Netflix Reaches New Heights Amid Economic Concerns

While many tech stocks are down about 20% from their all-time highs, Netflix(NASDAQ: NFLX) recently achieved a new all-time high. This resilience stands in contrast to broader market fears regarding trade wars and tariffs affecting the economy.

This raises an important question: Is Netflix really recession-proof? If so, does the stock have further growth potential? Let’s explore the details.

Netflix as a Recession-Resistant Service

Netflix requires little introduction, as nearly everyone either has an account or can access one, despite the recent crackdown on password sharing. Even those without current access often return once a new show or popular series is released.

Despite recent price increases, Netflix continues to deliver significant value. For less than the cost of a family dinner, subscribers can access a vast library of content each month. This value proposition could make the company resilient as consumers tighten their budgets.

Such factors contribute to its perception as “recession-proof,” a designation typically reserved for a few select companies.

Now that Netflix has hit a new all-time high, is it the right moment to invest?

Netflix’s Stock Valuation Remains High

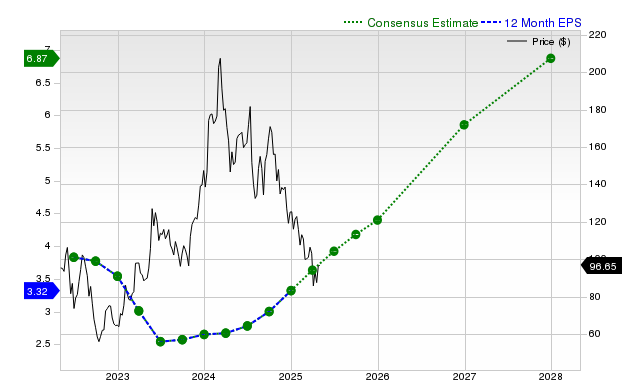

The current market capitalization of Netflix stands at approximately $481 billion. Co-CEO Ted Sarandos has set an ambitious goal of achieving a $1 trillion valuation by 2030, suggesting the stock would need to double in value within six years. But how realistic is this projection?

It’s worth noting that Sarandos also aims for Netflix’s revenue to double by 2030, indicating that financial performance will play a critical role in reaching this valuation.

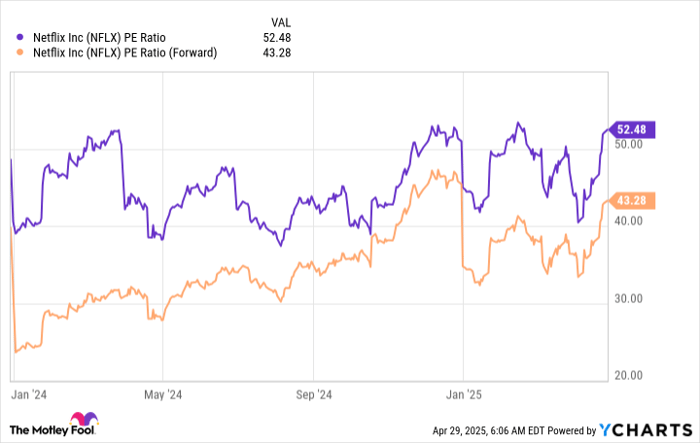

However, Netflix’s high valuation could complicate this goal. The stock now trades at an expensive 52.5 times earnings and 43 times forward earnings.

NFLX PE Ratio data by YCharts. PE = price-to-earnings.

While some tech rivals may have previously matched Netflix’s valuations, they have recently seen significant sell-offs due to economic concerns. Additionally, these competitors are often projected to grow at similar or faster rates than Netflix.

Here’s how Netflix compares to notable peers:

| Company | Forward P/E Ratio | 2025 Projected Revenue Growth | 2026 Projected Revenue Growth |

|---|---|---|---|

| Netflix | 43.3 | 14% | 12% |

| Nvidia | 24.6 | 54% | 23% |

| Alphabet | 16.9 | 11% | 11% |

| Meta Platforms | 22.2 | 13% | 13% |

Data source: YCharts and Yahoo! Finance. Note: Projected revenue growth is from Wall Street analysts. Nvidia’s projections are for FY 2026 and FY 2027.

Although Netflix is expected to grow at a pace similar to Alphabet and Meta Platforms, its stock carries almost double the premium. Even a high-growth competitor like Nvidia is valued significantly less than Netflix, suggesting that aggressive growth expectations are already reflected in Netflix’s stock price.

At 43 times forward earnings, Netflix’s stock appears too expensive for solid profits. Other tech stocks offer better value opportunities, making them potentially more attractive investments. With these considerations in mind, it may be wise to explore shares of Netflix’s peers during this period instead.

Should You Invest $1,000 in Netflix Now?

Before investing in Netflix, consider this:

The Motley Fool analyst team recently identified 10 stocks deemed better investment options than Netflix. These selections are expected to yield strong returns over the coming years.

To illustrate potential gains, consider that had you invested $1,000 in Netflix when it was recommended on December 17, 2004, it would now be worth $610,327! Alternatively, an investment in Nvidia from when it was recommended on April 15, 2005, would have grown to $667,581.

On average, Stock Advisor has produced a 882% return, far surpassing the 161% return from the S&P 500. For current recommendations, check out Stock Advisor.

*Stock Advisor returns as of April 28, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. The Motley Fool has recommendations and holds positions in Netflix, Alphabet, Meta Platforms, and Nvidia.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.