Covered-call funds offer dividend yields ranging from 7% to 89%, providing income regardless of stock market movements. Popular funds include FT Vest Rising Dividend Achievers Target Income ETF (RDVI) yielding 8.2%, FT Energy Income Partners Enhanced Income ETF (EIPI) at 7.3%, Global X Russell 2000 Covered Call ETF (RYLD) offering 12.1%, and YieldMax NVDA Option Income Strategy (NVDY) boasting an extraordinary yield of 88.9%. Each fund employs a strategy of selling call options against owned stocks to generate income.

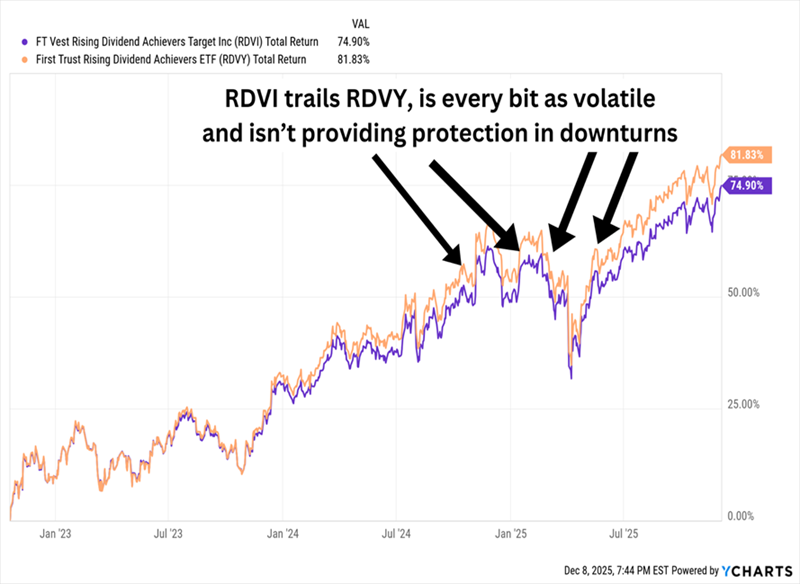

RDVI has underperformed its benchmark and shown little diversification, while EIPI demonstrates promise with better returns than its energy sector benchmark. Conversely, RYLD has underperformed significantly compared to the Russell 2000 index, and despite its high yield, NVDY has failed to keep up with NVIDIA’s actual stock performance.