Netflix Inc. (NFLX) achieved strong fourth-quarter results for 2025, driven by membership growth and a surge in advertising revenues, surpassing 325 million paid memberships globally. The company reported an operating income of $2.96 billion, a 30% increase year over year, and achieved an operating margin of 24.5%.

In 2025, Netflix’s ad revenues surged over 2.5 times to exceed $1.5 billion, bolstered by advancements in advertising technology. As of December 31, 2025, the company held $9.03 billion in cash. For Q1 2026, Netflix expects revenues of $12.16 billion, a 15.3% year-over-year growth projection, and anticipates full-year revenues between $50.7 billion and $51.7 billion, expecting a similar growth trajectory.

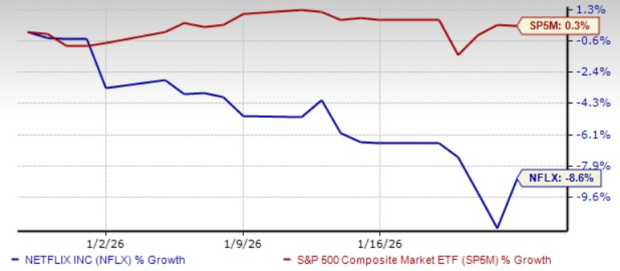

The Zacks Consensus Estimate indicates a revenue growth of 13.2% for the current year and an EPS growth of 24.1%. Netflix is currently trading at a 55.7% discount to its 52-week high, with a potential upside of 36.2% based on brokerage targets.