A Bird’s Eye View of Analyst Projections

As if soaring on thermals, NB Private Equity Partners (LSE:NBPE) has seen its average one-year price target upgraded to 1,978.80 / share – a climb reaching 12.14% from the previously anchored 1,764.60 as of January 16, 2024. This figure aggregates analyst forecasts, currently spanning between a modest 1,959.40 to an ambitious 2,037.00 / share. The mean target indicates an uplift of 28.66% from its most recent closing listing at 1,538.00 / share.

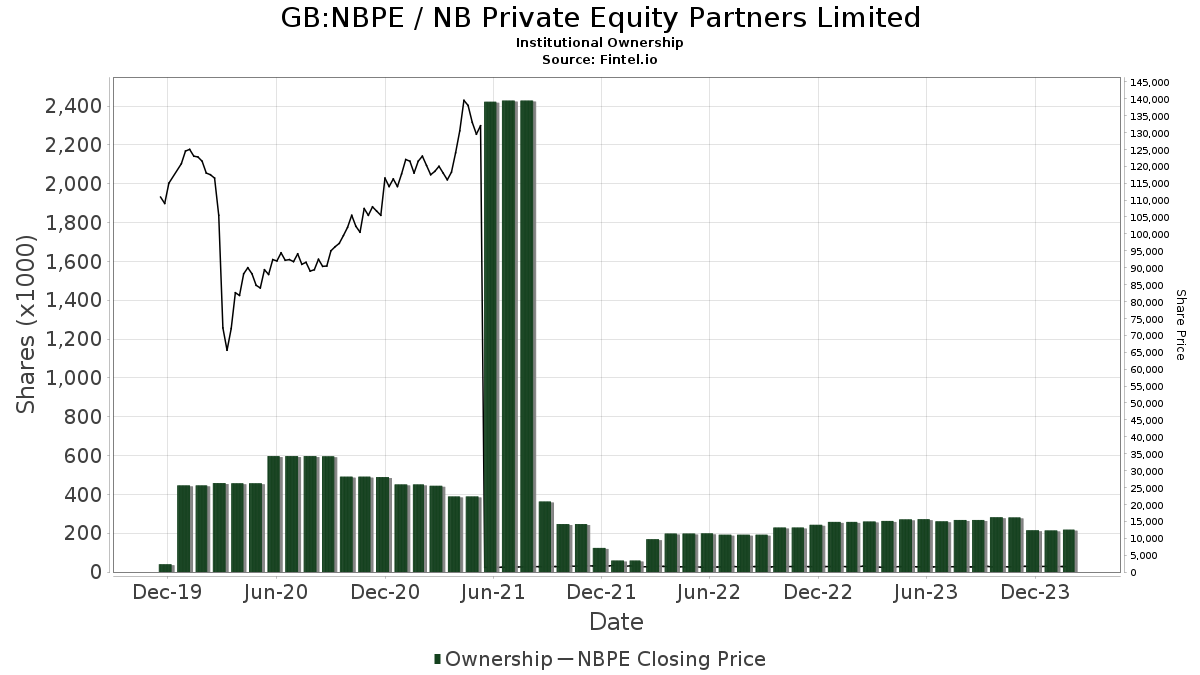

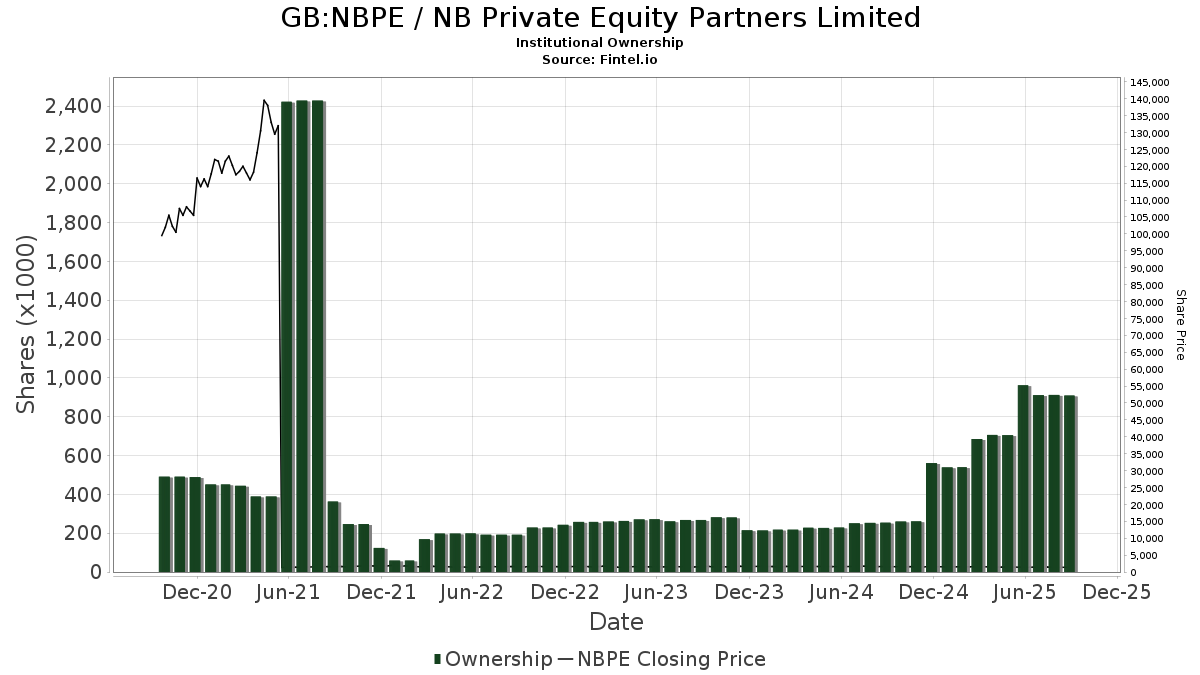

Exploring the Fund Sentiment

Like a robust oak with unwavering roots, NB Private Equity Partners stands tall with 6 funds or institutions maintaining positions, consistent with the previous quarter. The average portfolio weight invested across all funds in NBPE has blossomed to 0.99%, evidencing a sturdy 12.31% increase. However, the total institutional shareholding has dipped by 22.58% over the preceding three months to 218K shares.

Insights into Shareholder Activities

Like stars forming constellations in the night sky, various stakeholders have been making their moves with NB Private Equity Partners. PSP – Invesco Global Listed Private Equity ETF has boosted its NBPE holdings from 79K to 83K shares, witnessing a flight of 4.69% in ownership. Partners Group Private Equity, on the other hand, witnessed a decline from 138K to 72K shares, marking a significant 91.46% descent. Similarly, LPEFX – ALPS saw a subtle dip from 40K to 40K shares, representing a mere 1.35% fall. AVPEX – ALPS, with its 16K shares, experienced a nominal 5.16% decrease. In contrast, PEX – ProShares Global Listed Private Equity ETF held 6K shares, down from the previous 6K, pointing towards a slight 6.85% drop. Despite these variations, the commitment to NBPE radiates through these changes.

Fintel shines as a beacon among investing research platforms, catering to individual investors, traders, financial advisors, and small hedge funds. Drawing upon a wealth of data spanning fundamentals, analyst reports, ownership insights, fund sentiment, options activity, insider trading, and much more, Fintel seeks to empower and inform.

Embark on a journey of discovery by clicking with Fintel.

This narrative was originally featured on Fintel.

The vantage point presented herein reflects the perspective of the author and may not necessarily mirror those of Nasdaq, Inc.