Riding the Wave of Market Momentum

After meticulous analysis and evaluation, NB Private Equity Partners (LSE:NBPE) has witnessed a notable surge in its price target, skyrocketing by an impressive 12.14% to a remarkable 1,978.80 per share. This substantial upward revision, from the preceding estimate of 1,764.60 dated January 16, 2024, is setting the tone for a new chapter in NBPE’s trajectory.

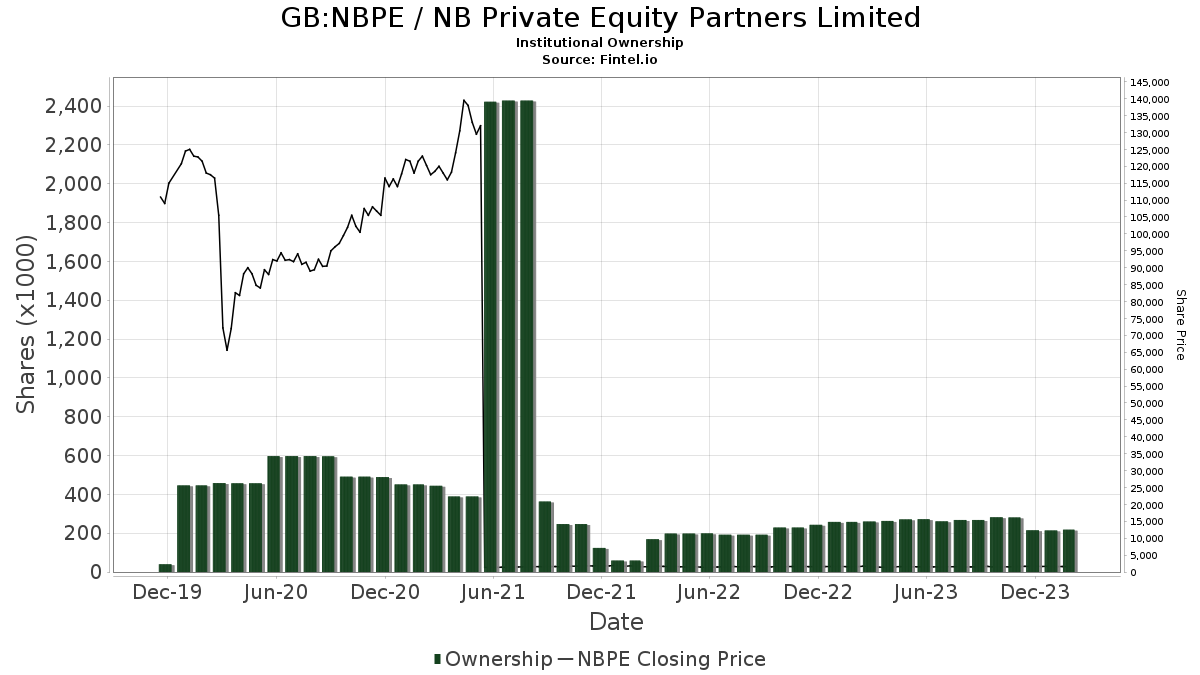

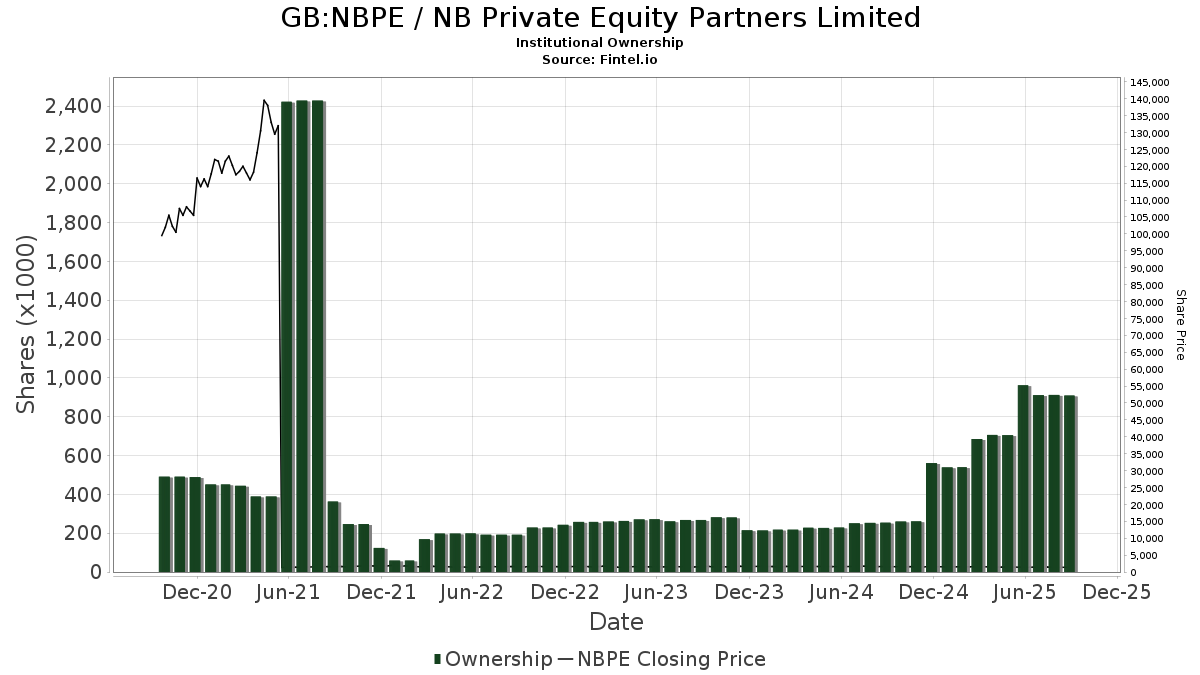

Unveiling the Fund Sentiment

As the market landscape evolves, fund sentiments toward NB Private Equity Partners stand firm with 6 funds or institutions reporting positions. This quantifiable stability has remained unscathed over the past quarter, showcasing an unwavering commitment to NBPE’s potential. The average portfolio weight dedicated to NBPE has seen a significant uptick of 12.31%, reinforcing the growing confidence in the company’s future prospects.

A Glimpse into Other Shareholders’ Actions

Delving deeper into the shareholder landscape, notable players such as PSP – Invesco Global Listed Private Equity ETF, Partners Group Private Equity, LPEFX – ALPS, AVPEX – ALPS, and PEX – ProShares Global Listed Private Equity ETF are making strategic moves regarding their NBPE investments. These fluctuations, ranging from increases to decreases in portfolio allocations, reflect the dynamic nature of the market and the nuanced strategies undertaken by astute investors.

Embark on an Investing Odyssey with Fintel

Dive into the riveting world of investing research with Fintel, a comprehensive platform catering to individual investors, traders, financial advisors, and small hedge funds. Offering a plethora of data spanning fundamentals, analyst reports, ownership insights, and fund sentiments, Fintel empowers investors with the tools needed to navigate the ever-changing financial landscape. Uncover exclusive stock picks driven by cutting-edge quantitative models to enhance your investment journey.

Unravel the mysteries of the stock market with Fintel – Your Gateway to Informed Investing.

This enlightening narrative was first featured on Fintel.

The opinions and sentiments conveyed in this article reflect the author’s viewpoints and do not necessarily align with those of Nasdaq, Inc.