“`html

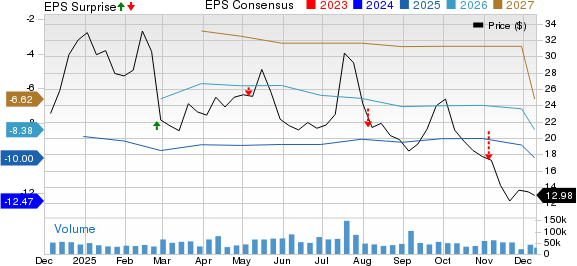

On December 9, 2025, Needham reiterated its Buy recommendation for Netflix (NasdaqGS:NFLX). The average one-year price target for Netflix is projected at $138.16/share, indicating a potential increase of 42.75% from its latest closing price of $96.79/share.

As of now, Netflix’s projected annual revenue is $39.63 billion, reflecting an 8.65% decrease, while the projected non-GAAP EPS stands at 15.13. There are currently 5,044 funds reporting positions in Netflix, with a total share ownership decreasing by 3.91% to 400,864K shares in the last three months.

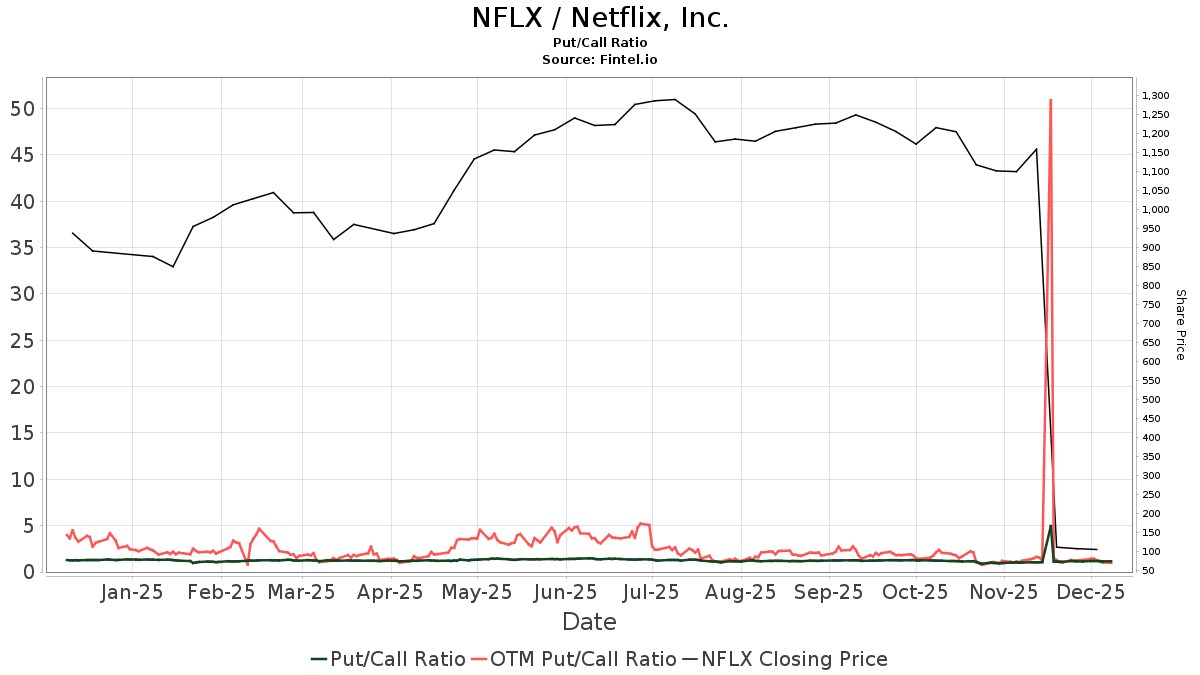

The put/call ratio for NFLX is at 1.15, suggesting a bearish outlook among investors. Significant shareholders such as Vanguard Total Stock Market Index Fund and Vanguard 500 Index Fund have increased their stakes by 1.25% and 1.60%, respectively, while other firms like Price T Rowe Associates and Capital World Investors have reduced their holdings by 2.17% and 12.29% over the last quarter.

“`