Dear readers/followers,

Although Neste (OTCPK:NTOIY) has had its ups and downs, my faith in this company as a long-term gem in the energy space remains unshaken. I am not new to the cyclical nature of markets, and Neste is no exception. It may not be the largest or most significant holding in my portfolio, but I see its potential for outperformance.

Enbridge (ENB), for instance, still holds the title for my largest investment in this space, and is likely to remain so for the foreseeable future.

This updated article aims to delve into the latest quarterly results and my reasons for increasing my pace of buying Neste stock.

This is not a spur-of-the-moment decision. I have consistently held a “BUY” position on Neste, based on its operational strength, biofuel, and ESG-upside, and my long-term outlook for outperformance.

An update for Neste – 3Q23 indicating further strength

While Neste has not been the most solid performer in my portfolio, the 3Q23 results finally indicate a positive trajectory. Despite its checkered performance in the past few quarters, the company is showing signs of recovery.

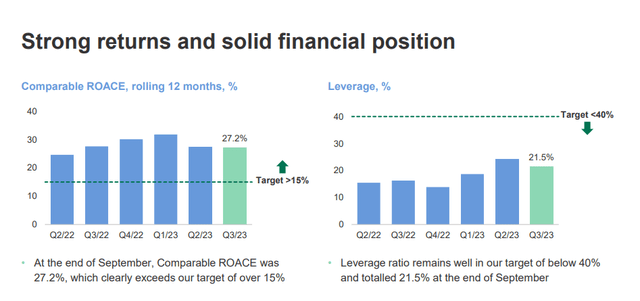

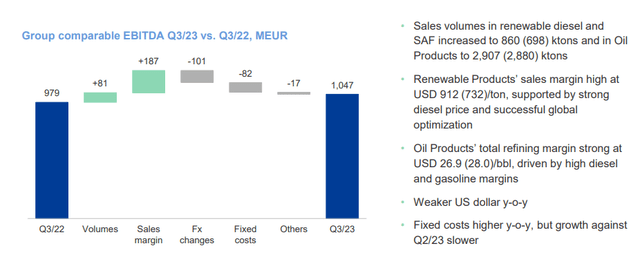

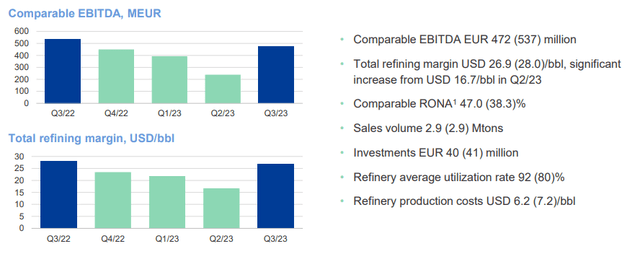

The bottom-line profits, or Free Cash flow/FCF proxies, are a reassuring indication. In this case, EBITDA clocked in above €1B for the quarter, surpassing the YoY figure of €980M. The company’s renewable sales margins saw strength at 912 USD per ton, buoyed by a robust diesel price, and the company’s robust execution across feedstocks, markets, and products.

The refining margins at 26.9 USD/bbl in oil products, driven by high margins in both diesel and gasoline, and the strong results in the market & services segment, further bolster the positive narrative.

However, challenges persist. The ramp-up in Singapore continues to pose hurdles, while construction activities in Martinez are ongoing, with the company projecting a 730M gallon nameplate capacity by year-end.

Given the company’s operations in renewables, feedstock prices such as used oil, soybean, palm oil, and animal fat continue to sway the company’s short-term margins. While margins in heavy fuel oil and diesel have been increasing, those in gasoline have been dwindling.

The upturn in renewables, which contributed no less than €155M to the company’s EBITDA during the latest quarter, signals growing interest and strength in the company’s products.

The company’s continued reliance on the LCFS credit price, along with other subsidies, presents a mixed bag. Although the current LCFS credit is at 75 USD/ton, down from 86, and over 160 at its high, the tightening carbon targets under movements like that managed by the California Air Resources Board (CARB) could provide additional cushion for Neste.

