 35.9% and 35.2%, respectively, indicative of efficient capital management in the face of competitive pressures.

Analyzing Stock Valuation and Competitive Landscape

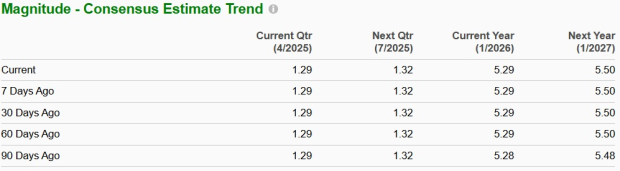

With a forward 12-month price-to-sales ratio of 4.74, Zoom is trading at a premium compared to the Zacks Internet – Software industry average of 4.64. This premium valuation embodies investor expectations for future AI-driven growth; however, it also heightens the risk of downside should the company fail to achieve its revenue growth targets in the subsequent quarters.

Concerns Rise Over ZM’s Valuation Metrics

Image Source: Zacks Investment Research

Competitive challenges are significant for Zoom, as it contends with major players like Microsoft (MSFT) with Teams, Cisco (CSCO) with Webex, and Alphabet (GOOGL) offering Google Meet. These competitors have integrated their collaboration tools into larger productivity suites and have vast resources to invest in AI technologies, utilizing existing enterprise relationships and bundled product offerings to compete effectively on price.

Though Zoom has established strong brand recognition, maintaining its market share mandates ongoing innovation and differentiation amid fierce competition from these ecosystem players who provide integrated collaboration solutions as part of broader enterprise contracts.

Focus on AI and Enterprise Solutions for Future Growth

Zoom is intensifying its focus on AI capabilities, with the monthly active users of Zoom AI Companion rising by 68% quarter-over-quarter. The company plans to introduce a Custom AI Companion add-on in April to automate workplace tasks via custom agents, allowing personalization aligned with customer needs while ensuring seamless integration with third-party tools.

In addition, Zoom’s Contact Center solution secured its largest annual recurring revenue deal to date with a Fortune 100 tech company in the U.S., evidencing the firm’s competitive edge in the enterprise market.

Investment Considerations for ZM Stock

For current shareholders, holding onto the stock may be advisable given Zoom’s solid cash position, active share buybacks, and strategic emphasis on AI, which could potentially reignite growth in the long term. The company remains poised to adapt as market conditions evolve.

Zoom Video Faces Growth Challenges Amid Expanding Service Portfolio

Zoom Video Communications is broadening its service offerings beyond traditional meetings to include phone, team chat, and contact center solutions. This expansion opens various avenues for potential growth. However, prospective investors may want to consider waiting for a better entry point during fiscal 2026. The company is currently navigating near-term growth obstacles, and the transition to an AI-first platform may introduce volatility in the market.

As Zoom continues to implement its strategic initiatives aimed at sustainable growth, it may present more appealing valuations in the upcoming quarters. The stock currently holds a Zacks Rank #3 (Hold), indicating a cautious outlook. For those interested in further market insights, you can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Expert Analysis Highlights Stock with High Growth Potential

Zacks’ research chief has identified five stocks with the potential for gains of 100% or more in the coming months. Among these, Sheraz Mian, Director of Research, emphasizes one stock that appears poised for significant growth. This top pick is recognized as one of the most innovative financial firms, boasting a rapidly expanding customer base of over 50 million and a diverse range of cutting-edge solutions.

While not every elite selection results in success, this particular stock is projected to outperform previous Zacks’ picks, such as Nano-X Imaging, which increased by 129.6% in just over nine months. Investors seeking insight into promising opportunities can access further recommendations.

Free: See Our Top Stock And 4 Runners Up

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Zoom Communications, Inc. (ZM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.