Here are five stocks that have been upgraded to Zacks Rank #1 (Strong Buy) List:

Marex Group plc MRX: This financial services platform provider has registered a significant uptick in the Zacks Consensus Estimate for current-year earnings, climbing by an impressive 22.3% over the past 60 days.

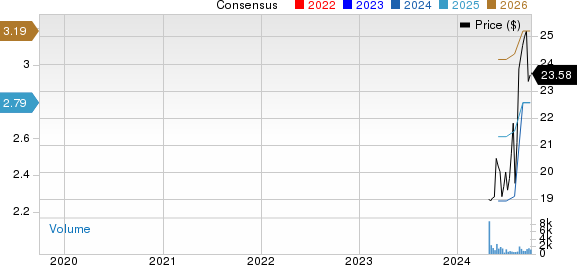

Marex Group PLC Stock Performance and Analyst Consensus

Marex Group PLC price-consensus-chart | Marex Group PLC Quote

AngioDynamics, Inc. ANGO: This medical technology company has seen a robust 12.8% increase in the Zacks Consensus Estimate for its current-year earnings in the past 60 days.

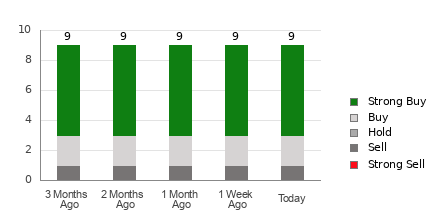

AngioDynamics, Inc. Financial Performance and Market Consensus

AngioDynamics, Inc. price-consensus-chart | AngioDynamics, Inc. Quote

Opera Limited OPRA: This internet technology firm has witnessed a 12.8% surge in the Zacks Consensus Estimate for its current-year earnings over the last 60 days.

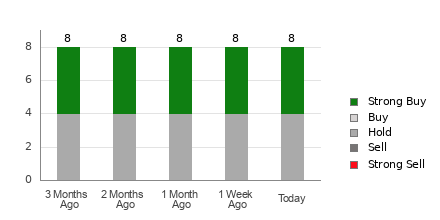

Opera Limited Financial Analysis and Consensus Forecast

Opera Limited Sponsored ADR price-consensus-chart | Opera Limited Sponsored ADR Quote

Atour Lifestyle Holdings Limited ATAT: This hospitality company has watched the Zacks Consensus Estimate for its current-year earnings grow by 9.9% in the past 60 days.

Atour Lifestyle Holdings Limited Financial Status and Analyst Consensus

Atour Lifestyle Holdings Limited Sponsored ADR price-consensus-chart | Atour Lifestyle Holdings Limited Sponsored ADR Quote

Pampa Energía PAM: This integrated power company has observed a 10.7% rise in the Zacks Consensus Estimate for its current-year earnings over the last 60 days.

Pampa Energía S.A. Financial Standing and Consensus Estimate

Pampa Energia S.A. price-consensus-chart | Pampa Energia S.A. Quote

Explore the full list of Zacks #1 Rank (Strong Buy) stocks for today here.

Zacks Unveils Top Semiconductor Stock

This stock is merely 1/9,000th of the size of NVIDIA, which has experienced a meteoric rise of over +800% since Zacks recommended it. While NVIDIA continues to be dominant, our newest top chip stock has immense growth potential.

With a robust uptrend in earnings and an expanding clientele, this stock is well-positioned to capitalize on the escalating demand for Artificial Intelligence, Machine Learning, and Internet of Things. Forecasts indicate that the global semiconductor manufacturing sector is set to surge from $452 billion in 2021 to a whopping $803 billion by 2028.

Witness Potential Now at No Cost >>

Free Stock Analysis Report on AngioDynamics, Inc. (ANGO)

Free Stock Analysis Report on Marex Group PLC (MRX)

Free Stock Analysis Report on Pampa Energia S.A. (PAM)

Free Stock Analysis Report on Opera Limited Sponsored ADR (OPRA)

Free Stock Analysis Report on Atour Lifestyle Holdings Limited Sponsored ADR (ATAT)

Read the full article on Zacks.com by clicking here.

Visit Zacks Investment Research

The expressed views and opinions in this piece are solely those of the author and may not necessarily align with those of Nasdaq, Inc.