The remarkable improvement in oil product margins, with margins in diesel and most other products increasing, bodes well for the company’s valuation trend. The shift in inventories during 3Q23 tightens the outlook, painting a positive picture moving forward.

“`html

Neste: A Look at the Rise in Results and Valuation

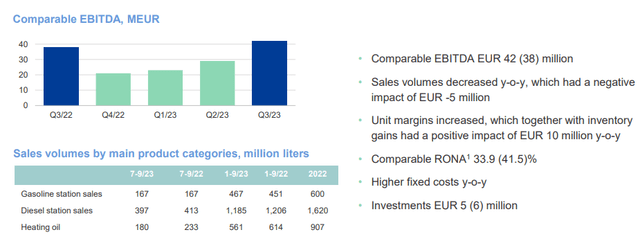

increase in results by the Marketing & Services segment, which is a clear doubling in less than a single year. The segment has fully reversed, and there is no indication for another crash down to the €20M level, at least not at this time.

But why do I like Neste so much anyway?

Well, there are a few reasons. The company’s market cap of over €28B, its home geography of Finland, its history, its markets active across the entire world, its operation of two of the non-Norwegian refineries still remaining in the Nordics which account for almost 20% of the current native capacity, but most of all because of the simple fact that Neste is the largest player in the world in renewable Diesel.

Unlike most energy companies though, part of the company’s issue is dividend yield. It has a very low yield, despite its share price decline and sector, which usually lends itself well to income investments. This is also why my investment remains fairly limited.

But let’s look at the Risks and Upsides to the company both over the long and the short term.

Taking Stock of Risks & Upside at Neste

While one of the primary upsides is the valuation upside to the company, we’ll go into that one later. One of the primary risks aside from the volatile macro of the energy sector is the company’s recovery of its sub-par profitability. The company manages sub-par operating and gross margins in a sector where many companies have higher (Source: GuruFocus), if we’re talking businesses in the Oil & Gas industry. The company also, despite being a market leader in renewable diesel, isn’t a market leader in financials or fundamentals. Neste still has a distance to cover before its fundamentals, according to most fundamental valuation methods, can really justify a far higher price point than we’re seeing here. Based on most sales models and valuation approaches, or a projection of its free cash flow relative to its peers, this company should trade in fact where it trades right now.

That means the risk here is that the company does not manage its operational improvements, such as Singapore and Martinez, along with other pushes.

But I view the company managing this over the long term as the likely scenario – and I believe the eventual upside if this does materialize, is significant enough to warrant interest here.

I believe the upside can be confirmed, at least on the short term, by the company’s special call held about 3 weeks ago. During that call, management reiterated the forecast provided during 3Q23 as follows.

The outlook provided at our third quarter reporting at the end of October remains valid. All forward-looking outlook statements relating to the first quarter of next year as well as the full year of next year remain to be published in our financial year ’23 financial statements released to be published on February 8 of next year.

(Source: Martti Ala-Harkonen, Neste Special Call)

All of the positive expectations with regard to Singapore and Martinez have been realized for the most part. A small fire at Martinez has set back some of the plans for full nameplate capacity, but it will be finished eventually – and 2 out of 3 lines at the facility are still operating as normal.

Let’s look at company valuation here.

Assessing Neste’s Valuation

The company has many exciting projects in the pipeline, which also need to be taken into consideration when evaluating this company as an investment. To say that Neste is a “future-oriented investment would be an understatement. To my mind, it’s one of “the” future-oriented investments in the biofuel space – its recent projects such as green hydrogen in the Finnish location at Porvoo only one of those upsides.

