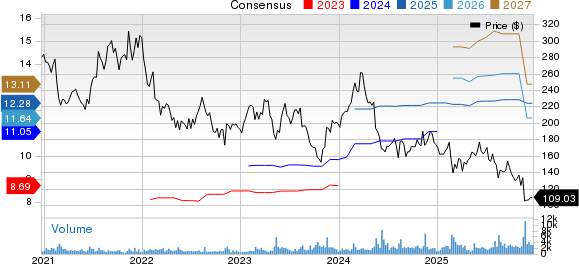

NICE Ltd. has seen its shares decline by 37.2% over the past year, significantly underperforming the Zacks Internet Software industry, which saw a return of 6.1%, and the broader Computer and Technology sector, which increased by 21.5%. The company’s struggles are attributed to a challenging macroeconomic environment and heightened competition. Analysts expect NICE’s operating margin to contract slightly in 2025 following their acquisition of Cognigy.

NICE’s guidance for fiscal 2025 indicates non-GAAP revenues forecasted between $2.932 billion and $2.946 billion, marking a potential year-over-year growth of 7% at the midpoint. Cloud revenue growth is anticipated to be between 12% and 13%, with adjusted earnings projected between $12.18 and $12.32 per share, also reflecting a 10% growth at the midpoint. The Zacks Consensus Estimate for 2025 revenues stands at $2.94 billion, suggesting a 7.4% growth year-over-year.

In the third quarter of 2025, NICE reported a 15% year-over-year increase in cloud backlog, with cloud revenues reaching $563 million, up 13% compared to the previous year. The company’s next-generation CX AI now contributes 12% of its overall cloud revenues, with strong demand for AI capabilities driving significant bookings growth for products like Autopilot and Copilot, which tripled in the same quarter.