Netflix Shares Surge After Power Inflow Trading Signal

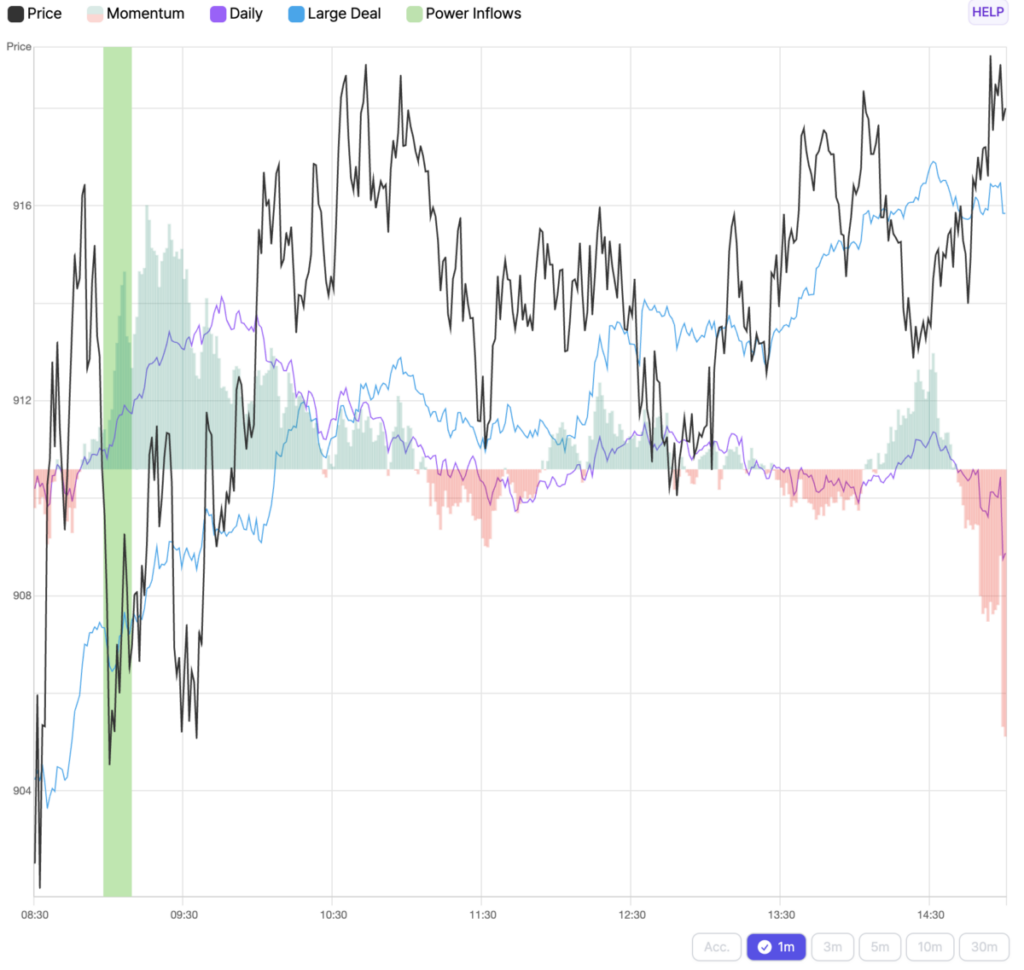

Netflix, Inc. (NFLX) experienced a significant market event today, reversing an early decline and increasing by over 11 points due to a Power Inflow signal, a key indicator for those tracking smart money movements and order flow analytics in trading.

This notable trading signal happened at 10:07 AM on March 14th, when Netflix, Inc. (NFLX) recorded a Power Inflow at a price of $908.18. This data is vital for traders aiming to understand the direction of institutional and smart money activity in the market. The occurrence of a Power Inflow suggests a potential uptrend, which could serve as an attractive entry point for those looking to take advantage of an anticipated increase in Netflix’s Stock. Traders interpreting this signal as bullish will closely monitor the stock for continued momentum.

Understanding the Power Inflow Indicator

Order flow analytics, often referred to as transaction or market flow analysis, involve the breakdown of retail versus institutional order volumes. This analysis includes the examination of buy and sell order flow, as well as order size, timing, and correlated patterns to derive meaningful insights for trading strategies. This specific indicator is regarded as a bullish signal by active traders.

The Power Inflow typically takes place within the first two hours of trading, signaling a trend that can help ascertain the stock’s overall trajectory, influenced by institutional activities for the rest of the trading day.

Integrating Analytics into Trading Strategies

Market participants using order flow analytics can better interpret current market conditions, spot trading opportunities, and enhance overall trading performance. It’s essential to combine insights from smart money flows with effective risk management strategies to safeguard capital and minimize potential losses. A sound risk management approach allows traders to navigate market uncertainties more effectively, thereby increasing the likelihood of achieving long-term success.

For those wanting to stay informed about the latest options trades for NFLX, Benzinga Pro provides real-time alerts on options trades.

Market News and Data are provided by Benzinga APIs and include contributions from various firms, such as Trade Pulse, responsible for portions of the data used in this article.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

After Market Close UPDATE:

The Power Inflow registered at $908.18. The stock reached a high of $919.63 and closed at $918, resulting in returns of 1.3% and 1.2% respectively. This underlines the importance of a well-defined trading plan, incorporating Profit Targets and Stop Losses aligned with one’s risk tolerance. In this scenario, the day’s high and close were closely aligned, although this isn’t always the case.

Past Performance is Not Indicative of Future Results

Momentum92.68

Growth62.70

Quality86.52

Value12.56

Market News and Data are brought to you by Benzinga APIs