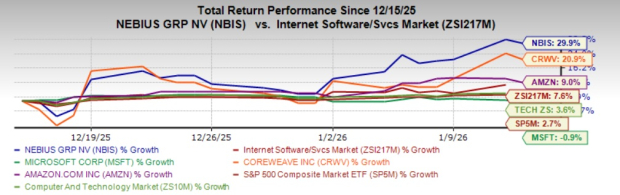

Nebius Group N.V. (NBIS) has seen its stock rise 29.9% over the past month, significantly outperforming the Zacks Computer & Technology sector growth of 3.6% and the S&P 500’s 2.7% increase. In the last six months, NBIS shares have surged 97%. The company is experiencing high demand for AI infrastructure, prompting an increase in its contracted power target from 1 gigawatt to 2.5 gigawatts by 2026, and expects between 800 megawatts to 1 gigawatt of operational capacity by then.

Nebius is strengthening its position in the AI market through partnerships, including multi-billion-dollar contracts with major tech companies like Microsoft (valued between $17.4 billion and $19.4 billion) and Meta (up to $3 billion). The company anticipates generating $900 million to $1.1 billion in annual recurring revenue (ARR) by the end of 2025, with a target of $7 to $9 billion in ARR by 2026. However, rising operational costs and aggressive capital spending—forecasted at approximately $5 billion for 2025—could pose risks amid fluctuating AI demand.