New York Community Bancorp has emerged from the financial trenches with Moody’s Investors Service bestowing a striking upgrade upon the company. In the wake of a monumental $1.05 billion capital injection, courtesy of the banking deities, NYCB’s credit rating ascended from B3 to B2. Although still residing a few rungs beneath the investment-grade echelon, the rating outlook now gleams with positivity, akin to a phoenix rising from its fiscal ashes.

Capital Infusion: A Lifeline Amidst Turbulent Waters

This cash infusion serves as a shield, fortifying NYCB’s common equity tier 1 (CET1) capital ratio to a robust 10.2% on a proforma basis, poised to swat away potential credit losses filtering through its commercial real estate portfolio. Moody’s nod of approval was further validated by NYCB receiving a resounding applause in the form of an unqualified audit opinion on its recently wrapped-up financial statements. A step in the right direction indeed.

Challenges Lurk Amidst the Jubilation

Yet, nothing is ever as perfect as it seems in the world of finance. Moody’s tempered the jubilation by highlighting NYCB’s looming challenges — an opera of strategic decisions awaits the bank amidst the melodic murmurs of governance woes, financial intricacies, risk management acrobatics, and internal control acumen. Scaling up the mountain of fiscal redemption is NYCB’s uphill battle.

Undulating Share Prices and the Thorny Path Ahead

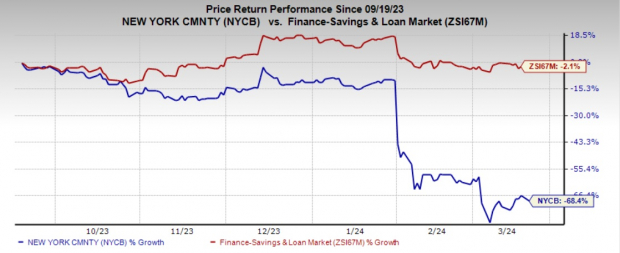

As the company navigates through this challenging terrain, NYCB shares have taken quite the rollercoaster ride, plummeting by 68.4% in the past six months — a stark contrast to the industry’s modest 2.1% dip. But as they say, the market is a fickle friend, one who can lift you high only to drop you with a sudden gust of uncertainty.

In a bid to shore up its defenses, NYCB made some strategic maneuvers: the lucrative sale of consumer loans to the tune of $899 million echoes throughout the financial landscape, a concession that might steer the ship towards calmer waters in the quarters to come.

The Moody’s Ripple Effect: TFC Treads Uncertain Waters

Speaking of financial tides, the waves of Moody’s credit actions hit another shore — Truist Financial felt the tremors post its decision to divest from Truist Insurance Holdings. Fitch Ratings and Moody’s Investors Service echoed different tunes in reaction, marking a nuanced narrative for the financial behemoth.

As Fitch Ratings downgraded TFC’s long-term issuer rating, Moody’s hesitated, placing Truist’s long-term ratings beneath a magnifying glass — a tale of diverging opinions unfolding amidst the pulsating rhythm of financial scrutiny.

Opportunities Amidst the Chaos: Infrastructure Stock Surge!

Amidst this tempest of financial recalibration, a silver lining emerges — the clarion call for an infrastructure reawakening echoes across the U.S. landscape. It’s a bipartisan symphony of rebuilding endeavors sure to set the markets ablaze, offering a gambit of fortunes to be made amongst the cacophony of construction and repair.

The question, dear investors, is: are you poised to ride this wave of financial resurgence as mighty fortunes rise and fall amidst the clinking of hammers and the rumble of reconstruction?

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>