NextEra Energy’s Stock Soars 9.2% as Demand for Clean Power Grows

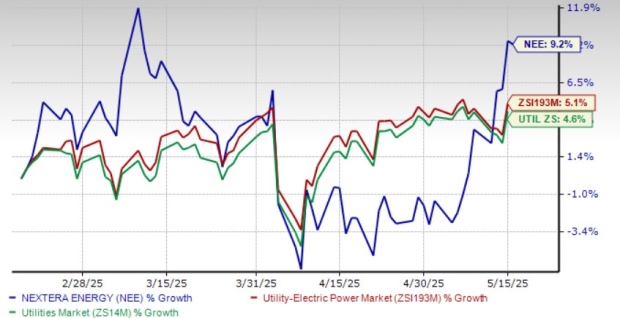

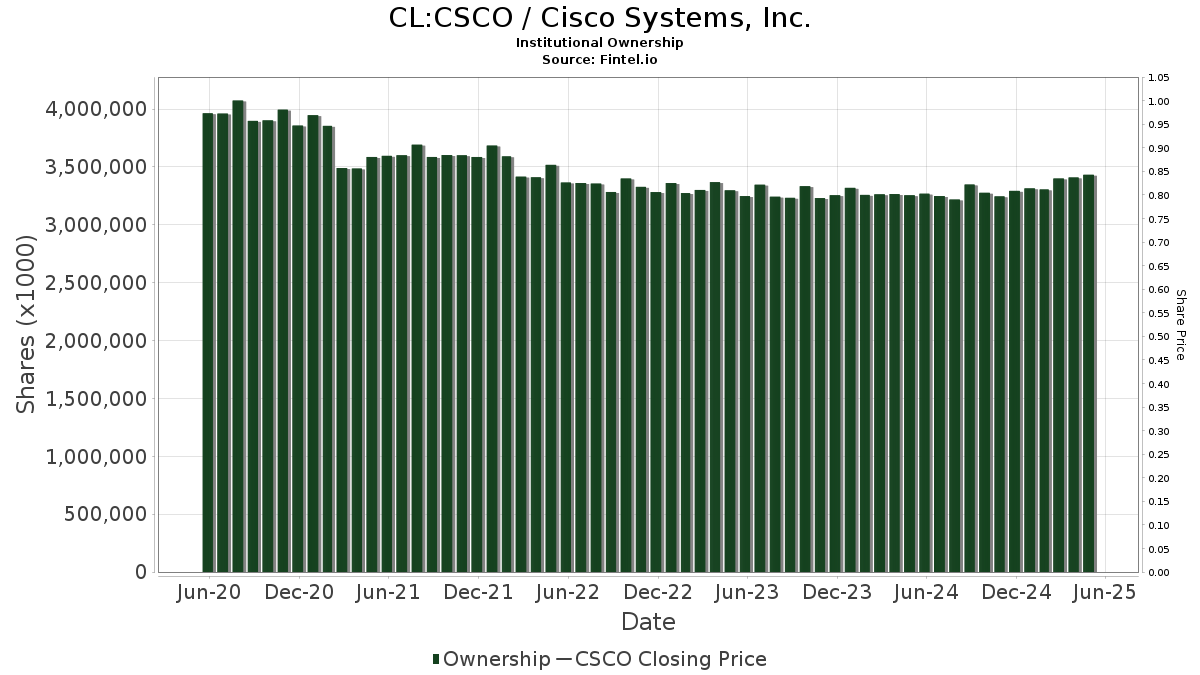

Shares of NextEra Energy (NEE) have increased by 9.2% over the past three months, outpacing the Zacks Utility – Electric Power industry’s 5.1% gain. During the same timeframe, the company has also outperformed the broader Zacks Utilities sector.

This rise in NextEra Energy’s stock price indicates robust performance and an expanding customer base, which is driving heightened demand for its services. A decline in interest rates is also expected to positively influence the outlook for this capital-intensive sector.

Price Performance (Last Three Months)

Image Source: Zacks Investment Research

NextEra is currently trading above its 50-day simple moving average (SMA), indicating a bullish trend. The 50-day SMA serves as a crucial indicator for traders and analysts, helping to establish support and resistance levels. It plays an essential role in identifying the initial stages of either an uptrend or downtrend.

NEE’s 50-Day SMA

Image Source: Zacks Investment Research

Should investors consider adding NEE to their portfolios solely based on positive price movements? Let’s explore the key factors that may help investors determine if now is a good time to buy NEE stock.

Factors Contributing to NEE Stock’s Stable Performance

The strengthening economy in Florida is boosting demand for NextEra Energy’s services. As the appetite for clean energy grows, the company is strategically investing in upgrading and expanding its infrastructure. Notably, Florida Power & Light Company (FPL), a unit of NextEra, offers residential bills that are significantly lower than the national average, providing a competitive edge and attracting new customers.

