Comparing Nebius Group and Microsoft in AI Infrastructure Investment

Nebius Group N.V. (NBIS) is emerging in the AI infrastructure market, while Microsoft Corporation (MSFT) remains a formidable force. Microsoft’s Azure cloud platform ranks as the second-largest globally, following Amazon Web Services (AWS). MSFT’s substantial investment in OpenAI positions it as a primary choice for cutting-edge AI applications.

The rapid expansion of AI is reshaping the tech landscape, making AI infrastructure an essential focus for technology firms. According to a report by IDC, spending in AI infrastructure is projected to exceed $200 billion by 2028. This growth trend benefits both Microsoft and Nebius, though their gains are not equal. For investors seeking opportunities in AI infrastructure, which Stock is the most promising?

We will take a closer look at each company’s strengths and weaknesses to determine which presents a better investment opportunity.

The Case for Nebius

Headquartered in Amsterdam, Nebius specializes in AI infrastructure. Its main offering is the Nebius cloud platform, which supports intensive AI and machine learning workloads in both owned and colocation data centers. The firm utilizes NVIDIA’s NVDA Reference Architecture to develop its AI cloud services. Additionally, NBIS creates full-stack infrastructure encompassing large-scale graphics processing units (GPU) clusters, cloud platforms, and developer tools. Other notable products include Toloka, an AI development platform; TripleTen, an edtech service; and Avride, an autonomous vehicle platform.

Nebius aims to expand its data center footprint and increase GPU deployments through a strategy geared toward enhancing installed capacity in the United States and Europe by 2025. The company commenced its U.S. expansion by launching an NVIDIA GPU cluster in Kansas City, which has a 5MW initial phase, in November 2024. This facility will initially host thousands of NVIDIA’s Hopper GPUs, with plans for the NVIDIA Blackwell platform to arrive in 2025, and there is potential to scale to 40MW. Establishing a presence in the United States is vital for reducing latency for domestic clients and reinforces the advantages of its AI-native cloud capabilities amidst rising demand.

Furthermore, in March 2025, NBIS revealed plans for a new data center in New Jersey, with a total capacity of 300MW expected for completion by summer 2025. Concurrently, capacity expansions at its Kansas City facility are projected to be operational by the end of the second quarter of 2025. In Europe, Nebius is also working on a new colocation deployment in Keflavik, Iceland.

With these initiatives, Nebius targets a revenue run rate between $750 million and $1 billion for 2025. Importantly, Nebius maintains a solid balance sheet, having raised $700 million in a private placement from investors like NVIDIA, Accel, and Orbis in December 2024. At the end of Q4 2024, the company reported $2.4 billion in cash.

However, growth prospects for NBIS may be subdued in the near term due to a challenging global economic climate. Increasing lead times from more selective customers are likely to hinder top-line growth. Nebius is investing heavily in capacity expansion, which may pressure margins in the short term.

The Case for Microsoft

In contrast, Microsoft stands as a leading player in the AI infrastructure sector, bolstered by its Azure platform, which offers extensive global data center coverage. Azure is now available in over 60 regions worldwide, which strengthens Microsoft’s competitive edge in the cloud market.

Microsoft is making significant investments in AI infrastructure, including the development of its proprietary AI chips such as Azure Maia and Azure Cobalt.

The company’s multi-billion dollar investment in OpenAI has been transformative. Microsoft holds the exclusive cloud partnership with OpenAI, with all workloads managed on the Azure platform. This collaboration allows Azure to leverage advanced AI models like GPT-4 Turbo and DALL·E. Additionally, Microsoft embeds OpenAI’s models directly into services such as Copilot, Azure, and Bing, facilitating monetization through vertical integration and cross-selling.

The increasing uptake of Azure OpenAI and Copilot across Microsoft 365, Dynamics 365, and the Power Platform enhances Microsoft’s growth prospects. With Azure AI, Microsoft is creating the foundational infrastructure for the AI boom, providing a wide variety of models to satisfy customer requirements for cost, latency, and design. Currently, the firm has over 60,000 Azure AI customers.

In its last quarter, Microsoft reported Cloud revenues of $40.9 billion, a 21% increase. Specifically, Azure and related cloud services revenues grew 31%, with 13 percentage points attributed to AI services that surged by 157% year-over-year. This growth far surpassed expectations, even as demand outstripped available capacity. Microsoft’s forecast anticipates Azure revenue growth in the fiscal third quarter between 31% and 32%. Additionally, MSFT’s cash reserve of $71.55 billion significantly exceeds that of Nebius.

MSFT Shares Are More Resilient Than NBIS

Recently, both MSFT and NBIS shares faced declines amid a broader tech sell-off. However, MSFT’s shares fell by only 3.1%, while NBIS experienced a more severe drop of 17.9%.

Image Source: Zacks Investment Research

Valuation for MSFT & NBIS

From a valuation perspective, both Microsoft and Nebius seem overvalued, as indicated by their Value Scores of D and F, respectively.

Looking at Price/Book ratios, NBIS shares are trading at 1.52X, compared to MSFT’s 9.13X.

Image Source:

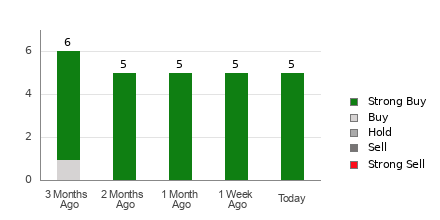

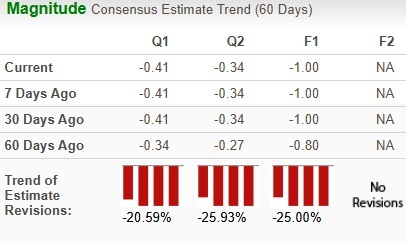

Comparison of Earnings Estimates: NBIS vs. MSFT

Earnings Estimates for NBIS and MSFT Show Divergent Trends

Analysts have notably decreased their earnings estimates for Nebius Group N.V. (NBIS), signaling potential challenges for the company’s bottom line.

Image Source: Zacks Investment Research

On the other hand, Microsoft Corporation (MSFT) experiences only a minor downward revision.

Image Source: Zacks Investment Research

Evaluating Investment Choices: NBIS vs. MSFT

As NBIS works to establish its position in the AI infrastructure sector, MSFT remains a formidable competitor. For investors looking toward long-term growth in AI infrastructure, Microsoft tends to be the preferable option.

Currently, Microsoft holds a Zacks Rank #3 (Hold), positioning it as a stronger investment compared to Nebius, which has a Zacks Rank #4 (Sell).

For a detailed insight, you can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Unlock Full Access to Zacks’ Recommendations for Just $1

This isn’t a gimmick.

Years ago, Zacks Investment Research provided a unique opportunity, granting 30 days of access to all our picks for just $1, with no commitment to invest further.

Many have seized this chance, while others hesitated, suspecting a catch. The incentive is simple: we aim for you to explore our portfolio services such as Surprise Trader, Stocks Under $10, Technology Innovators, and others that each closed 256 positions with significant gains in 2024 alone.

Looking for the most recent recommendations from Zacks Investment Research? Today, you can download the report on 7 Best Stocks for the Next 30 Days. Click to receive this free report.

Microsoft Corporation (MSFT): Free Stock Analysis report.

NVIDIA Corporation (NVDA): Free Stock Analysis report.

Nebius Group N.V. (NBIS): Free Stock Analysis report.

This article originally appeared on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.