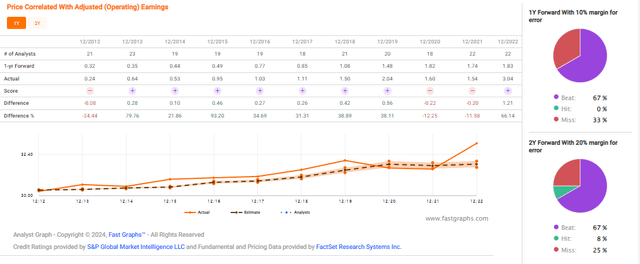

The company is being undervalued here – that’s what most analysts, including myself, say here. Trading at almost just 1x sales and at a forward EBITDA multiple of below 9.9x, usually above 13-14x, is significant. 21 S&P Global analysts follow Neste, and out of those, 16 have the company at a “BUY” or equally positive rating, with a range starting at €30/share and going to €60/share, with an average of €44/share.

Recall that my previous target for this company was €47/share, and I am not reducing or adjusting this target at this time – I’m keeping it.

One of the key parts of being a successful value-oriented investor is recognizing undervaluation when it’s present. I believe Neste is currently one of the most undervalued biofuel businesses with this sort of scale on the planet.

While the company is unlikely to generate massively significant earnings growth over the next few years due to both macro, but also investment-heavy years, I believe what will come out on the other side is a business with plenty of growth potential. The company’s 3.1% yield is decently well covered under the normalized EPS level for the next few years of around €2.5-€3/share, which I believe to be a likely level for the years until and including 2026E.

Provided you allow the company to trade at least 13x P/E despite low growth, that means you could see a double-digit upside here. (Source: FactSet/F.A.S.T graphs)

Why should you allow this?

Because statistically speaking, Neste outperforms. Statistically speaking, this company manages to beat estimates over 65% of the time both on a 10% and 20% MoE on a 1-2 year basis. That’s more than a coincidence, in my view, but an underestimation.

And it’s the sort of underestimation I am happy to invest in.

Here is my ongoing thesis for Neste, mostly unchanged since my last article.

The Ongoing Neste Thesis

- Neste is perhaps one of the most interesting oil/energy companies in Europe. They’ve found their niche, and they’ve pivoted at what I view

“`

The Promising Investment of Neste for 2024E

When it comes to investing, timing is everything. It’s like hitting a home run in the bottom of the ninth or pulling a winning lottery ticket just before the numbers are called. In the financial market, Neste seems to have struck gold at exactly the right time, ready to serve a market that will require their products for decades to come.

The Financial Strength of Neste

Neste, known for its strong financials, presents a compelling case for investment. While the current yield may not be breathtaking, the potential for future returns is nothing short of striking, with projections reaching the high double or even low triple digits.

An Attractive “BUY” with Long-Term Potential

Neste stock has been marked as a “BUY” with a price target of €47 as of May 2023. This recommendation remains firm, despite the recent drop in the company’s valuation. The recent biofuel mandate and reductions in credits have not deterred the allure of Neste as an investment choice.

Intrinsic Value for 2024E

In the eyes of many investors, Neste is viewed as a positive potential investment for 2024E, signifying the confidence in its enduring prospects.

The Investment Approach

Investment maestro emphasizes the importance of buying undervalued companies and nurturing them to normalize over time, reaping the rewards of capital gains and dividends along the way. If a company ventures into overvaluation, it’s time to cash in and redirect the funds to other undervalued stocks, thereby continuing the cycle.

If a firm hovers around fair value or dips back into undervaluation, the response is to seize the opportunity and invest further, breathing life into the cycle of potential growth and reward.

Reinvesting revenue from dividends, work-based savings, or other streams of income is outlined as a key strategy, embodying a commitment to the enduring potential of each investment.

Critical Criteria for Investing

The outlined criteria stress the emphasis on qualitative measures, conservative business practices, well-covered dividends, current affordability, and realistic growth prospects. Neste aligns with all these benchmarks, solidifying its position as a promising investment prospect.

A Note of Caution

It’s important to note that this discussion involves securities that do not trade on a major U.S. exchange. Hence, it’s crucial to consider the associated risks when exploring these investment avenues.