NextEra Energy’s capital-intensive model benefits from the Federal Reserve’s recent decision to cut interest rates, reducing the benchmark from the 5.25-5.5% range to 4.25-4.5%. Further anticipated cuts in 2025 could lower the company’s capital service costs. Thanks to its operational efficiency and economies of scale in renewable energy, NextEra maintains one of the lowest cost structures in the utility industry, which supports strong profit margins.

NEE’s Energy Resources division is committed to long-term investments in clean energy. The company intends to add between 36.5 and 46.5 gigawatts (GW) of new renewable capacity to its portfolio from 2024 to 2027. Currently, it boasts a renewable project backlog exceeding 28 GW.

Consistent Earnings Surprises

Due to effective planning and smart capital investments, NextEra Energy has consistently exceeded earnings per share expectations, achieving this milestone in each of the past four quarters with an average surprise of 3.58%.

Image Source: Zacks Investment Research

NextEra Energy’s Earnings Estimates Show Growth

The company anticipates earnings per share of $3.45-$3.70 for 2025, a slight increase from the $3.43 reported the previous year. The Zacks Consensus Estimate for NEE’s 2025 and 2026 earnings per share suggests year-over-year growth rates of 7.29% and 7.92%, respectively. Furthermore, the company expects to achieve annual earnings per share growth of 6-8% through 2027 compared to 2024 levels.

Image Source: Zacks Investment Research

For comparison, another utility company, Duke Energy Corporation (DUK), anticipates growth rates of 7.12% and 6.16% for its 2025 and 2026 earnings per share, respectively. Duke maintains a long-term earnings growth projection of 6.33% over the next three to five years.

NextEra Energy’s Commitment to Capital Return

NextEra Energy has plans to increase its annual dividend rate by 10%, at least through 2026, pending board approval. The current annual dividend stands at $2.27 per share, offering a dividend yield of 3%, significantly higher than the Zacks S&P 500 Composite’s yield of 1.54%. The company has raised its dividend five times in the last five years. More about NEE’s dividend history can be found here.

Duke Energy also has an annual dividend of $4.18 per share, resulting in a 3.72% yield, and has similarly increased its dividend five times over the same period.

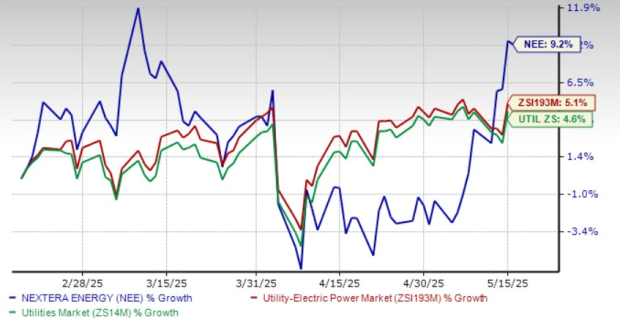

NextEra Energy’s Stock Returns Outperform Industry

NextEra’s Return on Equity (ROE) reflects effective resource utilization, currently at 12.06%, which surpasses the industry average of 10.34%. This performance indicates sound management practices within the company.

Image Source: Zacks Investment Research

In contrast, Dominion Energy (D) reports an ROE of 9.51%, slightly below the industry norm.

NextEra Energy’s Premium Valuation

Currently, NextEra Energy’s valuation stands at a premium compared to its industry on a forward P/E basis, trading at 19.7X compared to the industry average of 14.91X.

Image Source: Zacks Investment Research

Similarly, DUK and D are trading at P/E ratios of 17.93X and 15.9X, respectively.

Conclusion

NextEra Energy continues to demonstrate stable performance, driven by increasing demand for clean energy across its service areas. Its extensive operations in the U.S., coupled with declining interest rates, further strengthen its outlook. The company’s operational efficiencies, large-scale renewable capabilities, and well-positioned projects persistently enhance its overall performance.

Utility Stock Enhances Portfolio with Strong ROE and Dividends

Investors may consider maintaining a position in this Zacks Rank #3 (Hold) utility stock due to its stable return on equity (ROE), increasing earnings estimates, and consistent dividend payments.

Trending: Zacks Highlights #1 Semiconductor Stock

A standout in the market, this semiconductor stock is just 1/9,000th the size of NVIDIA, which has surged over 800% since our initial recommendation. While NVIDIA remains a strong player, the new top chip stock is poised for substantial growth.

Boasting robust earnings growth and a widening customer base, this company is set to capitalize on the soaring demand for Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT). Global semiconductor manufacturing is anticipated to grow from $452 billion in 2021 to $803 billion by 2028.

Discover This Stock Now for Free >>

For those interested in the latest market insights, click here to download the 7 Best Stocks for the Next 30 Days.

Explore additional analysis reports on these companies:

For further context on NextEra’s market performance, read this detailed article.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.