“`html

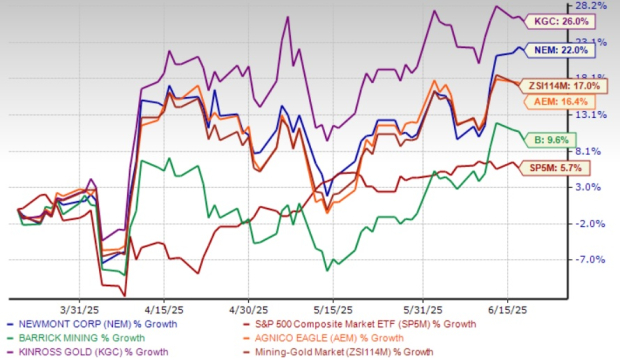

Newmont Corporation (NEM) shares have risen 22% over the past three months, outperforming the Zacks Mining – Gold industry’s 17% and the S&P 500’s 5.7%, driven by increased gold prices amid trade tensions and geopolitical uncertainties, particularly due to escalating Israel-Iran tensions. Gold prices surged approximately 29% this year, peaking at $3,500 per ounce on April 22, 2025, and currently hover around $3,400 per ounce.

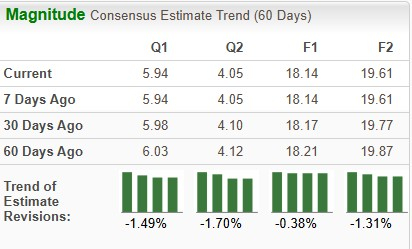

Newmont reported liquidity of $8.8 billion and a record free cash flow of $1.2 billion in Q1 2025, bolstered by a 162% year-over-year increase in operating cash flow to about $2 billion. The company’s earnings estimates for 2025 have risen, with the Zacks Consensus Estimate currently at $4.18, indicating a projected 20.1% year-over-year growth. Newmont’s current price-to-earnings ratio stands at 13.21X, compared to the industry average of 14.21X.

Additionally, Newmont has facilitated $500 million in annual run-rate synergies following its acquisition of Newcrest Mining Limited, alongside generating total cash proceeds of approximately $4.3 billion through divestitures of non-core assets since March 2025.

“`