Newmont Corp Set to Report First-Quarter Earnings with Promising Outlook

Newmont Corp NEM, the largest gold miner globally, is preparing to announce its first-quarter earnings on Thursday. Analysts predict $0.55 in earnings per share (EPS) and $3.3 billion in revenue, with results scheduled to be released after market hours.

The company’s stock has experienced considerable growth, increasing 39.41% over the past year and 37.28% year-to-date.

Even with recent fluctuations in gold prices, influenced by remarks from President Donald Trump regarding tariffs and continued support for Fed Chair Jerome Powell, Newmont’s stock has shown resilience. It has appreciated over 12% in the past month and nearly 40% over the last year. Investors are anticipating the upcoming earnings report and the underlying trends in the stock’s performance.

NEM Stock Technical Analysis: Indicators Show Mixed Signals

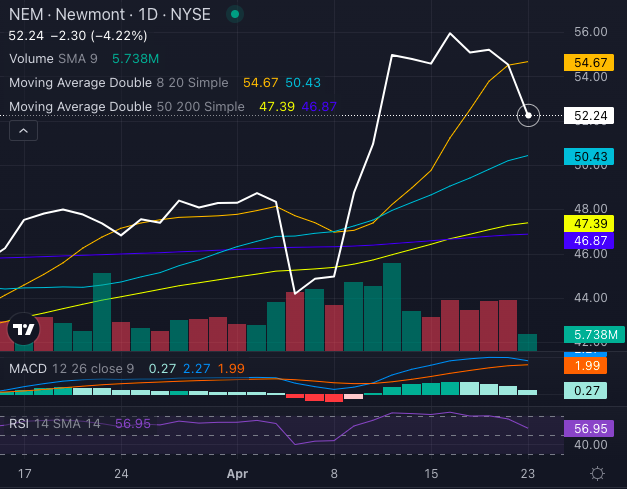

Chart created using Benzinga Pro

Recently, Newmont’s stock experienced a Golden Cross, where its 50-day simple moving average (SMA) of $47.39 crossed above the 200-day SMA of $46.87. This is a bullish signal often indicating potential for long-term price growth. Currently, NEM is trading at $52.24, surpassing both key moving averages, as well as the 20-day SMA of $50.43, demonstrating sustained upward momentum. This alignment of shorter- and longer-term averages suggests increasing investor confidence.

However, the technical indicators present a nuanced picture. The Moving Average Convergence Divergence (MACD) shows a value of 2.27, supporting bullish momentum, although some selling pressure might induce near-term volatility. The Relative Strength Index (RSI) is currently at 56.95, nearing overbought levels, indicating that while momentum persists, traders should remain cautious regarding a potential pullback after the earnings announcement.

At this moment, the technical landscape favors bullish sentiment, but outcomes could shift rapidly based on the first-quarter earnings results.

Market Predictions: Analyst Consensus Indicates Positive Outlook

Consensus Ratings & Targets: Currently, Wall Street analysts rate Newmont stock as a Buy, with a consensus price target of $53.40. According to the latest reports from UBS, Raymond James, and RBC Capital, the average price target reaches $58.33, implying an upside potential of nearly 11% from its current price.

NEM Price Action: At the time of publication, NEM stock was trading at $52.24.

Read Next:

Image: Shutterstock