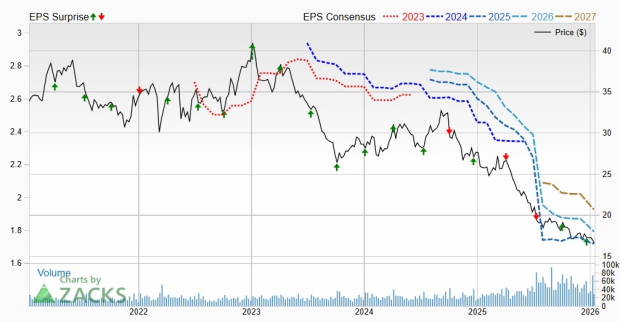

Micron Technology, Inc. (MU) reported a significant revenue increase in its fiscal first quarter of 2026, reaching $13.64 billion, a 56.8% year-over-year increase. However, with shares currently near all-time highs and future earnings expectations causing uncertainty, the company faces potential volatility. Looking ahead, Micron anticipates fiscal second-quarter revenues between $18.3 billion and $19.1 billion.

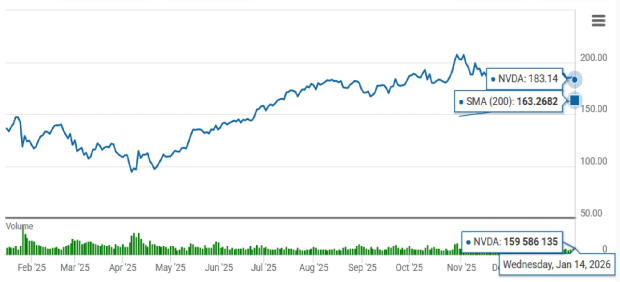

Meanwhile, NVIDIA Corporation (NVDA) is poised to surpass Micron as the leading AI chip stock of 2026, boosted by robust demand for its innovative hardware and anticipated fiscal fourth-quarter revenues of approximately $65 billion. NVIDIA’s fiscal third-quarter revenues were $57 billion, marking a 62% year-over-year increase. The company benefits from growing global data center spending and approval to sell H200 AI chips to select customers in China.